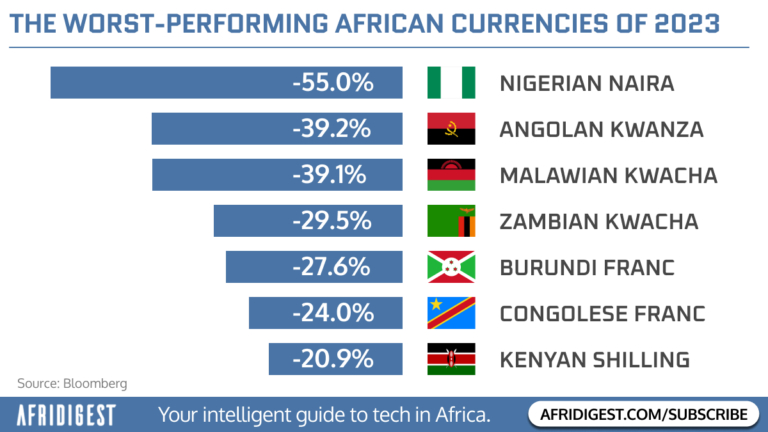

2023 was a disastrous year for African currencies.

Three of the world’s five worst-performing currencies were from the continent: Nigeria’s naira, Angola’s kwanza, and Malawi’s kwacha.

The Nigerian naira — the third worst-performing currency in the world, behind only the Lebanese pound and the Argentine peso — claimed the dubious honor of being the worst-performing African currency of 2023.

Nigerian banknotes fell 55% in value versus the US dollar over the course of the year, so companies operating in Nigeria would have needed to grow their naira revenue by ~2.2x in 2023 just to hold constant in dollar terms.

Given that the majority of Nigerian (and African) startups raise dollar-denominated capital, it’s no surprise that they (and their counterparts in other hard-hit countries) are increasingly deploying these tactics:

- Localizing costs

- Increasing exposure to markets with less FX risk

- Pivoting to earn more hard currency, and

- Fundraising in local currency

Here are some examples.

Localizing costs

In addition to Nigeria, Paystack, the payments platform acquired by Stripe, also operates in Kenya, Ghana, and South Africa, and is in beta testing in Ivory Coast, Egypt, and Rwanda. Nonetheless, Nigeria accounts for at least a plurality, if not the absolute majority of its revenues today.

So as the value of the naira plunged, the company’s foreign costs — like its engineering hub in Dubai and its European payroll — became increasingly untenable, leading to layoffs of foreign employees in November in a bid to “localize costs,” according to Paystack CEO Shola Akinlade.

Today was a difficult day at Paystack.

We’re reducing our operations outside of Africa, and will be parting ways with up to 33 employees in Europe and the UAE.

In the last 3 years, our hiring philosophy was to recruit great talent regardless of location, including opening an…

— shollsman (@shollsman) November 16, 2023

Increasing exposure to markets with less FX risk

While geographic expansion across Africa is often an offensive move as most markets in Africa are sub-scale, international expansion across African markets can also act as a shield — against a falling naira in this case. And Francophone African markets, with their peg to the euro, offer an often overlooked respite.

In recent months, customer engagement & messaging platform Termii and identity verification & digital KYC platform Smile ID, which both earn the majority of their revenues in Nigerian naira, have prioritized expanding to Francophone Africa — Ivory Coast for Termii and Ivory Coast and Senegal for Smile ID.

Earning more hard currency

Nigerian subscription video-on-demand (SVOD) platform IrokoTV once embraced African customers. But the company has since shifted its focus to customers in the US and elsewhere overseas.

As Iroko TV CEO Jason Njoku noted in October, “89% of our revenues for the first nine months of 2023 were outside of Nigeria. With the Naira devaluations that ultimately makes sense.”

It's scary that most people truly don't understand inflation nor appreciate the absolute wealth destruction of periodic Naira devaluations.

— JasonNjoku (@JasonNjoku) December 19, 2019

Fundraising in local currency

Across Africa, fundraising in local currency certainly has its challenges.

Local currency fundraising would be ideal but I find that it is hard to explain losses to local investors.

— Chijioke Dozie (@ChijiokeD) December 29, 2023

But local currency investment vehicles & opportunities seem to be on the rise — particularly for debt instruments.

Nigerian invoice financing platform Zuvy, for example, secured $4 million in debt financing from TLG Capital as part of the seed round it announced in July, with CEO Angel Onuoha praising “TLG’s innovative approach to lending in naira.”

Similarly, Nigerian high-speed wireless internet provider Tizeti secured an undisclosed amount of naira-denominated debt financing in December from local investment bank Chapel Hill Denham’s Nigeria Infrastructure Debt Fund.

(And here’s Tizeti’s CEO warning against raising dollar-denominated debt while earning revenues in naira.)

When it rains it pours, however.

And after a horrible year for the naira — its worst since Nigeria’s return to democracy in 1999 — the currency is widely expected to fall further in 2024.

And as that happens, one should expect increased urgency from founders and investors around localizing foreign costs, diversifying revenues via market expansion, re-orienting business lines around hard currency, fundraising in local currency, and more.

In Nigeria, the beatings will continue until morale improves.

Share: