Five months before Nigerian fintech Okra confirmed its shutdown to the press, CEO Fara Ashiru sat on an Afridigest panel about focus versus diversification and gave brutally candid answers in what now appears to be her company’s final interview.

Here are three lessons founders and builders can learn from the Afridigest Building in Africa panel on focus vs. diversification:

- Market reality trumps theory.

“Everyone has a plan until they get punched in the face.” Startups operating in Africa must adapt to local conditions that may not necessarily match Silicon Valley playbooks. Build for the terrain you’re actually in, not the map you hoped for. - Diversification is both a sword and a shield.

When core markets develop slower than expected, diversification may become necessary to stay alive. But ensure new verticals can actually generate meaningful revenue. - The regulatory environment is often key.

Businesses in highly regulated industries may face additional risks in African markets as policy environments can be uncertain with unclear regulatory timelines. Have contingency plans when regulations move slower than your burn rate.

When news broke in July 2025 that Okra had shut down after raising ~$16 million, the Nigerian tech ecosystem was stunned.

The open banking pioneer, reportedly valued at ~$92 million after a quiet 2022 Series A round, had been a darling of investors (backers included Base10 Partners, Susa Ventures, and TLcom Capital) and a symbol of the next wave of fintech in Africa.

But for those who watched the CEO panel discussion on startup strategy, the signs were already there.

The moment of truth

During Afridigest’s virtual panel “Building in Africa: Focus vs. Diversification,” Ashiru was asked about her company’s expansion from open banking into cloud infrastructure. Her answer shed light on the sometimes brutal calculus behind startup decision-making on the continent.

“I think it’s definitely a mix of both,” Ashiru said, referring to whether Okra’s diversification was driven by opportunity or necessity. “We found this opportunity because we needed to.”

She continued with stark honesty: “From the necessity standpoint, it was becoming increasingly harder to run a business that’s sustainable. You see your runway essentially decreasing month over month because you’re spending more than you’re bringing in. At a certain point, that was happening regardless of what we were doing or how well we were selling. We were having the same amount of API calls, but essentially revenues were reducing.”

The admission was striking — and rare.

Here was the CEO of a celebrated African fintech pioneer acknowledging that market conditions had forced her hand. The company’s pivot to cloud infrastructure through its Nebula product was as much survival as it was strategy.

When the map meets the terrain

Ashiru’s February comments revealed a fundamental tension in company building across African markets: the gap between startup theory and market reality. “There’s the terrain and there’s the map,” she explained. “The map is what you think is going to happen… but then you actually get in the terrain.”

For Okra, that terrain proved treacherous.

The company had built arguably Nigeria’s most comprehensive open banking infrastructure, processing millions of API calls for major clients including UBA, Access Bank, MTN, and Interswitch. But as Ashiru admitted on the panel, regulatory delays and slower-than-expected consumer adoption created a challenging environment.

“The open banking framework has not been widely implemented at all,” she said. “Banks [didn’t] commit as fast… We didn’t see [consumer growth] happen as fast as we wanted to.”

The diversification dilemma

The February panel, which also featured Vesti CEO Olusola Amusan and Anka CEO Moulaye Tabouré, explored a question that’s increasingly become central to early-stage startup strategy across the continent: Is focus a luxury African entrepreneurs can’t afford?

Traditional Silicon Valley wisdom preaches relentless focus. But as the panel revealed, African startups may face unique localized pressures that make early diversification not just attractive, but often necessary for survival.

Tabouré, whose company evolved from e-commerce marketplace Afrikrea into the multi-product SaaS suite Anka, put it bluntly: “In Africa, we have a lot of headwinds that slow us down. The only way is to actually be faster than people that are in the West.”

For Ashiru, those headwinds included currency devaluation, regulatory uncertainty, and infrastructure costs that made Okra’s original business model unsustainable. “What we realized is that you have to look at the market,” she said. “Although we didn’t see consumer growth at the level we thought, what we have seen is growth in all these other sectors.”

The cost of adaptation

Okra’s pivot to cloud infrastructure made logical sense. The company was already managing its own hosting costs and saw an opportunity to help other African startups facing similar challenges. “Can we do this for ourselves?” Ashiru recalled thinking. “Can we go bare metal, bare bones, and actually host our own infrastructure? If we can, can we then in turn do it for other businesses?”

But adaptation came with costs. As revealed in reports following Okra’s shutdown, the company’s infrastructure business, Nebula, failed to gain significant traction. The diversification that was meant to save the company ultimately couldn’t generate enough revenue to sustain operations.

Industry observers now point to Okra’s story as a cautionary tale about the limits of diversification and the importance of timing. “Okra’s vision — local cloud billed in naira, built for African compliance — was years ahead,” said Bashir Are, CEO of Lagos State Lotteries & Gaming Authority. And indeed Okra might not have only been too early for the market but too early for policymakers as well.

Regulatory reckoning

The regulatory environment that Ashiru referenced in February proved to be a critical factor. Dr. Omobola Johnson, Senior Partner at TLcom Capital, Okra’s pre-seed investor, explained at a later investment summit that “[government] pulled the rug from under their feet.”

We need more honest conversations about startup failures in Africa

When @Okra_HQ shut down after raising $16M, most coverage focused on the money & founders

But I asked TLcom's Omobola Johnson for the inside story at the US-NG Startup Investment Summit

Here's what she said ???????? pic.twitter.com/AQtFb5Ls7a

— Emeka Ajene ✍???? (@eajene) July 23, 2025

The Central Bank of Nigeria’s delayed open banking framework came too late for Okra. The company couldn’t wait for regulatory clarity while burning through cash and facing mounting infrastructure costs.

Lessons from the arena

Today, the virtual panel discussion reads as a real-time case study in startup decision-making under extreme pressure in African markets. Ashiru’s honest assessment of her company’s challenges offers crucial insights for other founders navigating similar terrain.

Her emphasis on staying “grounded in reality and realism” and being honest about what the company could and couldn’t deliver proved prescient. “We at no point are going to sell you something we don’t have,” she said. “If you’re looking for something that is further out on our roadmap, it’s just something that we can’t do today.”

The panel also highlighted the importance of team structure and effective leadership while diversifying. As Ashiru noted, “The more you grow, the more you have to grow in your managerial aspects. The CEO of a 10-person company is not the same as [that of] a 50-person company.”

The broader context

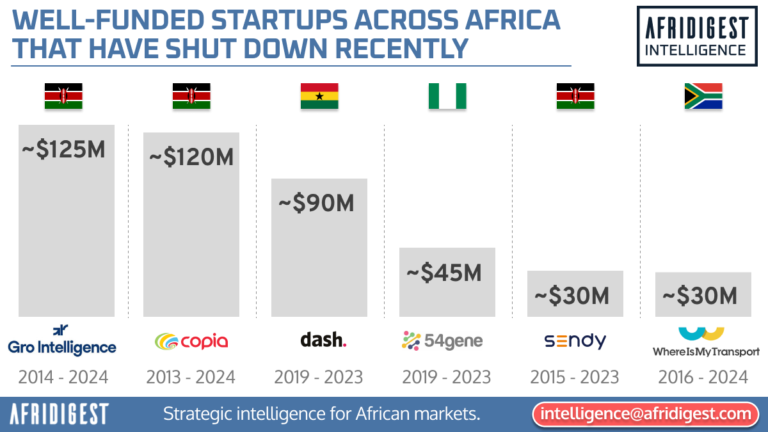

With its shutdown (and reported return of unused capital to investors), Okra joins a growing list of well-funded African startups that have closed despite significant investor backing.

But as the panel discussion made clear, these closures aren’t necessarily failures of vision or execution. They’re often the result of founders making rational decisions in irrational markets, adapting to conditions that don’t match traditional playbooks.

Vesti’s Amusan captured this reality during the panel: “Adaptability takes the forefront. You have to be adaptable… and resilient. The journey really defines the company ultimately.”

A prescient warning

Looking back at the discussion, Ashiru’s comments about infrastructure and survival read like a warning to the broader ecosystem. Her observation that “infrastructure is survival,” coupled with the need for “homegrown solutions” points to fundamental market challenges that extend beyond any single company.

The panel’s exploration of focus versus diversification happened in real time, with real consequences — it wasn’t just theoretical. And Ashiru’s honest assessment of her company’s position, her team’s capabilities, and the market’s constraints offers a masterclass in transparent leadership during crisis.

The aftermath

Since the shut down of Okra, Ashiru has joined UK-based startup Kernel as Head of Engineering. Meanwhile, the open banking space she helped pioneer in Nigeria sees players like Mono also diversifying into new product lines as they await regulatory clarity and an acceleration in market uptake.

Ultimately, the panel conversation on focus versus diversification stands as a remarkable document for the continent’s startup ecosystem — a founder pioneering a new opportunity space speaking candidly about her company’s struggles just months before its closure. For founders, investors, and executives across Africa and beyond, it offers a rare glimpse into the real-time decision-making that defines success or failure on the continent.

As Tabouré warned during the panel, “You don’t have the luxury of time.” For Okra, that warning proved all too prophetic.

Why is Nigerian API fintech Okra now providing cloud infrastructure?

Why does Nigerian stock trading platform Bamboo now have a remittance app?

Why is Nigerian immigrant neobank Vesti now testing airport concierge services?

Because sometimes focus is a luxury you can't afford

— Emeka Ajene ✍???? (@eajene) January 8, 2025

The full panel discussion “Building in Africa: Focus vs. Diversification” is available on YouTube and offers additional insights from founders navigating similar challenges across the continent.

Afridigest’s advisory arm Afridigest Intelligence helps executives, investors, and institutions create and capture opportunities across African markets through strategic intelligence, analysis, and insight. Contact intelligence@afridigest.com to see how we can help.

Share: