Africa’s narrative hasn’t yet caught up to the numbers.

The IMF projects sub-Saharan Africa to grow at 4.4% in 2026 — nearly 50% higher than the world average of 3.1%.

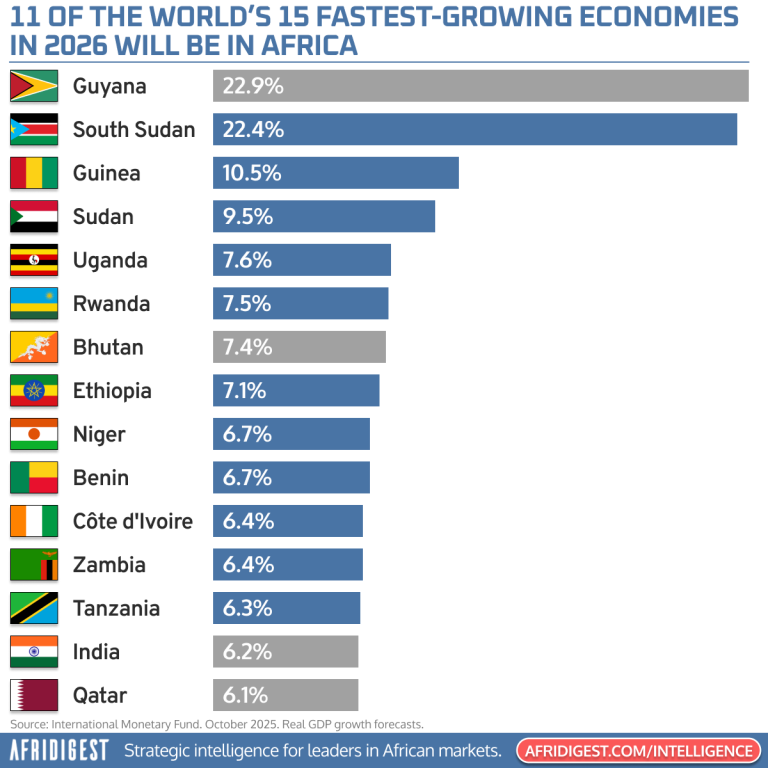

While economists debate recession risks in developed markets, Africa accounts for 11 of the world’s 15 fastest-growing economies — a concentration that challenges perception.

That said, the IMF’s optimism about Africa in 2026 comes with significant caveats.

It warns of “overlapping monetary, financial, external, and fiscal vulnerabilities” across much of the region, with rising debt service costs “crowding out development spending” and a shift toward domestic financing generating “a growing bank-sovereign nexus” that needs to be carefully managed.

Translation: Even as growth accelerates, structural fragilities remain.

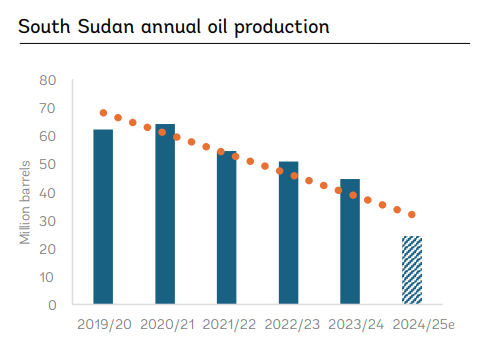

Many economies across the continent haven’t yet demonstrated the institutional capacity to drive consistent performance. Resource booms can evaporate with commodity price swings or geopolitical shocks — as South Sudan’s pipeline damage demonstrated. And high growth rates from small bases don’t automatically translate into broad-based prosperity or development.

Nonetheless, the global concentration of high-growth economies in Africa is undeniable.

For investors, entrepreneurs, and policymakers, this represents genuine opportunity. A number of mega-trends — digitization, urbanization, and a demographic ‘youthquake’ among them — are colliding with untapped markets to create favorable conditions across multiple sectors.

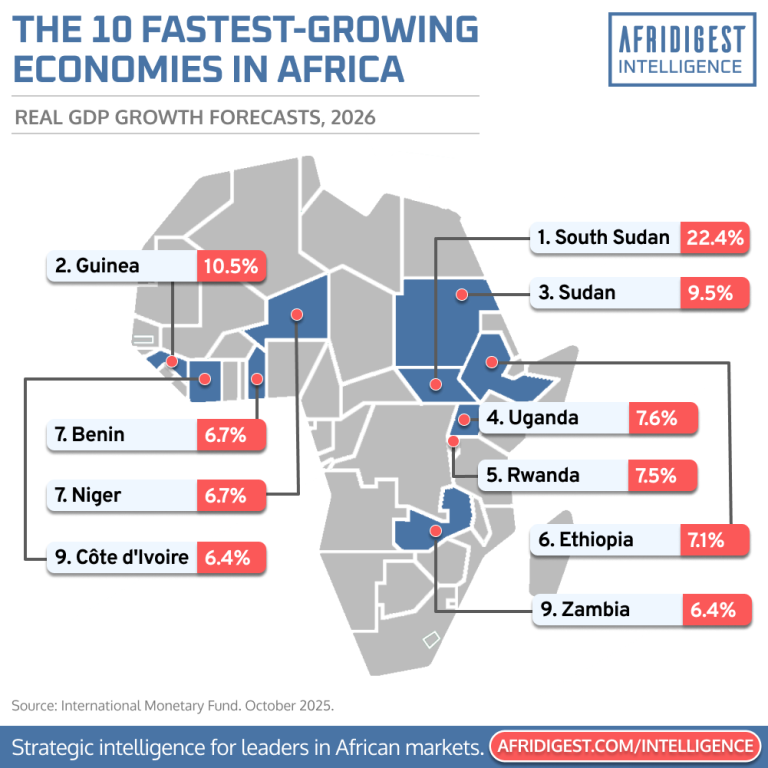

Here’s what’s driving growth in Africa’s 10 fastest-growing economies; they can be split into three main categories:

• Ongoing conflict recovery/stabilization (South Sudan, Sudan)

• Resource extraction (mining in Guinea, Zambia; oil in Niger)

• Sustainable institutional reforms and economic diversification (Rwanda, Ethiopia, Uganda, Benin, Côte d’Ivoire)

- South Sudan (22.4%) – Restoration and rebound of oil export capabilities. After the Petrodar pipeline was damaged in February 2024 during Sudan’s civil war, oil exports — which account for ~98% of government revenue — plummeted from 186,000 barrels per day in January 2024 to just 58,000 bpd in December 2024.

With the resumption of oil exports in April 2025, the country’s current account is expected to move back into surplus in 2026.

With the resumption of oil exports in April 2025, the country’s current account is expected to move back into surplus in 2026. - Guinea (10.5%) – Expanding mining sector. Driven by robust Chinese demand, Guinea exported a record 99.8 million tons of bauxite in the first half of 2025 — a 36% jump from 2024. The country now supplies over 70% of global bauxite exports. Guinea’s bauxite exports in the first half of 2025 alone were equivalent to a quarter of 2024’s total global supply. Moreover, the start of iron ore exports from the Simandou mine is expected to be transformative for the economy.

- Sudan (9.5%) – Ongoing economic stabilization, conflict recovery, and resumption of economic activity, with reconstruction spending on social services and infrastructure. The focus has shifted from managing crisis to reconstructing the basic systems that enable economic activity: transportation networks, communication systems, and financial infrastructure.

- Uganda (7.6%) – Rising gold and coffee exports, recovering household consumption, robust investment growth, improved regional transportation links, and surge in public spending. Crude oil production expected to begin toward the end of 2026.

- Rwanda (7.5%) – Strong growth in services (~44% of GDP), mining, manufacturing, construction, tourism, public investment, and the Bugesera airport project. The country’s transformation into a regional financial and technology hub is an example of how consistent infrastructure investment can compound into sustained economic growth.

- Ethiopia (7.1%) – Massive hydroelectric investments, particularly around the Grand Ethiopian Renaissance Dam, are beginning to reshape the country’s energy profile and industrial capacity. Other drivers include the expansion of coffee production, mining sector growth, and major reforms (e.g., restoring debt sustainability, liberalizing the exchange rate, creating a stock exchange, opening the economy to private investors).

- Benin (6.7%) – A combination of sustained structural reforms, expanding industrial activities (especially agribusiness and textiles), a robust agricultural sector, and major investments in port and regional trade infrastructure.

- Niger (6.7%) – Driven by a ramp-up in oil production and exports. Supported by an acceleration of public spending and investment in agriculture and infrastructure.

- Côte d’Ivoire (6.4%) – Sound macroeconomic policies, sustained public and private infrastructure investment (e.g., transport and digital networks), buoyant domestic consumption, a continued emphasis on agricultural value addition, and rising oil production. The country is also transforming into a regional financial services hub and enjoying an uptick in export revenues thanks to high gold and cocoa prices.

- Zambia (6.4%) Mining, particularly copper production, remains the country’s main driver, with the government aiming to raise copper output to 1 million tons in 2026. In addition to mining, which accounts for 70% of export earnings, agriculture, ICT, energy, and tourism are important drivers of growth.

Africa’s fastest-growing markets are far from uniform, but some themes apply broadly.

Resource-rich economies face the perennial challenge of converting natural resource wealth into broad-based development. Countries pursuing institutional reforms face the slower and arguably harder work of building state capacity and diversifying their economies. All face external headwinds from uncertain global trade policy, volatile commodity prices, and constrained access to capital.All things considered, what’s clear is that some of the world’s most interesting economic stories are happening in Africa right now.

But whether those stories end in transformation or disappointment depend less on a single year’s growth rate and more on sustaining growth over decades, translating GDP expansion into improved living standards, and building the institutions that drive productivity and transform it into lasting prosperity.

Share: