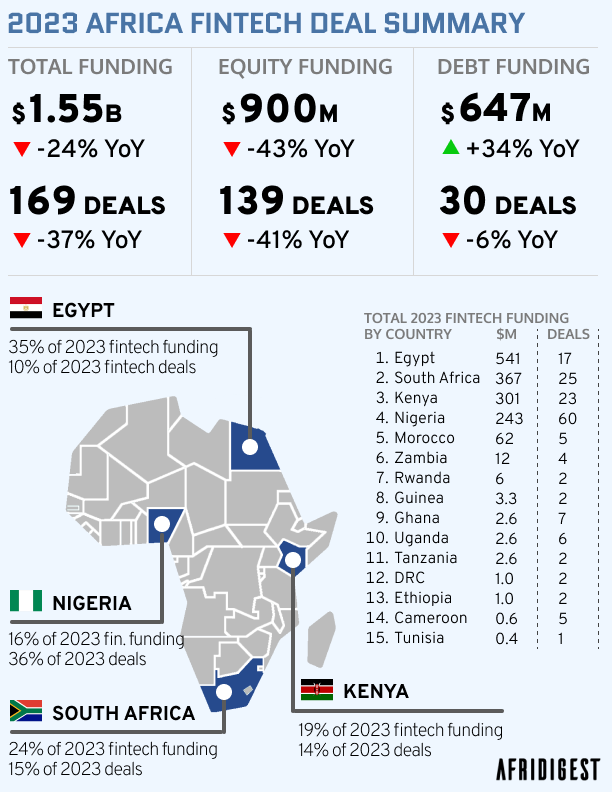

In 2023, fintechs across Africa announced raising a cumulative $1.55 billion in equity and debt.

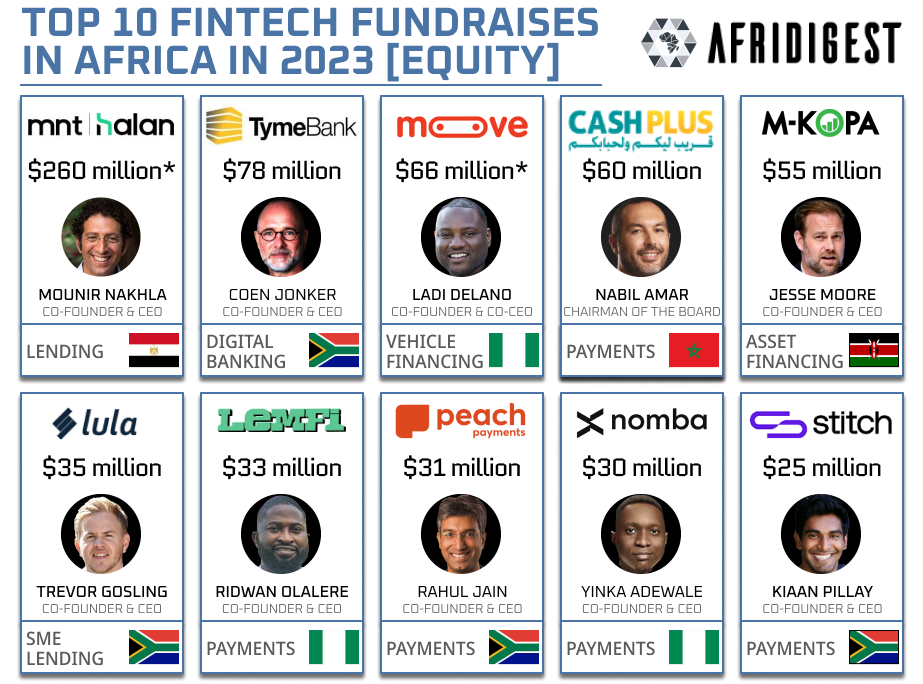

$900 million of that was in equity, and three-fourths of the equity raised went to just ten companies:

• MNT-Halan (Egypt)

• TymeBank (South Africa)

• Moove (Nigeria)

• CashPlus (Morocco)

• M-Kopa (Kenya)

• Lula (South Africa)

• LemFi (Nigeria)

• Peach Payments (South Africa)

• Nomba (Nigeria)

• Stitch (South Africa)

Here are three takeaways about fintech in Africa today from the top ten fintech fundraises of 2023:

- The appetite for credit is virtually unlimited. Consumers and businesses across the continent are significantly underserved by traditional institutions relative to the provision of credit.

Across disparate African markets, consumers and businesses have rapidly adopted diverse credit solutions offered by MNT-Halan, Moove, M-Kopa, Lula, and other players. The level of market acceptance across borders points to the opportunity for innovators to explore & implement smart non-bank lending solutions across African markets. - The opportunity isn’t limited to Africa. Many of the problems faced by consumers & businesses in African markets are also faced by their counterparts across other emerging markets. And the models and playbooks used by fintechs in Africa can be deployed elsewhere successfully.

South Africa’s TymeBank, for example, was built to serve the country’s lower-income masses and does so with a hybrid online & offline strategy that relies on partnerships with Pick n Pay and other retailers. In 2022, it launched GoTyme in the Philippines using the same hybrid playbook in partnership with one of the country’s largest retailers, Robinsons.

Similarly, Moove was founded in response to a key challenge faced by Nigerian Uber drivers: the lack of access to vehicle financing. But Moove has since taken its revenue-based financing model worldwide to serve millions of mobility microentrepreneurs in emerging markets beyond Africa, while using the playbooks it developed on the continent. - Cash is still king. Despite all the traction digital payments have experienced across Africa, cash is still the dominant payment method.

So on the one hand, digitizing payments is a promising, long-term wave for companies like Peach Payments and Stitch to ride.

And on the other hand, there are still interesting opportunities for fintechs across Africa to play at the intersection of cash and e-money today like Morocco’s CashPlus does with its branch network and Nigeria’s Nomba does with its agent network.

Share: