Editor’s note: This article on African unicorns was originally published in February 2023 and last updated in September 2025 to add Nigeria’s Moniepoint and South Africa’s Tyme.

The term “unicorn” was coined in a 2013 Techcrunch article by Aileen Lee, founder and managing partner of Palo Alto’s Cowboy Ventures. She used it to describe American software companies that were less than 10 years old and valued at $1 billion or more by private investors or public markets.

Today, it’s widely accepted by the global VC & tech community that a ‘unicorn’ is a privately-held (i.e., not public) tech startup worth $1 billion or more on paper, irrespective of its founding date, sector of operations, and regional focus.

And according to that definition, there are currently nine unicorns in Africa, with the newest — Nigeria’s Moniepoint and South Africa’s Tyme — being minted in Q4 2024.

Here’s an overview of the nine African unicorns today.

Interswitch

Founded in 2002 in Nigeria as a nationwide transaction switching platform, Interswitch is Africa’s oldest unicorn.

The company today offers a variety of digital payment & commerce solutions including online payment gateways, interbank transaction switching and third-party card processing, card acquiring & issuance via domestic card scheme Verve, identity management and digital payment infrastructure for state governments, point-of-sale solutions, and more.

While Interswitch’s IPO plans were first made public in 2016 and new media reports bubbled up in 2019, those plans haven’t yet come to fruition and the company remains privately held.

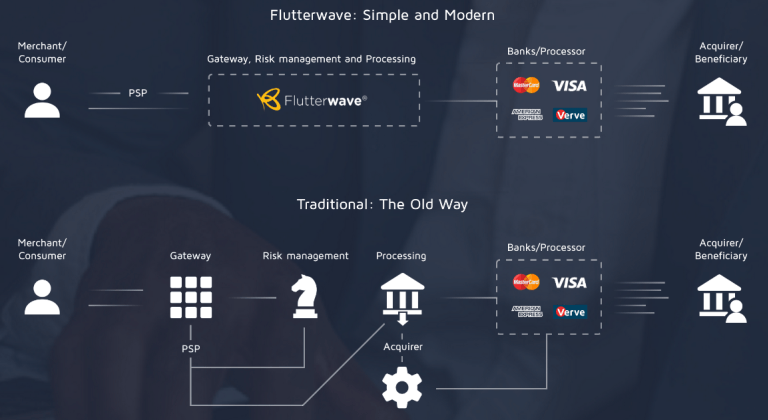

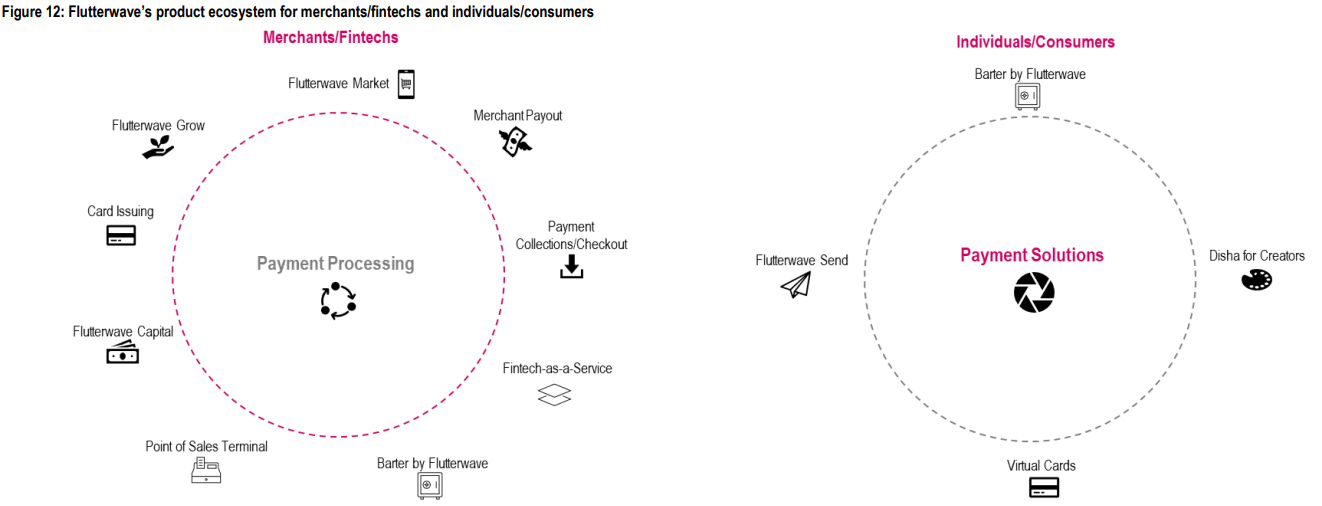

Flutterwave

Founded in 2016, Flutterwave is a Nigerian API-driven platform that aggregates payment gateways across the continent, allowing merchants to accept card & alternative payments (e.g., mobile money and bank transfers) easily.

The company initially focused on global enterprise customers (e.g., helping Uber easily accept payments across various African markets), but has since diversified to offer a full range of products to a wide variety of customer groups with solutions like the Flutterwave Store, Flutterwave Capital, creator economy platform Disha, and more.

Source: Renaissance Capital.

OPay

Co-founded in late 2017 by Opera, makers of the data-lite internet browser, and Balder Investment, an entity controlled by Chinese billionaire (and Opera Chairman & CEO) Yahui Zhou, OPay is a mobile payments platform that began operations in Nigeria in 2018.

The company’s strategy initially leaned on its motorcycle taxi ride-hailing service ORide, but it renewed its focus on payments after a legislative ban on commercial motorbike taxis.

Today, in addition to payment & money transfer services, OPay also offers airtime top-ups, loans, savings, and more to over 18 million registered app users via 500,000 agents across Nigeria, according to its website.

Wave

Piloted in 2016 and launched fully in 2017, Wave is a full-stack digital mobile money wallet initially focused on Francophone Africa.

The company offers a range of free or low-cost financial services including money transfers, bill payments, airtime top-ups, and more.

In Senegal, its first market, it has already beaten out the telcos to become the country’s largest mobile money provider, and today the majority of Senegal’s adult population uses Wave every month.

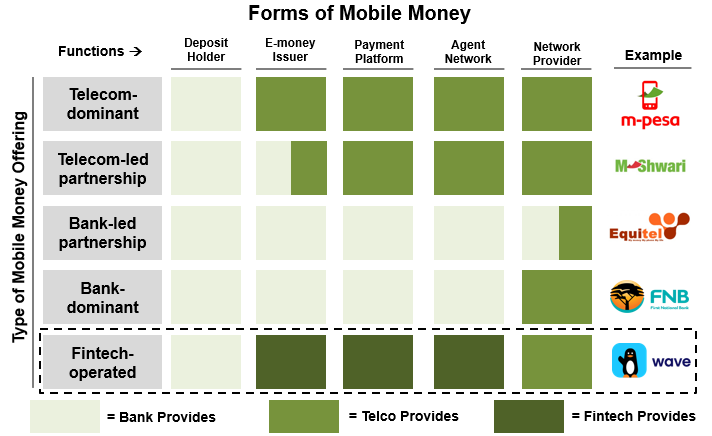

When considering the competition between banks, telcos, and fintechs for the future of financial services across the African continent, Wave is perhaps the top fintech to watch in the mobile money space.

Source: McKinsey.

Andela

Founded in 2014, Andela is today a talent marketplace that connects leading companies across the world to technology talent in emerging markets.

The company initially began its journey as a remote-engineering-as-a-service platform. It trained and hired junior software developers across Africa, then placed them with global businesses as full-time distributed engineers.

In 2019 however, the company announced a ‘strategic shift’ away from junior talent to focus on placing experienced, senior engineers.

And in 2020, the company moved away from its in-house, full-time employee model to become a talent marketplace that places external tech talent without prior Andela training or a pre-existing Andela relationship.

Chipper Cash

Launched in 2018, Chipper Cash is a cross-border, peer-to-peer money transfer platform.

In addition to cross-border money transfers, the company offers bill payments, airtime top-up services, virtual cards, stock marketing investing, crypto trading, and more.

According to the company’s website, it has over 5 million users, processes over $1.5 billion quarterly, and has issued over 300,000 virtual cards.

MNT-Halan

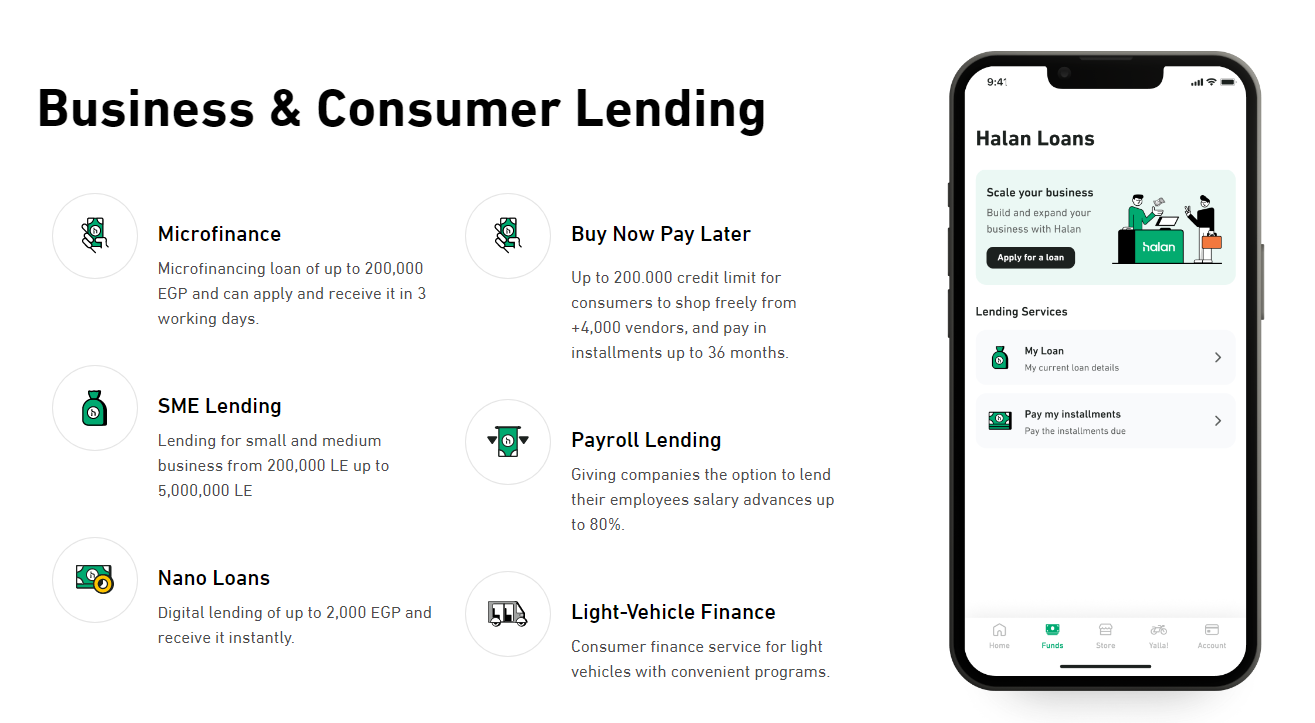

Strictly speaking, MNT-Halan was created in 2021 as a result of a share swap merger between two entities founded by Egyptian serial entrepreneur Mounir Nakhlar: ride-hailing & delivery platform Halan and microlending holding company MNT.

The merger happened after MNT’s 100% consolidation of Raseedy, the first interoperable digital wallet licensed by the Central Bank of Egypt. (And Raseedy lives on as Halan Cash.)

Today, MNT-Halan derives most of its revenue from lending — over $300M in 2022, it says — and has since shut down its ride-hailing operations.

In addition to disbursing over $2 billion in loans of various types (BNPL, vehicle financing, payroll lending, & more) since inception, the company also offers a variety of digital payments and e-commerce services (both B2C and FMCG B2B).

Moniepoint

Founded in 2015 by Tosin Eniolorunda and Felix Ike under the name TeamApt, Moniepoint initially focused on building software infrastructure for financial institutions in Nigeria before pivoting to become a comprehensive business and personal banking platform, and one of Africa’s largest agent banking networks.

The company operates through both digital channels and a vast network of physical point-of-sale (POS) machines carried by hundreds of thousands of agents across Nigeria.

Its strategy increasingly centers on being an all-in-one financial platform, offering digital payment, business banking, personal banking, credit, remittance, and business management solutions.

Since the early 2020’s, the company has leveraged the Central Bank of Nigeria’s cashless drive to rapidly scale its operations, positioning itself as a key player shaping the future of digital payments in the country by occupying an intermediate position between analog and digital worlds and acting as a key on-ramp to the ongoing digitization of SME financial services in the country.

Today, Moniepoint serves over 10 million businesses and individuals in Nigeria, processing over 1 billion transactions worth over $22 billion monthly — and its annualized revenue at the time of its $110 million Series C unicorn round in 2024 was said to exceed $100 million.

According to the company, Moniepoint has achieved profitability with industry-leading margins, and following its unicorn round, it has expanded internationally with the launch of a UK-Nigeria remittance product and the acquisition of a controlling stake in Kenya’s Sumac Microfinance Bank.

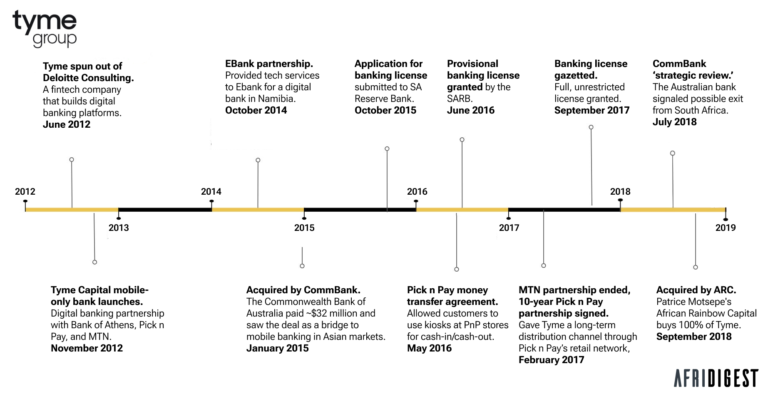

Tyme

Tyme, originally known as ‘TYME’ (“Take Your Money Everywhere”), started in June 2012 as a spin-out of a Deloitte Consulting project to build digital banking and mobile money platforms funded by South African telco MTN and led by Coen Jonker and Tjaart van der Walt.

The company initially developed a mobile money remittance platform for MTN and launched mobile-only bank ‘Tyme Capital’ in partnership with South Africa’s Bank of Athens (as the banking partner), retailer Pick n Pay (whose store footprint facilitated cash deposits/withdrawals), and MTN (who provided a sizeable existing customer base).

In 2015, Tyme was acquired by the Commonwealth Bank of Australia for $32 million (AU$40 million) as part of a strategy to use its tech for mobile banking initiatives in developing markets across Asia. In 2017, MTN ended its partnership due to the apparent “lack of commercial viability.” And in 2018, South African billionaire Patrice Motsepe swooped in, with his firm African Rainbow Capital (ARC) acquiring the company.

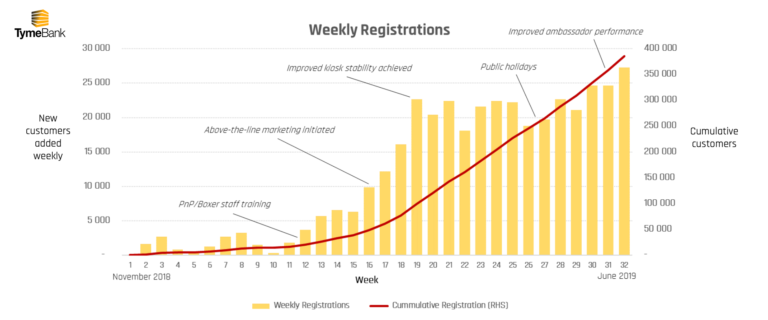

After the acquisition, Tyme launched TymeBank after receiving a full banking license from the South African Reserve Bank — the first such license issued since 1999.

In 2022, Tyme launched its Philippine operations, GoTyme through a joint venture with the Gokongwei Group, a diversified conglomerate owned by one of the Philippines’ wealthiest families; the Group operates one of the country’s largest omnichannel retailers. Now, with its group headquarters in Singapore, Tyme is exploring expansion to Pakistan, Vietnam, and/or Indonesia — a continuation of its strategy from a decade ago during its years with Australia’s CommBank.

Since inception, Tyme’s strategy has been to combine digital banking with physical touchpoints through a hybrid “high tech-high touch” model.Instead of traditional branches, the company operates thousands of self-service banking kiosks located within retail partner stores like Pick n Pay and The Foschini Group in South Africa and Robinsons in the Philippines. Customers can open accounts, capture biometric data, and print debit cards instantly using just an ID and mobile phone at those kiosks, and they can deposit or withdraw funds at any checkout counter within the partner network.

Today, Tyme has a combined customer count of over 17 million, with over 11 million TymeBank customers in South Africa and approximately 6.5 million GoTyme customers in the Philippines. After the company’s $250 million Series D unicorn round in 2024, Tyme’s leadership discussed plans for a US IPO by 2028 with a secondary listing in South Africa.

The last word

There you have it — the African tech ecosystem’s nine unicorns today.

It’s worth noting, however, that this list of African unicorns is largely based on historical paper valuations. And given current market conditions globally, those valuations might well be depressed today.

how many of the companies listed are still unicorns in today's market? so once unicorns but now looking more like pelicans.

and how many companies that would be unicorns based on revenues aren't on that list?

— Eghosa Omoigui (@EghosaO) February 2, 2023

Still, the addition of Moniepoint and Tyme to the list of unicorns in Africa in 2024 signals renewed confidence in tech on the continent, with both companies achieving billion-dollar valuations at a time when global venture funding remained constrained. This suggests that the continent’s most promising startups continue to demonstrate resilience and growth potential that transcends broader market cycles.

Ultimately, as tech in Africa continues to evolve, the question isn’t just how many companies can reach billion-dollar valuations, but whether they can build sustainable, profitable businesses that drive prosperity for the continent’s 1.5 billion people and beyond.

Afridigest’s advisory arm Afridigest Intelligence helps executives, investors, and institutions create and capture opportunities across African markets through strategic intelligence, analysis, and insight. Contact intelligence@afridigest.com to see how we can help.

Share: