Businesses founded by women ultimately deliver higher revenue than those founded by men… In terms of how effectively companies turn a dollar of investment into a dollar of revenue, startups founded and co-founded by women are significantly better financial investments. For every dollar of funding, these startups generated 78 cents, while male-founded startups generated less than half that—just 31 cents.❞

— BCG, ‘Why women-owned startups are a better bet.’

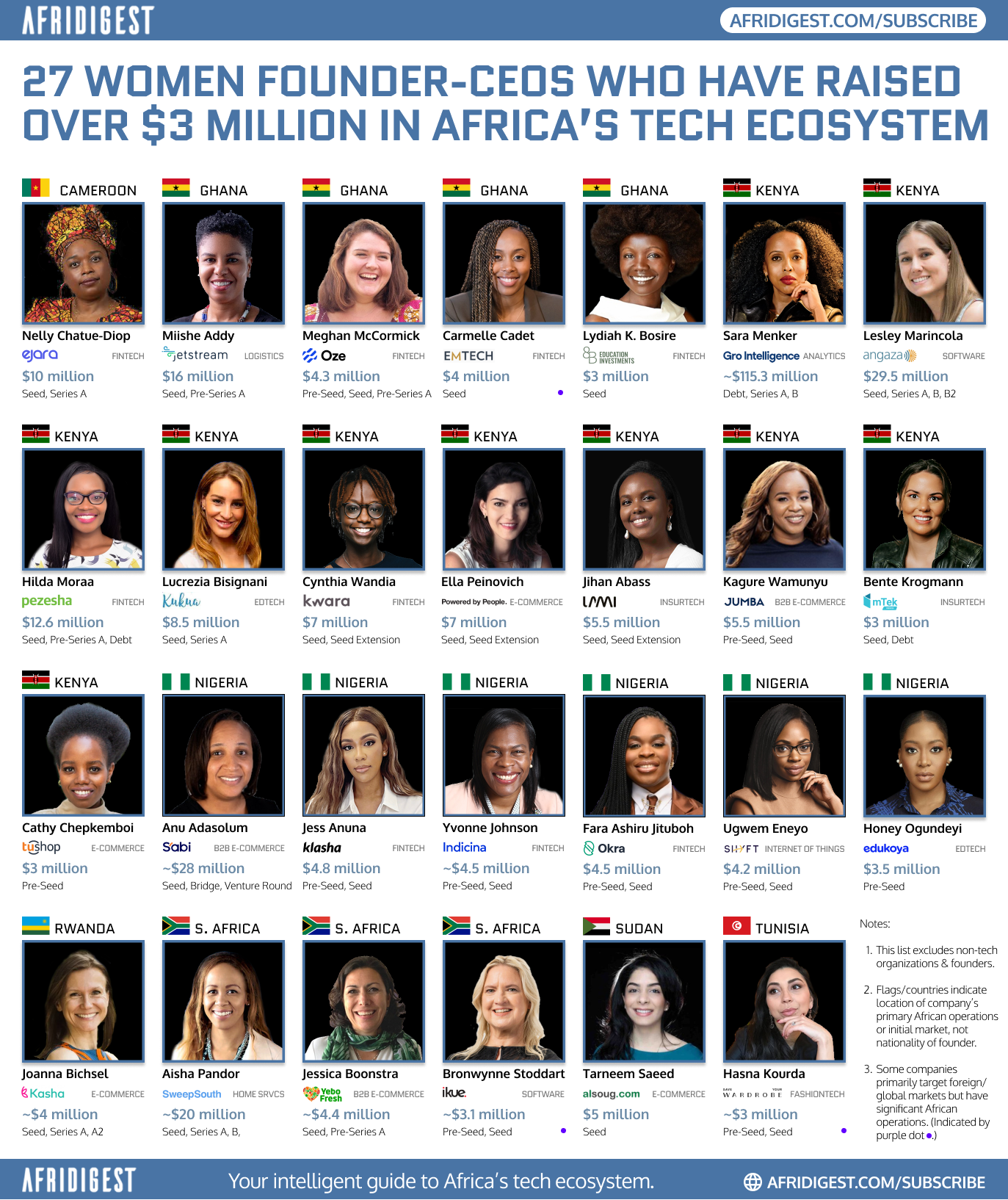

Despite the emerging body of research from BCG, McKinsey, First Round Capital, and others finding that companies with gender diverse leadership teams generally outperform their peers, business ecosystems worldwide continue to struggle with various gender-related issues, including gender gaps in financing entrepreneurs.

Across Africa’s tech ecosystem specifically:

- Less than a third of VC-funded startups have women founders/co-founders,

- Less than a fifth of venture-backed startup CEOs in the ecosystem are women, and

- The vast majority (~85%) of venture capital funding goes to founding teams composed solely of men.

Across the continent, women who are both founders and chief executives of tech startups that have raised significant amounts of capital are exceedingly rare.

Here’s a list of twenty-seven women who have raised $3 million or more in equity and are both CEOs and founders of tech startups focused on or heavily supported by teams in Africa, listed in order of their country of operations.

Cameroon

Nelly Chatue Diop, Ejara

Across the fourteen sub-Saharan Francophone countries that make up the CEMAC and UEMOA CFA Franc zone, Nelly is the only woman to have raised over $3 million, at least so far.

She’s building Ejara, a platform for investing in cryptocurrency & other assets.

Ghana

Miishe Addy, Jetstream

Cross-border logistics is broken and Miishe’s on the job. She’s building Jetstream, a cross-border logistics platform that digitizes the supply chain and helps cargo owners with import, export, and trade financing needs.

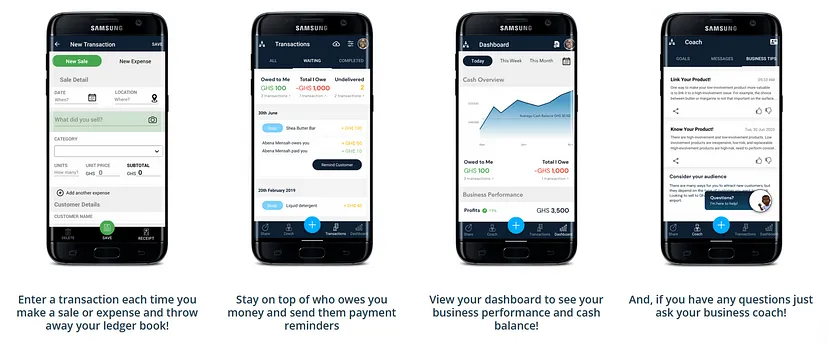

Meghan McCormick, Oze

Many small businesses across Africa use pen and paper to manage their operations, which reduces transparency, creates obstacles for growth, and contributes to the SME financing gap.

There’s a sizeable opportunity in digitizing the sector and Meghan’s on the case.

She’s building Oze, a digital bookkeeping & lending platform targeting SMEs. The Oze app helps small businesses manage their operations, provides tips & insights for business success, and facilitates bank loans.

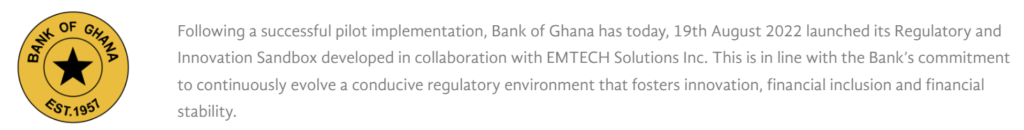

Carmelle Cadet, Emtech

Technology is eating almost every aspect of financial services, but central banks — particularly those in emerging markets — are being left behind.

That won’t be the case for long if Carmelle has her way.

She’s building Emtech, an American provider of digital, blockchain, & open banking infrastructure for central banks across Africa and other emerging markets.

The company has completed a sandbox pilot with The Central Bank of Ghana and has signed a number of agreements with central banks across Africa and the Caribbean.

Source: Bank of Ghana

Dr. Lydiah Kemunto Bosire, 8B Education Investments

“The world has underinvested in African brilliance.” That’s according to Kenyan-born Lydiah Bosire.

She estimates that there’s a $25 billion annual financing gap for African students that receive offers from global universities but don’t have the means to finance their education.

So, she’s building 8B Education Investments, a fintech platform that specializes in lending to students from African countries (starting with Ghana) attending the best universities in the United States and around the world.

Kenya

Sara Menker, Gro Intelligence

Food shortages and climate change are significant global problems, but very little data is used to make critical decisions on those subjects.

That’s why Ethiopia-born Sara Menker is building Gro Intelligence. It’s an AI-powered company providing decision-making tools and analytics to the food, agriculture, and climate industries.

Gro combines more than 650 trillion data points from 50,000 data sets with over 2 million AI models that predict a wide range of phenomena — from the impact of natural and human-caused disasters on food supply to how weather events affect the price of goods.

The fourth agricultural revolution has digital agriculture at its center … and access to quality and actionable data is absolutely crucial.EchoVC

Lesley Marincola, Company

Solar energy home systems and solutions have become mainstream across African households over the past decade, thanks in no small part to the Pay-As-You-Go business model.

But building customized PAYGo software and technology can be time and cost-intensive for various players in the value chain.

That’s where Lesley comes in.

She’s building Angaza, a PAYGo-enabled sales & customer management SaaS platform whose technology is deployed in over 30 African countries.

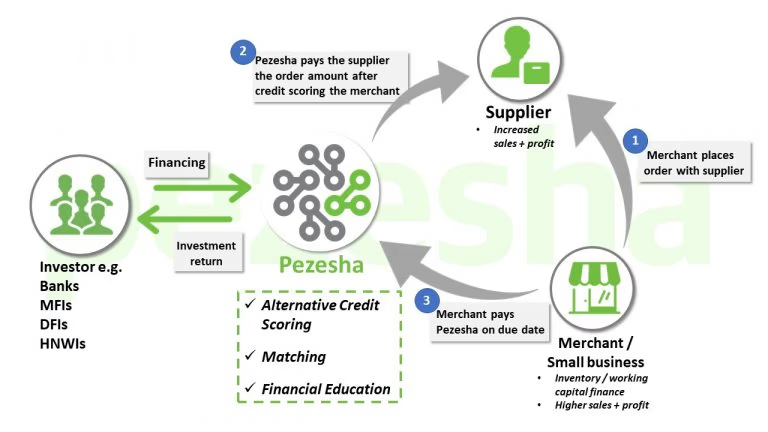

Hilda Moraa, Pezesha

“If you financially empower a business owner to meet their business goals, they can feed their family, employ people, and ultimately support the wider community.”

That’s why Hilda is building SME financing platform Pezesha.

The company has built embedded lending infrastructure that allows traditional and non-traditional finance institutions to offer working capital financing to SMEs. And since its founding in 2017, Pezesha has extended loans to over 100,000 businesses via over 20 partner companies.

Lucrezia Bisignani, Kukua

“Children aren’t learning with the correct teaching methodologies.”

That’s the kernel at the core of edtech & media platform Kukua.

It’s an entertainment- & fun-first ‘edutainment’ platform, underpinned by ‘Super Sema’ — its original, character-driven African animated superhero(ine) franchise, that empowers African children with basic literacy and numeracy skills

Kukua’s goal is to take full advantage of its IP to build an interactive, learning-focused, Disney-like universe that will include a suite of licensing, merchandising, and publishing offerings and perhaps even a foray into the metaverse.

Cynthia Wandia, Kwara

Informal communal savings systems — known as susu and ajo in parts of West Africa, chama and SACCOs in parts of East Africa, hagbad in Somalia, ekub in Ethiopia, tontines in parts of Francophone Africa, and stokvels in South Africa — are widespread across the continent.

But manual record-keeping is largely the norm, resulting in inefficient operations and poor experiences for participants.

But where there’s inefficiency, there’s opportunity. And Cynthia is going after it.

She’s building Kwara, a software provider that’s digitizing the savings and credit co-operatives (SACCOs) sector.

Kwara offers back-end-as-a-service (BaaS) software that brings tedious, paper-based back-office administration online, as well as a digital banking platform that facilitates loans and other services.

Ella Peinovich, Powered by People

In many industries across Africa, inequitable supply chains mean that producers — often working in the informal economy — earn a meager share of the market value of their goods.

In the arts & crafts industry in particular, producers, who are largely women, take home only about 10% of the income generated from the crafts supply chain.

That’s why Ella’s building Powered by People.

It’s a wholesale B2B e-commerce platform, that removes supply chain intermediaries and directly connects local producers to international markets, helping local producers earn more.

Jihan Abass, Lami

Insurance penetration rates across Africa are some of the lowest in the world. But Africa’s appetite for insurance is growing.

That’s why she set out to build Griffin, Kenya’s first digital-only car insurance company.

But to get Griffin off the ground a technology solution was needed to link insurance companies with brokers/providers to simplify the policy underwriting and claims processes.

Today that tech solution is Lami, a product-agnostic, API-driven digital insurance platform that helps businesses across sectors to easily embed insurance products into their offerings.

Lami has also integrated its API with more than 15 companies — from logistics providers to e-commerce companies to banks and fintechs — and has a portfolio of over 85,000 policies, with premiums underwritten of nearly $1 million annually.

Kagure Wamunyu, Jumba

Across Africa, supply chains are largely fragmented and problematic across verticals.

And this fact, coupled with one of the megatrends taking place across the continent — urbanization — points to an opportunity to integrate construction supply chains that underpin growth of residential and commercial real estate.

That’s the opportunity Kagure is going after with Jumba.

The company is digitizing the construction material supply chain, aggregating construction material supply from large vendors and allowing neighborhood stores to place orders digitally, usually on credit.

Bente Krogmann, mTek

“Everyone deserves to be insured.” That’s what drove Bente to start digital insurance platform mTek.

The company digitizes various insurance processes — onboarding, underwriting, policy management, claim processes, fraud detection, data monitoring, & more — and allows brokers, agents, & consumers to benefit from the various efficiencies and time/cost savings of digitization.

Cathy Chepkemboi, Tushop

On average, Americans spend 6% of their income on food while Kenyans spend a whopping 46%. And Kenya isn’t unique.

According to a recent note in the Financial Times, citing estimates from the IMF, food represents 17% of expenditure in advanced economies and 40% in sub-Saharan Africa.

Driving the share of income spent of food down across Africa is what spurred Cathy to start Tushop, an agent-driven, community group-buying platform.

The company, whose purpose is to “lower the cost of living,” onboards last-mile agents or community leaders who collect orders from their neighbours and facilitate deliveries in exchange for a commission. The company then aggregates these orders into bulk purchases from suppliers, resulting in up to 60% savings.

Nigeria

Anu Adasolum, Sabi

Retail in Africa is largely informal.

According to Boston Consulting Group (BCG), for example, the informal retail sector accounts for more than 70% of consumer food, beverage, and personal care purchases across the continent.

It’s no surprise then that a number of innovators are looking to leverage technology to empower retailers, reduce efficiencies, and minimize frictions across a variety of functions.

Enter Anu.

She’s building Sabi, a sector-agnostic B2B marketplace that connects informal retailers to suppliers — manufacturers, distributors, wholesalers, etc. — and offers them e-commerce support, logistics services, and working capital loans through third-party providers.

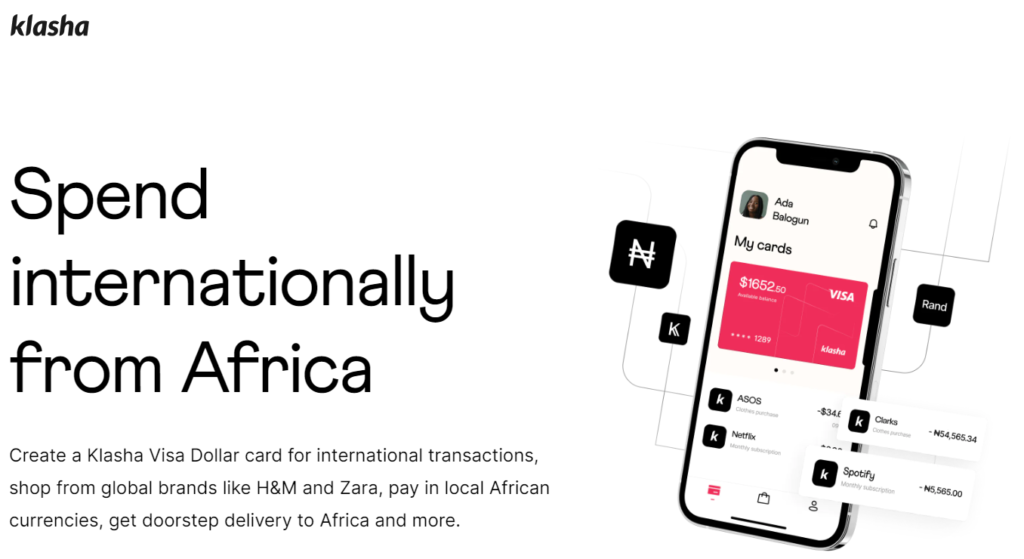

Jess Anuna, Klasha

“People in Africa should have the same access to frictionless e-commerce experiences offered in developed markets.”

That’s the idea behind Klasha, a provider of fintech solutions for the cross-border e-commerce space.

Jess explains, “The core mission of Klasha is to streamline cross border commerce from Africa to the rest of the world. And in turn, give the rest of the world access to African consumers on the ground who want and need these goods globally.”

Yvonne Johnson, Indicina

Access to credit is a huge problem across Africa.

But with so many unbanked and underbanked people across the African continent, formal credit data largely doesn’t exist and centralized credit bureaus tend to be in their infancy.

Unlocking the consumer credit opportunity requires technology and innovation in credit risk.

And that’s where Yvonne comes in.

She’s building Indicina, a provider of API-driven credit infrastructure that facilitates lending decisions and enables efficient risk assessment.

Fara Ashiru Jituboh, Okra

“I was speaking to a lot of CEOs & CTOs and I noticed infrastructure gaps in Nigeria’s fintech space were causing them similar issues.”

That’s why Fara decided to build open finance API infrastructure platform Okra.

Okra is stepping in to fill the gap.

Their open finance API allows users to connect their bank accounts and permission real-time financial data to an app or financial service. Today, developers and businesses are using Okra to build full end-to-end digital services like lending, personal financial management tools, real estate credit assessments, and SMB banking products.Misha Gordon-Rowe, Investor at Susa Ventures

Ugwem Eneyo, Shyft Power Solutions

Nearly half of Nigeria’s population has no access to grid electricity, and those that do face regular power cuts. As a result, consumers and businesses across the country rely on over 60 million generators — spending over $14B annually to power them — to supplement their energy needs.

Solar systems are an increasingly attractive alternative to unreliable grid power and expensive diesel generators, but most consumers and businesses do not have the expertise or desire to manage hybrid power systems.

That’s where Shyft comes in.

The company builds IoT hardware and software solutions to optimize distributed energy resource performance and operational efficiency, unlocking cheaper, cleaner, and more reliable power for businesses and consumers in emerging markets, starting with Nigeria.

I founded Shyft to build the technology that can enable and accelerate this transition, and ensure that on the path to reliable energy access, the use of cleaner solutions can mitigate carbon emissions as well.Ugwem Eneyo

Honey Ogundeyi, Edukoya

“If we look at all the innovation across different industries, Africa’s education system has remained untouched for 50 years; it’s been stagnant.”

That’s why Honey founded Edukoya — to bring impactful innovation to Africa’s education sector.

The edtech is an tutoring, homework help, and exam prep platform that targets Nigerian secondary school students.

Edukoya goes beyond exam prep. First, it’s an educational partner to parents and learners in primary and secondary school. We’ve seen people tackle smaller pockets in different ways, but not in a holistic way that we’re thinking about it.Honey Ogundeyi

Rwanda

Joanna Bichsel, Kasha

Women in emerging markets struggle to access high-quality menstrual and sexual health products. It’s not uncommon for them to encounter social stigma, counterfeit products, and stockouts.

That’s why Joanna founded femtech e-retail platform Kasha — to provide women in East Africa with access to high-quality women’s health, personal care, and beauty products.

“Women are very influential in … household purchases. But when you look at how tech solutions are traditionally built, they’re usually built by men for men. The largest customer base in health and personal care, which is women, is massively underserved,” adds Joanna.

The beauty of Kasha’s platform is that it caters to a variety of customers, including students, young professionals, low-income women, and new mothers. That means there’s a possibility of retaining a customer for life, from adolescence through adulthood.Lavanya Anand, Vice President, VestedWorld

South Africa

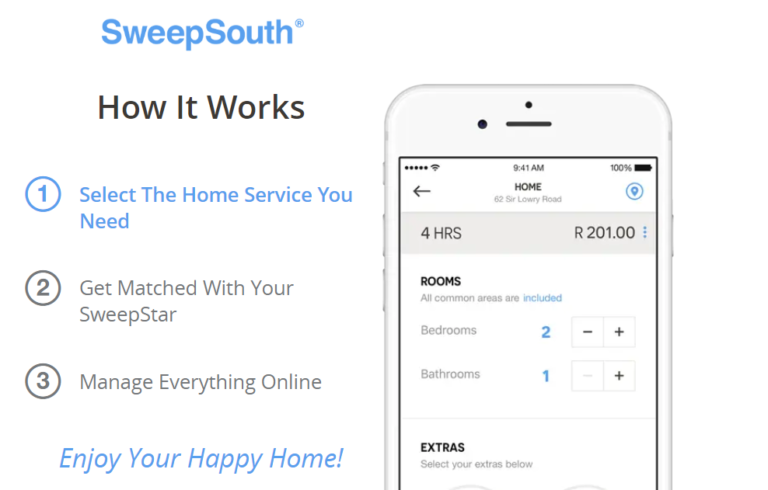

Aisha Pandor, SweepSouth

After struggling to find a cleaner in South Africa, Aisha thought there had to be a better way.

So she founded on-demand home cleaning & services platform SweepSouth to simplify life for working professionals while creating meaningful employment opportunities for informal sector workers.

Jessica Boonstra, Yebo Fresh

Grocery shopping can be a challenge if you live in one of South Africa’s townships.

And while township entrepreneurs arguably form the backbone of South Africa’s economy, they lack cost effective inventory restocking options, advanced retail technology & analytics, and market power, resulting in high costs that the pass on to end customers.

Jessica founded B2B e-commerce platform Yebo Fresh to provide township communities with access to affordable, quality food.

The platform offers an order-to-delivery solution that allows township retailers to place an order and get free delivery of goods within 24 hours and also offers BNPL financing solutions.

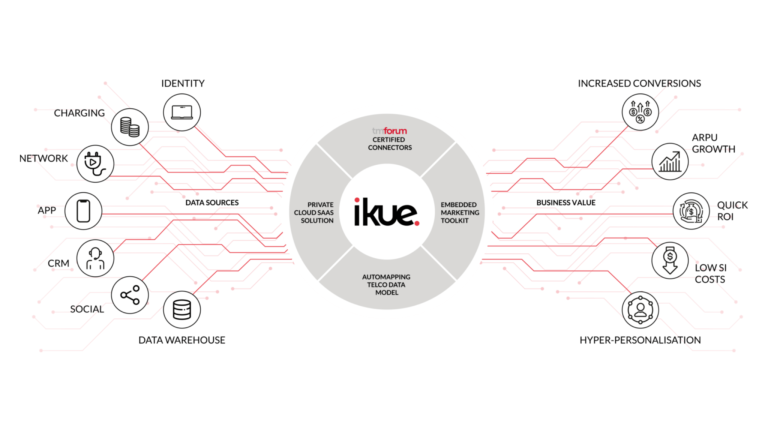

Bronwynne Stoddart, Ikue

Thanks to nearly a decade of experience at Vodacom in Cape Town, South Africa, Bronwyn was exposed to the challenges telcos have in getting the most out of customer data.

That’s why she’s building British customer data & personalization platform for telcos Ikue, which relies on a team of South African engineers.

Sudan

Tarneem Saeed, Alsoug

After years as a corporate lawyer in the UK, Tarneem returned to Sudan in 2014.

“Coming from London, Sudan just felt really empty. One thing that irked me the most was how difficult it was to find out the price of anything. You had to ask someone to get the price of a car, house, and even cattle,” Tarneem said.

So she built online classifieds market place alsoug.

Explaining her rationale, she added, “We chose the classifieds model because Sudan was quite unstable and the internet wasn’t great. The beauty of online classifieds platforms is that they don’t require heavy tech, and you can do a lot on it while keeping costs fairly low.”

Today, alsoug is completing its transition from a classifieds model where transactions between buyers and sellers happen off the platform to a full-stack e-commerce model that facilitates transactions on-platform.

As such, alsoug created a PayPal-like payment service provider, Cashi, that not only facilitates alsoug payments, but also accessible helps consumers pay utility bills, buy airtime, pay for government services, and more.

Today, alsoug is Sudan’s largest e-commerce platforms and one of the most visited local websites in the country, and Cashi is the leading fintech platform in the country.

Tunisia

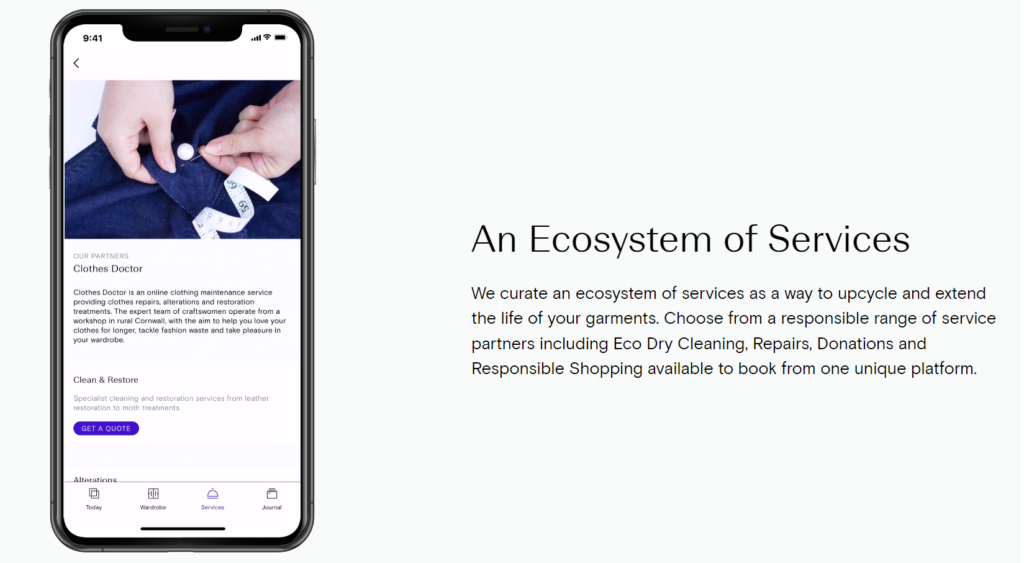

Hasna Kourda, Save Your Wardrobe

While Western culture can be said to be marked by overconsumption and single-use culture, underconsumption and reusing, repairing, & recycling are everyday occurrences across the continent.

As an example, look no further than the second-hand clothing market — known as madunusa in South Africa, okrika in Nigeria, and mtumba in Kenya — which is thriving across all corners of the continent.

Hasna notes, “I was born and raised in Tunisia where I learned the importance of a circular and sustainable approach to life. When I moved to Europe, it struck me that there was this throw-away culture. So, I decided to take all the values that I grew up with and [bring them to life with] technology.”

So she built Save Your Wardrobe, a British digital wardrobe and clothing repairs platform that’s supported by tech teams in Tunisia.

Venture capitalists are constantly telling the entrepreneurs they invest in to make data-driven decisions. But as an industry, we haven’t been very good at doing it ourselves… [Examining] 10 years worth of our proprietary investing data, [we found that] female founders outperform their male peers… Companies with a female founder performed 63% better than our investments with all-male founding teams.❞

– First Round Capital

Share: