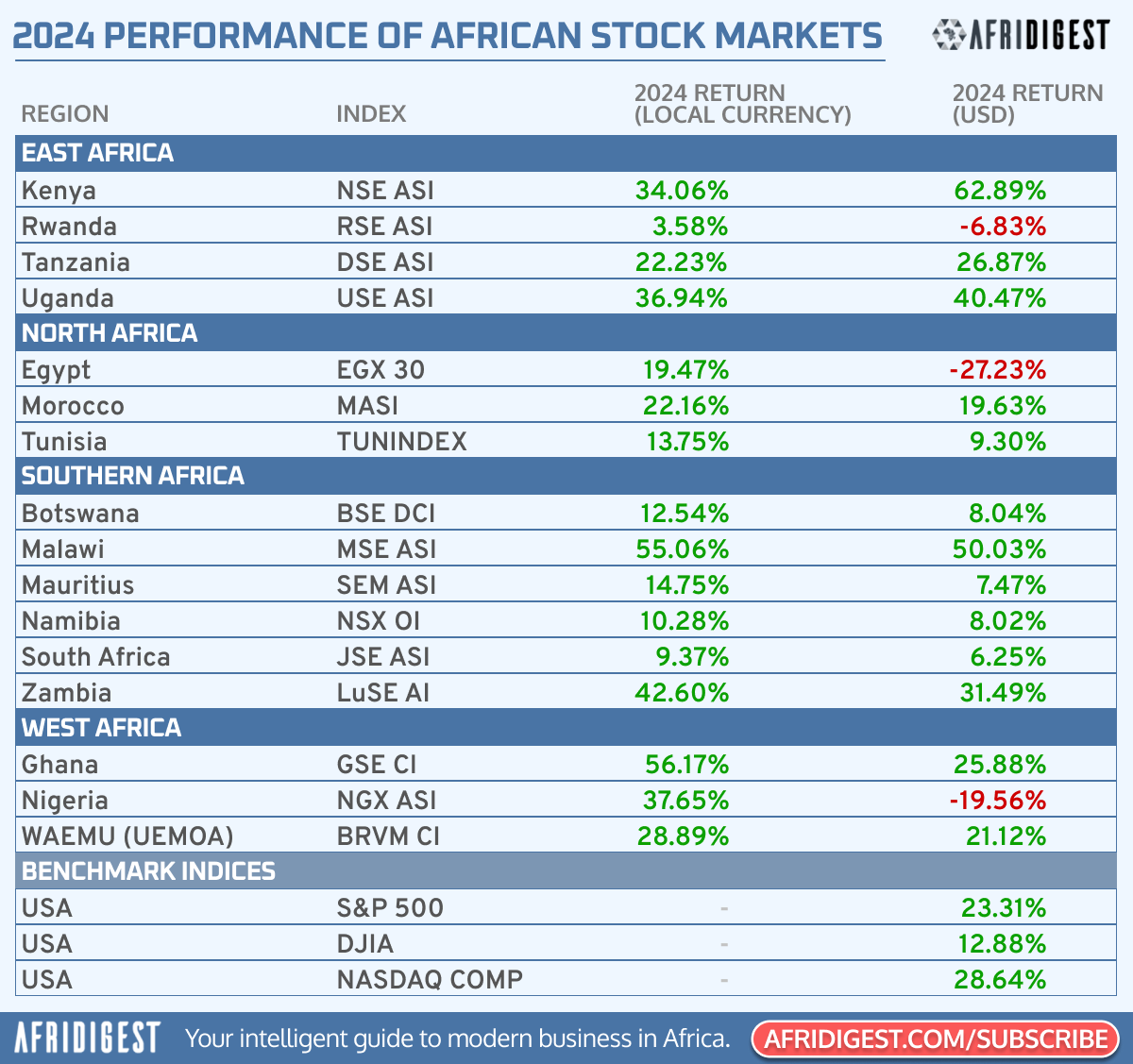

African stock markets demonstrated remarkable strength in 2024, with several exchanges significantly outperforming major global indices.

The standout performer was Kenya’s Nairobi Securities Exchange All Share Index (NSE ASI), which delivered an impressive 62.89% return in USD terms, nearly triple the United States S&P 500’s 23.31% return for the same period.

East African Excellence

The East African region emerged as a particular bright spot, with Uganda’s USE ASI and Tanzania’s DSE ASI returning 40.47% and 26.87% in USD terms respectively.

This regional outperformance suggests growing investor confidence in East African markets and their underlying economies.

Currency Dynamics at Play

2024 also underscored the impact of currency movements on USD returns. This was particularly evident in several markets:

- Egypt: While the EGX 30 gained 19.47% in local currency terms, USD returns were -27.23%.

- Nigeria: The NGX ASI’s strong 37.65% local currency gain translated to a -19.56% USD return.

- Ghana: The GSE CI delivered robust local currency returns of 56.17%, but only 25.88% in USD terms.

Southern African Resilience

Southern African markets also showed strong performance, with Malawi’s MSE ASI delivering 50.03% in USD terms and Zambia’s LuSE AI returning 31.49%.

This performance came despite economic headwinds in the region’s largest economy, South Africa, whose JSE ASI returned a more modest 6.25% in USD terms.

Regional Performance Overview

- East Africa: All markets except Rwanda showed positive USD returns.

- North Africa: Mixed performance with Morocco leading at 19.63% USD returns.

- Southern Africa: Consistently positive returns across all markets.

- West Africa: Strong local currency performance but mixed USD returns due to currency movements.

Looking Ahead

The strong performance of African markets in 2024 highlights both the opportunities and complexities of investing in the continent’s public markets.

While local currency returns were positive across all 16 markets tracked, currency movements significantly impacted USD returns, underscoring the importance of currency risk management in African market investment strategies — both for public and private market investing.

Lastly, the outperformance of several African markets relative to global indices may attract increased attention from international investors, particularly given the robust showing in established growth markets like Kenya and emerging ones like Uganda.

Share: