- Turn personal pain into category creation. The 17 credit card rejections Kredete CEO Adeola Adedewe received after moving to the US revealed a systemic flaw: millions of Africans living abroad are ‘credit invisible’ despite sending $100B home annually. Rather than building another money transfer platform, he reimagined remittances as credit-building tools, creating an entirely new fintech category.

- Build the rails, not just the app. While many competitors focused on customer acquisition and user-friendly apps, Kredete invested years developing institutional-grade payment rails. By building out this infrastructure layer, Kredete can now scale more rapidly and efficiently while maintaining competitive advantages in speed, cost, and reliability that pure distribution plays find hard to replicate.

- Don’t fight the market. When Kredete’s Africa-focused model hit roadblocks due to legacy systems and the regulatory environment, Adedewe pivoted to serve diaspora communities in the US. This strategic retreat allowed the company to scale quickly instead of spending years trying to change behaviors at traditional financial institutions.

- See compliance as a competitive advantage. Unlike many startups that treat regulatory requirements as overhead, Kredete made compliance central to its strategy from day one. The company made costly upfront investments in licenses, risk infrastructure, and integrations that now create trust with banking partners and prevent competitors from easily replicating the model.

- Product-market fit is about customers, not metrics. Despite hitting significant processing volumes, Adedewe considered Kredete a “proof of concept” until customers could complete what he calls the “credit flywheel” — moving from remittances to credit building to loan access to financial empowerment.

On September 15th 2025, Kredete announced a $22 million Series A round. Days later on September 19th, Afridigest spoke with Kredete Founder & CEO Adeola Adedewe about the company’s business model, strategy, and future plans.

Lucky number 17

When Adeola Adedewe was rejected for a credit card for the 17th time, he didn’t yet realize he was staring at a hundred-billion dollar market opportunity.

“When I moved to the [United] States, I got declined 17 times by a premium bank,” Adedewe recalls. “I lived my [early] years in Africa and I’m credit invisible to the US system.”

That invisibility isn’t unique.

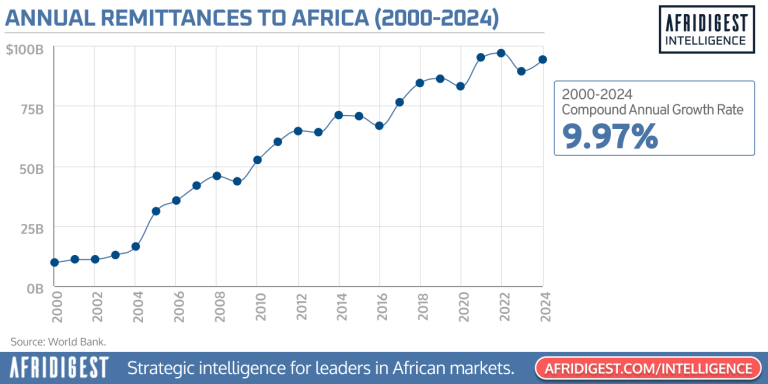

Across the global African diaspora, millions face the same paradox: they’re financially responsible enough to send $100 billion annually to support families back home, yet receive zero credit for these payments. Unlike loans, credit cards, or even rent payments in some cases, remittances don’t contribute to credit scores.

Today, Adedewe’s company Kredete is changing that. The platform allows African immigrants to build credit history through something they do prodigiously — send money home.

As a result users see their credit scores improve by an average of 58 points according to the company, and Kredete has processed over $1 billion to date for a customer base that now exceeds 1 million monthly users.

“We understand remittances to be black tax,” Adedewe explains. “We just have to say it. And in the prior history of remittance, it hasn’t built any substantial credit history.”

“This problem is deeply personal to me. Even today, I see new immigrants arriving and repeating the same cycle I went through a decade ago… Africans that are migrating [to the US] are pretty much set up for failure due to the lack of credit infrastructure in their home countries.”

Kredete 1.0

Kredete didn’t start with remittances, however. The company’s original vision was to address Africa’s lack of credit infrastructure and give the continent’s citizens strong financial foundations that would be beneficial both at home and abroad after migration.

The initial product was a digital lending platform that provided free credit scores to consumers & businesses, connected lenders and borrowers, and used AI, machine learning, and APIs to streamline credit origination, decisioning, and risk assessment for lenders.

While that business showed some early promise, Adedewe discovered a fundamental flaw.

“We realized that the banks and credit bureaus were not ready to innovate because of [structural issues]. In Nigeria, for example, you effectively have two social security numbers — the BVN and NIN,” he explains.

“That data [displacement] creates loopholes for people not to pay back… And it became clear that building credit infrastructure [in African markets] would take much longer than anticipated.”

So Adedewe then asked two questions:

- If his long-term goal was helping Africans in the diaspora, why not just start there from day one?

- And if it’s possible to build credit via rent payments, why can’t you build it via international money transfers?

“That’s how we made that pivot decision,” Adedewe reveals.

“Then we thought about the mechanism and we studied the credit agencies’ data in the United States — Equifax, TransUnion, and Experian — and we realized that the biggest way people can build credit is not when they receive a credit line, it’s about on-time payments. On-time payments history accounts for about 35% of your credit data today. And we built it up from there. That’s how we decided to move from the continent to the diaspora.”

That pivot from pre-migration customers in African markets to post-migration customers in America allowed Kredete to scale on top of clear regulatory frameworks and robust infrastructure in the US financial system.

Kredete 2.0

One key reason Kredete was able to quickly re-orient itself around the diaspora opportunity and see immediate traction was its focus on building infrastructure from scratch rather than relying on existing services.

“While many remittance companies are just plug and plays, we’ve built core infrastructure as the baseline of our product,” Adedewe stresses. “You didn’t hear much about us in 2023, you didn’t hear about us much in 2024, because we were building underlying tech.”

That infrastructure-first approach facilitated the company’s pivot from Africa-focused credit solutions to diaspora-focused remittances.

The credit-focused relationships Kredete built with financial institutions created the foundation for the company to create payment integrations that “terminate via remittances” as Adedewe puts it.

“All of our early integrations were very important because we could speak from a credit perspective and convert to payments,” Adedewe says. “We could meet with the credit division at a bank and say ‘Hey, we need to be integrated into your payments division.'”

The company’s rails also address correspondent banking bottlenecks that prevent many African banks from efficiently processing international payments.

“We now have direct bank integrations that help us with last-mile termination, and we help them with corresponding banking,” Adedewe explains. “It’s core tech that we’ve built here where our payment reliability is about 98 to 99% on average per day.”

At the heart of the company’s infrastructure are stablecoins which reduce transfer costs per $100 from $8-15 for traditional remittances to roughly $0.50, while enabling real-time settlements. But the company deliberately abstracts this complexity from users.

Its technical architecture involves converting fiat to stablecoins on the backend, moving money across borders via blockchain networks, then settling in local currencies through direct bank partnerships.

Adedewe draws a sharp distinction between companies building “infrastructure” of this sort versus “distribution” — explaining Kredete’s strategy and positioning.

“We spent two years building compliance infrastructure before we even launched,” Adedewe notes. “We needed direct integrations with credit agencies, money service business licenses across all 50 US states, and bank partnerships to make this work.”

Kredete even acquired a bank in Nigeria to facilitate final payment settlements and build legitimacy within the industry. “To partner with banks, you have to think like a bank,” Adedewe says.

“Banks hold the largest balance sheets of local currencies. If we could think like one, we could [build more fluid cross-border payment rails].”

Beyond remittances

What started as credit-building remittances is evolving into a comprehensive financial platform.

Kredete now offers FDIC-insured USD accounts accessible with international IDs, launched Africa’s first stablecoin-backed Visa credit card, and provides business payout APIs used by over 2,000 companies.

“We’re not just focused on the [global] $100+ trillion remittance space,” Adedewe tells me. “We’re building … financial services for diasporans in the West.”

In addition to product diversification, geographic expansion is accelerating as well. The proceeds of the company’s Series A will fuel expansion into Canada, the UK, and Europe, where Kredete aims to serve African immigrants from the moment they arrive.

“Our long-term vision is simple: the moment Africans land in JFK, Atlanta, Heathrow, et cetera, we want them to start building credit history on day one.”

While the remittance-to-credit category is still nascent, companies like Félix Pago (Latin America) and Pomelo (Philippines) are exploring similar remittance-based credit-building models, while traditional players are also innovating (e.g., Western Union’s partnership with Upward Financial).

But by turning routine money transfers into credit-building tools for the African diaspora, Kredete is showing that financial innovation can emerge from deep understanding of underserved communities.

Moreover, the company’s early success validates Afridigest’s January 2023 argument that Africa-focused innovators should embrace the global African diaspora as a business strategy.

African communities abroad have sophisticated financial needs that remain largely unmet by traditional institutions, creating a large opportunity for modern “diaspora-first” financial platforms — a new movement that companies like Kredete are at the forefront of.

Diamonds in the diaspora: How startups are building for African communities worldwide

Kredete growth timeline

• Q1 2022: Company officially founded/incorporated

• Mid-2022: Secured initial regulatory approvals and secured partnership with CRC Credit Bureau (largest African-based credit bureau)

• Q4 2022: Beta launch of digital lending marketplace

• Early 2023: Participation in Techstars Detroit

• April 2023: Official public launch event at Civic Centre, Lagos (25+ financial institution partnerships secured)

• Q1 2024: Processed first significant milestones

• May 2024: Joined Visa Africa Fintech Accelerator

• August 2024: $2.25M Seed round announced — led by Blockchain Founders Fund with participation from Techstars, Tezos Foundation, Polymorphic Capital, Launch Africa, & others

• Q4 2024: Expanded to 20+ African countries for remittances

• 300,000+ users at time of seed round announcement

• Reached $100 million monthly in US to Africa remittances

• $5.4 million in ARR in last 18 months

• Q1 2025: Major product launches (partnership with Visa for direct credit card issuance; launch of stablecoin-backed spending infrastructure; FDIC-insured USD accounts accessible with international IDs)

• May 2025: Launch of Africa’s first stablecoin-backed credit card in partnership with Visa, Stellar, and Rain

• Mid 2025: Geographic expansion — EMI license secured for Europe, expansion into Canada

• September 2025: $22M Series A round announced, co-led by AfricInvest (via CAIF & FIVE) and Partech with participation from Polymorphic Capital

If you made it this far, watch the full conversation with Kredete Founder & CEO Adeola Adedewe.

Share: