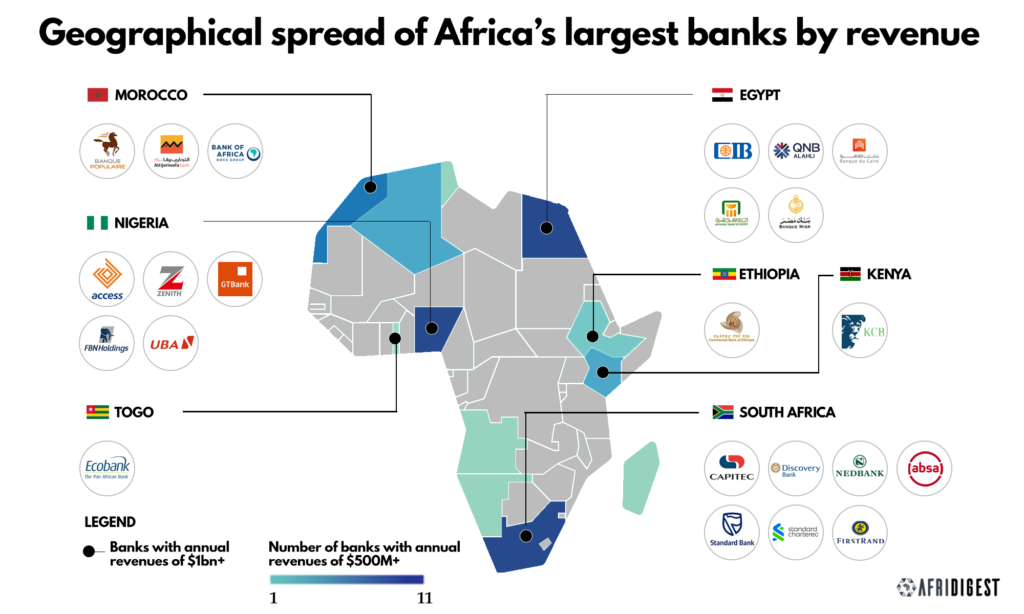

Africa’s largest banks, in terms of annual revenue, are concentrated in South Africa, Nigeria, Egypt, and to a lesser extent, Morocco.

Not surprisingly, this maps quite well with the largest economies on the continent — South Africa, Nigeria, and Egypt lead the way in terms of annual GDP, and Morocco is fifth, just behind Algeria.

The financial services sector as a whole—banks, insurance operators, asset managers, and other financial services players—accounts for ~20% of the 600 or so companies across the continent with annual revenues over $500M; it’s the leading sector among Africa’s top revenue-generating companies.

It’s perhaps no surprise, then, that fintech leads all venture capital funding on the continent.

- For one, financial services has one of the continent’s largest market sizes as evidenced by Africa’s largest companies by revenue.

- Secondly, fintech is foundational infrastructure for Africa’s emerging digital economies — digital services can’t proliferate without reliable & accessible means to pay for them, for example.

- Thirdly, financial services regulations across the continent are heavily fragmented so it’s difficult for truly pan-African winners to emerge, leading investors to repeatedly back potential local/regional champions.

And with large swathes of the population unbanked, underbanked, and underserved, there still remain myriad opportunities for banks and fintechs across Africa to collaborate and/or compete to broaden & deepen financial inclusion across the continent.

Interested in going deeper? Strategic intelligence & advisory firm Africreate can help you understand, identify, and take advantage of opportunities related to financial services & fintech on the continent.

Share: