Africans in the diaspora are Africa’s largest financiers.

That’s according to the President of the African Development Bank Group, Dr. Akinwumi Adesina.

Africans in diaspora are Africa’s largest financiers. Remittances from the diaspora to Africa grew from $37 billion in 2010 to $96 billion in 2021. Total Official Development Assistance to Africa in 2021 was $35 billion or 36% of remittances from diaspora. Prioritize their voice!

— Akinwumi A. Adesina (@akin_adesina) December 3, 2022

It’s a good reminder that contrary to the prevailing image of the African continent as a global charity case, capital inflows to Africa are increasingly provided by Africans abroad, as opposed to foreign aid.”

And as important as that may be for policy experts & development theorists, there’s a practical business implication there: Africa-focused innovators should explore embracing the global African diaspora as a strategy.

Here’s a look at five startups doing just that.

From financial services to entertainment to Web3 and more, each startup is embracing Africans abroad in different ways.

Cross-border embedded remittances: Kaoshi

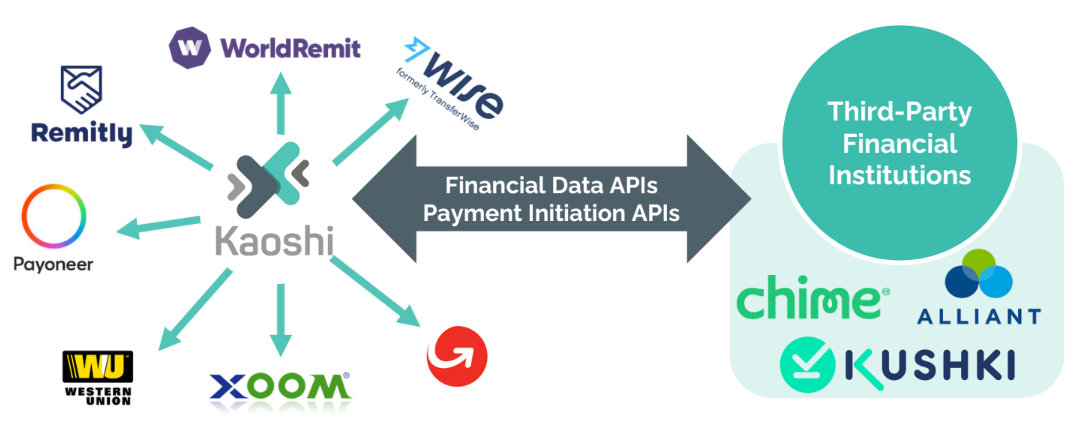

While there are myriad cross-border payment services facilitating remittances from the diaspora into African markets, Kaoshi is attacking this opportunity in a refreshing way — by providing underlying open finance infrastructure.

Think of it as Plaid for cross-border finance.

Just as Plaid enables embedded finance by aggregating data from credit cards and bank accounts, Kaoshi aggregates cross-border financial services, allowing businesses to embed cross-border payments into their applications.

As a result, businesses in Africa and elsewhere can integrate with Kaoshi and collect international payments using services like Remitly, WorldRemit, Wise, etc. in place of (or in addition to) international debit cards. So, for example, if an airline integrates with Kaoshi, a Nigerian living in the diaspora can buy her mother in Abuja a plane ticket and pay directly with Remitly.

Kaoshi was recently accepted into Mastercard’s Start Path Open Banking program, and while the focus of this article is on the African diaspora, Kaoshi’s cross-border open finance infrastructure equally applies to other diasporas worldwide.

Home-grown entertainment: IrokoTV

If you’re an African living in the diaspora, how do you stay connected to home?

One way is by consuming local content, and IrokoTV offers just that. It’s a Nollywood-focused subscription video-on-demand platform that gives its subscribers a taste of home.

It’s also a good example of the zigs and zags involved in building businesses.

In 2017, Afridigest published this article covering Iroko’s evolution from 2010-2016, and at that time the company was in the middle of embracing Nigerian consumers. But after being “scammed by the giant of Africa narrative,” it’s since turned its strategic focus to the African diaspora — particularly those in the US, its leading market.

Texas is the #1 state in our #1 ??market for @irokotv subscribers. In terms of culminative revenues we have made the most amount of money here since we started almost 10years ago. Its my first ever trip here in all that time???. Scammed by the giant of Africa narrative ????.

— JasonNjoku (@JasonNjoku) July 26, 2021

A Web3 digital nation: Afropolitan

It’s not quite clear what exactly a digital nation is. But, be that as it may, one is being built for the African diaspora: Afropolitan.

It’s alternatively been referred to as a ‘community-as-a-service’ platform, the ‘first-ever internet country,’ and a ‘network state’ — a sort of successor to the nation-state.

But perhaps the simplest way to think of Afropolitan is as an attempt to aggregate & integrate today’s fragmented African diaspora. And if it’s able to do that at scale — becoming a key node within the global African community — there’s a lot of value in that.

In any case, with backing from angel investors like Shola Akinlade (Paystack), Iyinoluwa Aboyeji (Future Africa), Olugbenga ‘GB’ Agboola (Flutterwave), and institutional investors like Atlantica Ventures, Ingressive Capital, and RaliCap, it’ll be fun to watch Afropolitan’s vision materialize.

The Problem

The African diaspora has been underserved.

● Minimal events that cater specifically to them, (Events)

● Minimal media and content that caters specifically to them, (Media)

● The lack of opportunities to reconnect with the continent. (Travel) pic.twitter.com/0zuw9f4XDS

— Eche Enziga ?️? (@Echecrates) July 18, 2021

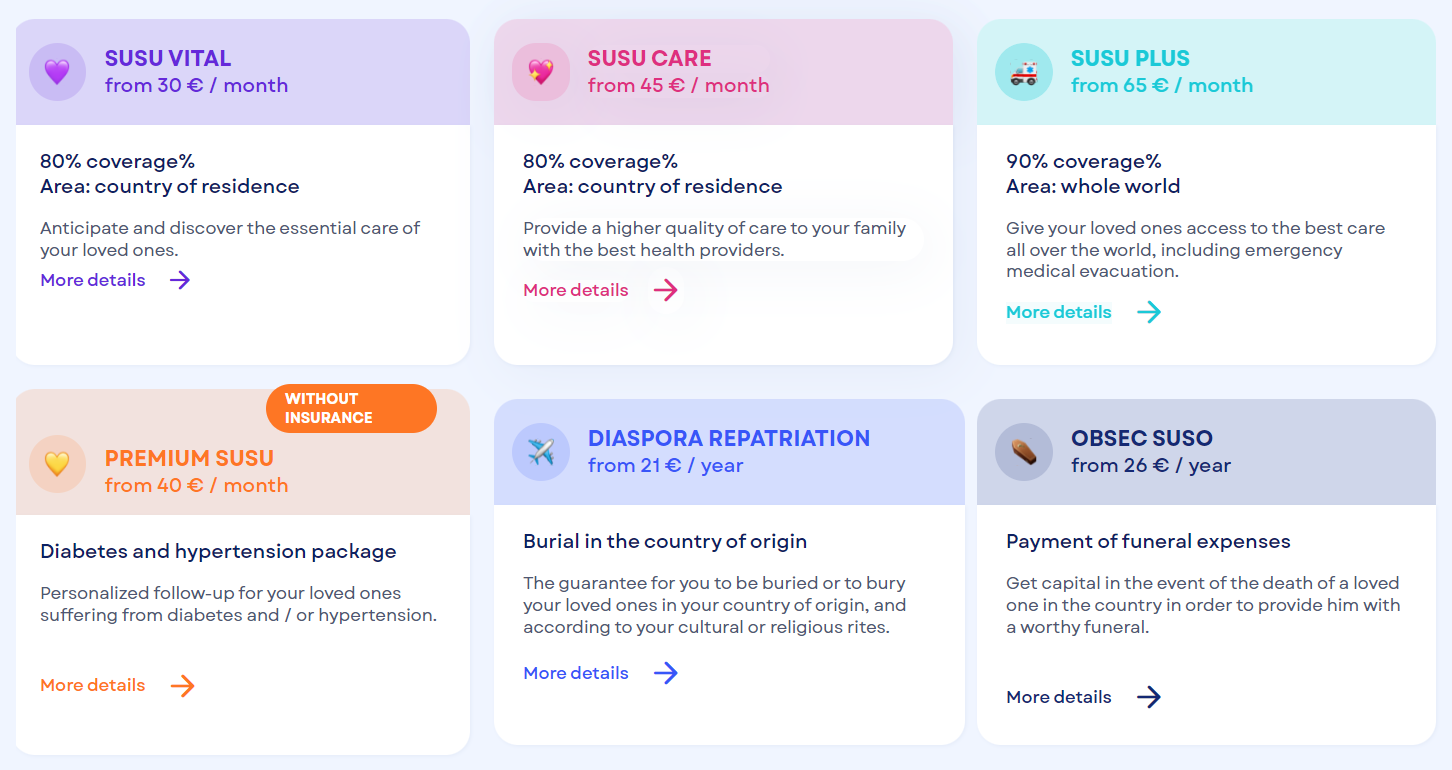

Healthcare bundles for loved ones back home: Susu

While most remittances worldwide are spent on basic necessities like food and shelter, once these are covered a good chunk goes toward health expenses.

Susu is a healthtech startup that’s leaning into this. It offers subscription bundles targeted at Africans in the diaspora, and these bundles provide family members on the ground with certain healthcare benefits.

One of the leading healthtechs in Francophone Africa, Susu currently operates in Ivory Coast, Cameroon, Senegal, and Benin, but it’s expanding to Nigeria and Ghana soon.

Mon coup de ❤️ du moment, c’est @Susucares. Ce service digitalisé permet aux personnes vivant en diaspora d’offrir la meilleure qualité de soins à leurs proches en Afrique, notamment Côte d’Ivoire où le service est désormais lancé. Visitez le site internet https://t.co/zkiEYsRIIB pic.twitter.com/5n66NWbbfV

— edithbrou.nft (@edithbrou) October 31, 2019

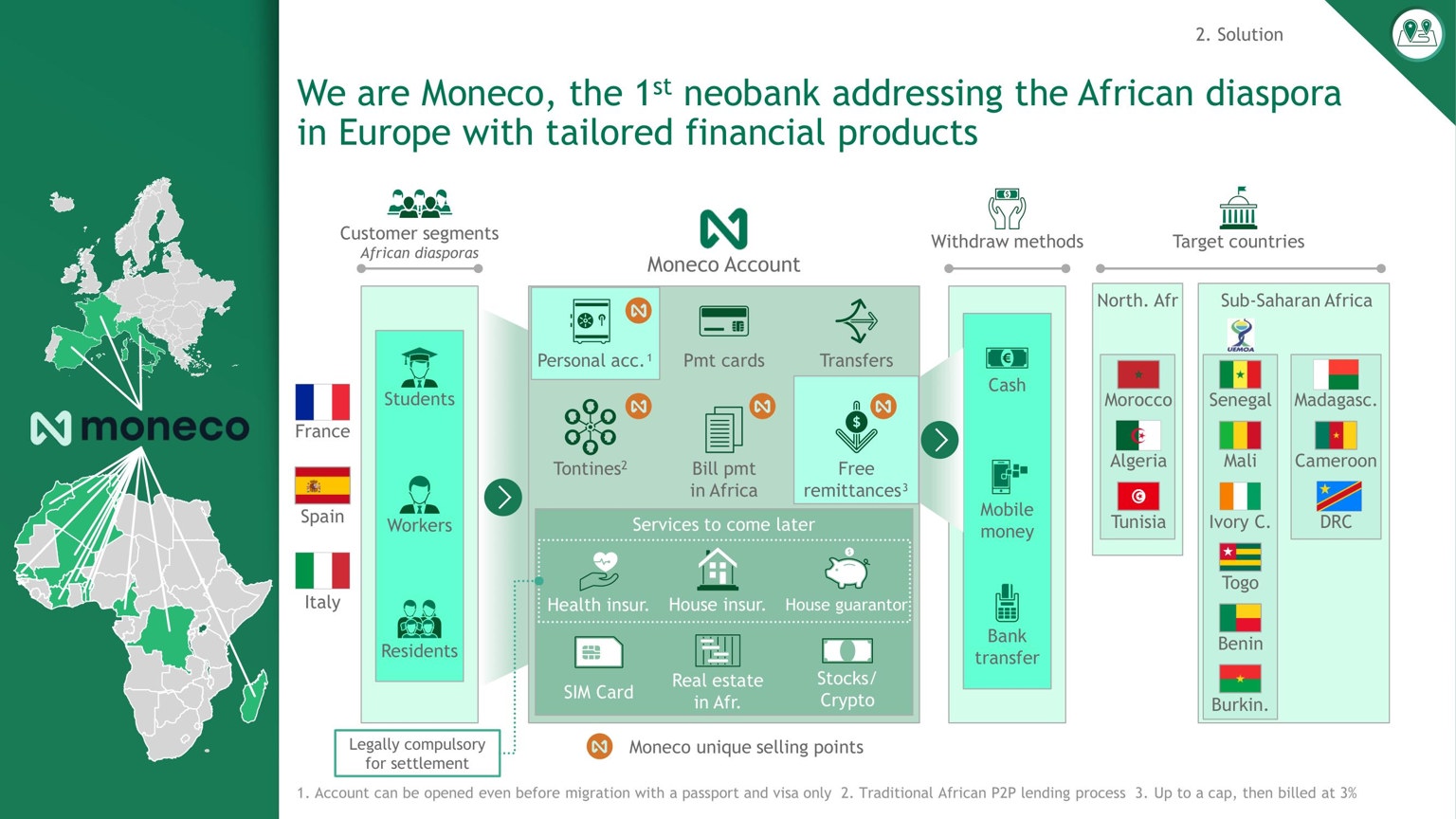

Financial services for Europe’s African diaspora: Moneco

Africans living abroad, especially recent migrants, face certain challenges relative to financial services.

It can be difficult to open financial accounts initially, sending money back home can be an expensive affair, and certain familiar services like rotating money-saving circles may be unavailable.

Moneco is addressing this. It’s a specialist neobank focused on the needs of the African diaspora in Europe — and it’s perhaps the first neobank worldwide with this specific niche.

It’s first focus is the so-called remittance “super tax” — the fact that remittance fees to Africa, particularly sub-Saharan Africa, are the highest in the world.

?Sub-Saharan Africa is the most expensive region in the world for remittances.

One culprit, according to Bloomberg's @aggichristiane & @herbling, is local regulators like @CBKKenya.

"Bureaucratic hurdles can be difficult to navigate in Kenya."

Source: https://t.co/u1Q2bNWi9q pic.twitter.com/yYpjLF4HTy

— Afridigest ????? (@AfridigestHQ) December 29, 2022

It offers fee-free remittances to several countries, and low (sub-2%) fees to the rest. But besides free remittances, it also offers a current account & a payment card and plans, in the near future, to offer a varied suite of tailored financial products, becoming a one-stop shop for Europe’s African diaspora.

Final thoughts

Cross-border open finance infrastructure. Entertainment. Web3. Healthcare. Neobanking. Very different verticals — but all the startups above are linked in their pursuit of & positioning towards the African diaspora.

While embracing the African diaspora may not be suitable for all businesses, Africa-focused business leaders should recognize the growing power of the global community of Africans abroad and reflect on how they might harness it for commercial impact.

Need a thinking partner to help your business explore opportunities in the diaspora?

Strategic intelligence firm Africreate can help.

Say hello: hello@africreate.com

Share: