Africa’s earned wage access (EWA) landscape may have just shifted dramatically.

TymeBank, the South African entity of unicorn digital banking group Tyme, just bought access to 15,000+ companies through a single partnership.

Welcome to unicorn-scale competition.

First time founders are obsessed with product.

Second time founders are obsessed with distribution.

— Justin Kan (@justinkan) November 7, 2018

This article is based on industry analysis and exclusive interviews with TymeBank’s Head of Growth.

TymeBank’s recently announced partnership with Deel Local Payroll (formerly Payspace) might ultimately prove to be a textbook example of how superior distribution infrastructure trumps product features — particularly in emerging fintech categories.

The distribution problem EWA startups face

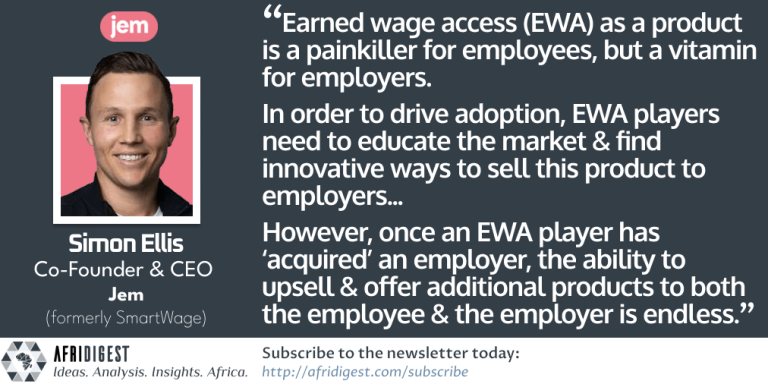

In our Thought Circle article on the rise of earned wage access across Africa, Jem’s Simon Ellis captured a fundamental challenge facing the industry: “EWA is a painkiller for employees, but a vitamin for employers.”

This asymmetry creates a distribution challenge — employees desperately want the service (or at least the capital) while employers need extensive education.

Pure-play EWA providers like South Africa’s Paymenow generally face a brutal reality: months-long sales cycles, complex payroll integrations, and ongoing relationship management with each employer.

As we noted in our EWA primer, “winning in the near term is likely to be a function of a differentiated distribution/GTM strategy.”

TymeBank just demonstrated what that might look like.

The infrastructure shortcut

Deel acquired PaySpace in March 2024, inheriting relationships with over 14,000 customers across 44 countries — a distribution network that would take standalone EWA startups significant time and capital to replicate.

Bootstrapped South African HR & payroll tech platform @PaySpace was just acquired by global HR solution provider @Deel for an estimated $100M 👀

Founded in 2002 or so, PaySpace has 14k+ customers in 40+ countries across Africa & the Middle East

Huge newshttps://t.co/xTugvNRK7A

— Emeka Ajene ✍🏽 (@eajene) March 5, 2024

TymeBank’s partnership with Deel Local Payroll bought them instant access to this entire customer base in theory. In practice, the partnership is centered on the South African market.

TymeBank already operated TymeAdvance in the country, working directly with employers, but Jarred Deacon, Head of Growth at TymeBank, explains the strategic advantage: “We have an opportunity to drive acquisitions through an aggregated channel which lowers risk and cost and provides credibility to both services [the TymeBank-Deel offering and TymeAdvance].”

As with most EWA products, the elegance lies in the execution. Employees can access up to R5,000 (~$300) of earned wages through TymeBank’s app, USSD codes, or vouchers at retail stores, with deductions handled seamlessly in the next payroll cycle.

Warren van Wyk, Director at Deel Local Payroll, provides an overview: “EWA is a modern fintech product. It uses automation and API integration to streamline the underlying processes, making access easy while taking care of regulatory requirements.”

While upstart EWA players convince employers one-by-one that EWA is worth the operational overhead, TymeBank just embedded their service within thousands of existing payroll relationships where trust and integrations already exist.

The unicorn’s shadow

In December 2024, Tyme became Africa’s newest unicorn in a Series D round that valued the group at $1.5 billion. With $250 million in fresh capital, Tyme has advantages pure-play EWA startups simply can’t match.

Unlike competitors that must consistently seek external financing for advance pools, TymeBank, as perhaps Africa’s first profitable digital bank, may soon generate the internal cash flows necessary to finance employee advances at scale.

Deacon confirms Tyme’s fundamental advantage: “We have an advantage from a cost perspective as we are a source of funds rather than lending from a partner that is purely looking for a return.”

This working capital advantage compounds with scale; where EWA startups may hit funding walls relatively quickly, TymeBank can deploy more of its balance sheet over a longer period.

What this might mean for EWA in Africa

This development likely crystallizes a fundamental shift in the landscape: from startup innovation to infrastructure control. Success with EWA on the continent will increasingly depend on controlling distribution infrastructure rather than building superior products.

When asked about competing with Paymenow, which positions itself as the top company in South Africa’s EWA space, Deacon was direct: “Paymenow is the market leader in EWA as they are an organization purely focused on one product. The technology & support functionality cannot compete with a bank.”

Deacon revealed a broader strategic insight. For TymeBank, “EWA is a good way to provide benefit to users rather than just trying to fund and return capital. [It’s] a great way to provide support for people without access to credit.” EWA, in other words, may perhaps best be deployed — from a competitive standpoint — as part of a full financial services suite, rather than a standalone offering.

Time will tell, and perhaps the most likely outcome beyond the two paths we laid out in our original EWA primer (becoming a full-service HR benefits & employee wellness platform or becoming a full-service credit & financial services provider) is consolidation pressure — with undercapitalized EWA providers either acquired by larger financial institutions or forced to find sustainable niches.

The bottom line

The TymeBank-Deel partnership — and South Africa’s EWA landscape — is worth watching as it offers a live case study into the startup adage: “Distribution is king.”

For other market participants, the message is clear: adapt quickly or risk displacement.

For the continent’s broader fintech ecosystem, this may be a preview of unicorn-scale players’ potential to reshape other categories through infrastructure control rather than organic competition.

Share: