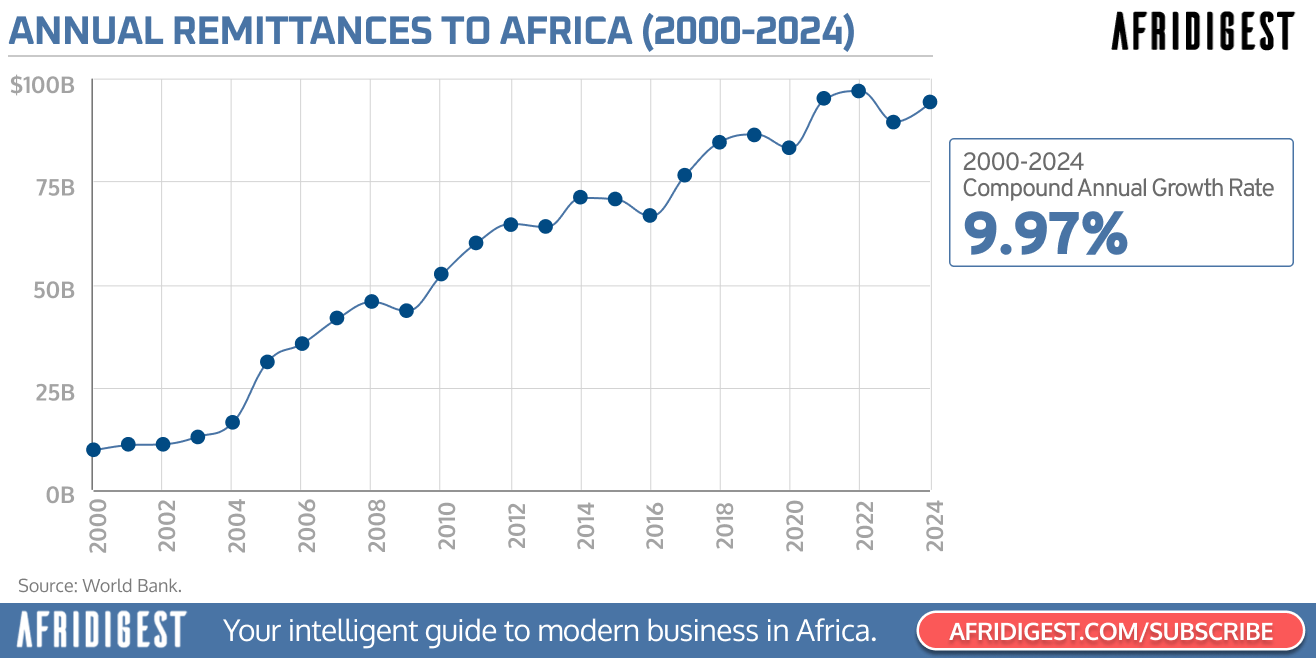

Africa currently receives just under $100 billion in annual remittances, growing at a robust 10% long-term CAGR.

This represents a massive and expanding revenue pool for fintechs and financial institutions active on the continent.

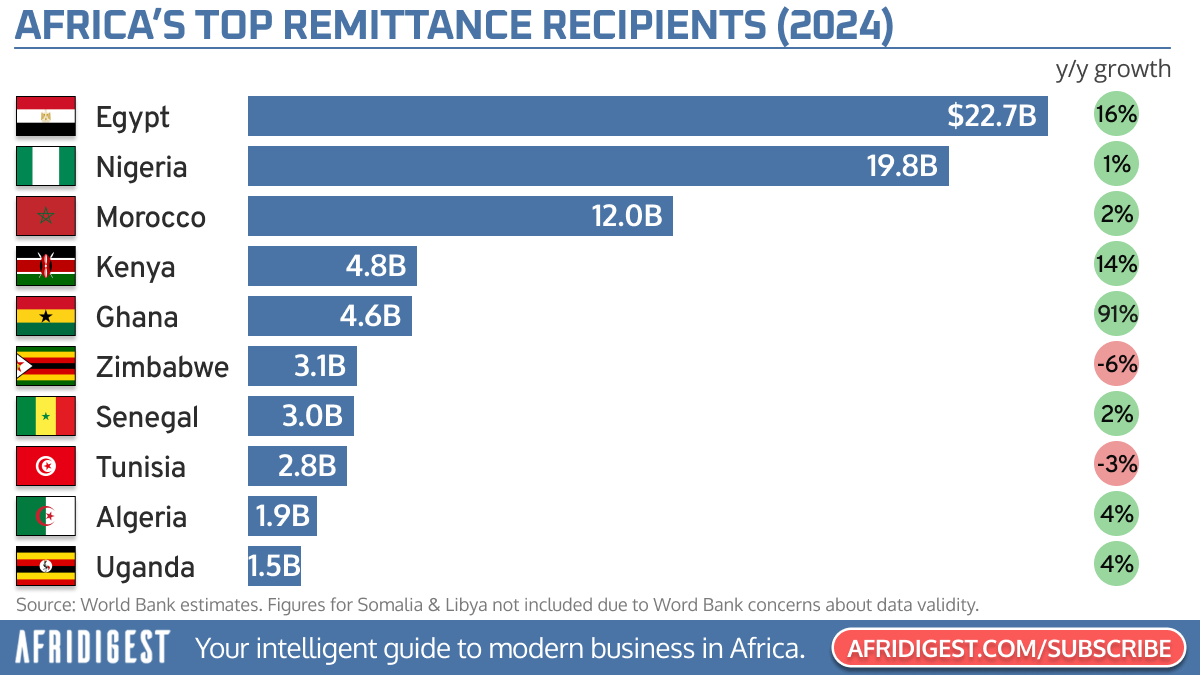

Africa’s remittance landscape continues to evolve, with recent World Bank estimates revealing Egypt overtaking Nigeria to become Africa’s largest remittance recipient and Ghana experiencing a remarkable surge in remittance inflows.

According to the latest estimates:

- Egypt again became Africa’s largest remittance recipient, attracting $22.7 billion in inflows and recording robust 16% year-over-year growth.

The country, which boasts Africa’s largest diaspora, receives significant inflows from the Gulf region, Europe, and North America. - Nigeria, Africa’s most populous nation, fell to the #2 position, reverting back to its ranking since 2020 (outside of an anomalous 2023).

The Nigerian diaspora, concentrated primarily in the United States and United Kingdom, continues to maintain strong ties to their homeland, sending $19.8 billion back in 2024. - Morocco rounded out the top three with $12 billion in inflows, up a modest 2% year-on-year.

The North African kingdom, benefiting from its proximity to Europe, receives remittances primarily from France, Spain, and Italy, reflecting its strong diaspora presence in these countries.

Key Trends and Insights

- Ghana’s Spectacular Rise: Perhaps the most striking development of 2024 was Ghana’s exceptional performance, with remittance inflows surging by 91% to reach $4.6 billion. On the one hand, this dramatic increase may reflect the success of recent government initiatives aimed at diaspora engagement and investment. On the other hand, the World Bank’s estimates for the country may again be revised downwards as happened last year.

- North African Dominance: North African nations collectively receive ~$39.4 billion, approximately 42% of all inflows, demonstrating the region’s significant role in Africa’s remittance landscape.

- Market Concentration: The top 10 recipients accounted for over 80% of remittance inflows to Africa, highlighting the concentrated nature of Africa’s diaspora remittance opportunity.

Future Outlook

Despite global economic headwinds, Africa continues to show resilience in remittance inflows.

Indeed, with out-of-Africa migration poised to grow significantly due to the continent’s ongoing population boom, the accelerating jobs crisis, and a number of other factors, it’s likely that the diaspora remittances to Africa will take on increased importance in years to come.

For entrepreneurs, investors, and policymakers, while the scale of Africa’s remittance market is significant today, its future potential simply can’t be ignored.

But taking full advantage of this opportunity requires a thorough understanding of the nuances of specific regions, countries, and remittance corridors.

With a combination of fintech innovations, policy initiatives, and demographic shifts taking place concurrently, the opportunity in diaspora remittances to Africa appears poised to grow significantly.

Share: