2023 saw a significant surge in startup shutdowns worldwide.

All but the most promising and well-run VC-backed startups struggled to raise funding as venture capital investors became much more selective than they were just a few years ago.

As a result, startups that weren’t yet able to sustain their operations without additional funding ran out of money and closed up shop.

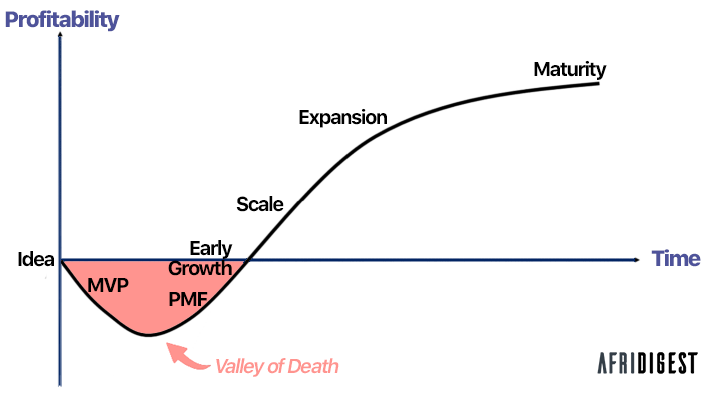

And going forward, the general expectation globally is that startup shutdowns will accelerate in 2024 as more young companies succumb to the so-called ‘valley of death.’

Africa is not immune, of course, and many of the same forces are at play across the continent.

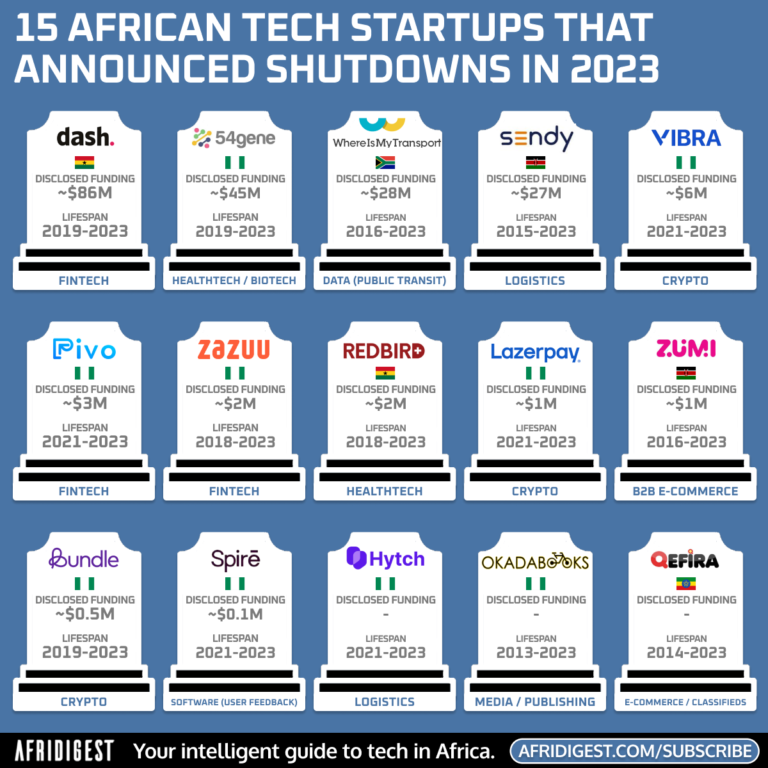

Nigerian genomics firm 54gene, South African transit data provider WhereIsMyTransport, and Kenyan logistics platform Sendy are among the highest-profile African startups to shut down this year.

In all, fifteen or so African tech startups announced their closure in 2023 — after raising some $200 million plus combined.

Here’s a look at them:

Why they shut down:

- Dash, a Ghanaian platform for payments interoperability, shut down after internal audits revealed that the company’s founder & CEO, Prince Boakye Boampong, exaggerated user numbers, misappropriated company funds, and engaged in other fraudulent practices.

- 54Gene, a Nigerian precision medicine biotech startup on a mission to transform racial disparity in genomics research globally, shut down as it “could not continue to operate financially,” according to Ron Chiarello, one of the company’s replacement CEOs.

Most startups fail

So the closure of any given company shouldn’t be entirely surprising

But the shutdown of Nigerian genomics startup 54gene raised a lot of eyebrows@IngressiveCap was an investor so I asked @MayaHorganFamod about how its failure affected the firm’s approach???????? pic.twitter.com/ii1LfT5IFa

— Emeka Ajene ✍???? (@eajene) November 18, 2023

- WhereIsMyTransport, a South African provider of public transport data for emerging markets, shut down after failing to raise new funding.

- Sendy, a Kenyan logistic platform, shut down after running out of money and having “key investors back out of” a new funding round.

- Vibra, a cryptocurrency trading app based in Nigera, shut down due to undisclosed reasons. An anonymous employee suggested, however, that the shutdown was linked to an inability to generate “commensurate” revenue from its efforts.

- Pivo, Nigerian financial services platform for supply chain SMEs, shut down due to co-founder conflict.

- Zazuu, a British/Nigerian cross-border remittance aggregation platform, shut down after “fail[ing] to secure a growth funding round” due to “a tough funding climate,” according to its founders.

- Redbird, a Ghanaian health monitoring and medical testing platform, shut down “due to a lack of funding,” according to the company’s CEO.

- Lazerpay, a Nigerian crypto payment gateway, shut down due to an inability to “close a successful fundraising round” and an “[uncertain] regulatory framework around crypto in Nigeria.”

- Zumi, a Kenyan B2B e-commerce platform for apparel and non-food items, shut down due to an inability to raise funding and a failure “to achieve sustainability in time to survive.”

- Bundle Africa, a Nigerian crypto platform that was incubated within Binance Africa’s ecosystem, shut down due to a “shareholders’ decision to restructure the business.”

- Spire, a Nigerian customer feedback & user research platform, shut down due to its failure to garner “enough sustainable usage or traction to reach product-market fit,” according to its CEO.

- Hytch, a Nigerian B2B logistic platform, shut down because it “couldn’t raise [funding] and couldn’t sustain the business with just the money [it was] making,” according to the company’s CEO.

- OkadaBooks, a Nigerian digital publishing platform, shut down due to unspecified “insurmountable challenges.”

- Qefira, an Ethiopian e-commerce classifieds platform, shut down after the ownership of its parent company changed hands and its new owners decided to cease operations.

While it may be tempting to look at the list above and conclude that the sky is falling, it’s worth remembering the recent words of Babs Ogundeyi, CEO and Co-Founder of Nigerian digital bank Kuda, who warns against reading too much into these startup shutdowns.

In his op-ed, Ogundeyi advises Africa-focused investors to “look past the short-term headwinds and focus on the continent’s long-term opportunities,” while advising startups to “build solid foundations, develop viable business models, and demonstrate their ability to deliver value to customers.”

Wise words.

Share: