In many ways, Nigeria is Africa’s leading fintech hub.

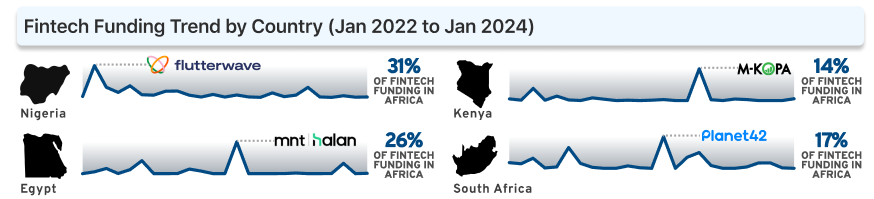

Since January 2022, the country — Africa’s most populous — has been the number one destination for fintech funding across the continent.

During that time, the West African country has accounted for almost a third of all disclosed funding raised by fintechs in Africa.

But despite the high levels of fintech activity in Nigeria, cash remains king.

While acceptance of digital payments outside of the country’s urban areas is on the rise, it’s still limited today.

And even in large cities like Lagos or Abuja, it can be hard for customers to conduct certain everyday transactions without cash.

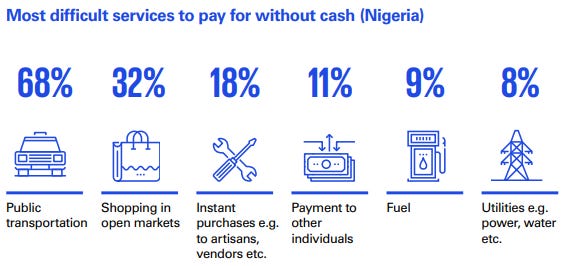

According to a recent KPMG survey, consumers in Nigeria struggle to go cashless when it comes to paying for public transportation, paying informal vendors and artisans, and paying for fuel.

Here’s a look at some innovators spearheading the adoption of digital payments in these tricky verticals in Nigeria.

Paying for public transportation

In partnership with the Lagos State government, Touch and Pay (TAP) rolled out a payment system for public transportation in February 2021.

In three short years, almost 4 million Lagosians have used either TAP’s Cowry app or its NFC-enabled Cowry cards.

Users can pay for buses, ferries, and trains by QR code or digital wallet transfer with the Cowry app and they can tap to pay using physical Cowry cards even when they aren’t connected.

When bank robber Willie Sutton was asked why he robbed banks, he famously replied, “Because that’s where the money is.”

Similarly, when I asked Afolabi Olamide, Co-Founder & CEO of Touch and Pay, why TAP is focused on the transport sector, he told me it’s because that’s where the financially underserved are.

“The major reason for picking the transport sector is because it resonates with our vision of making it possible for everyone to pay digitally, and it’s a sector where most of the financially excluded people are.

Transportation is so essential, yet both the drivers and the market woman may not trust the banking system or the financial system for that matter. It looked like an interesting challenge to us, so we decided to solve the problem.”

But why has it been hard for digital payments providers to penetrate public transportation in Nigeria? What are some of the obstacles that make cash more attractive in the vertical?

“Cowry didn’t happen overnight. We courted the transport unions for two years to understand their problems, and we developed our system based on their feedback and key concerns to be as simple and reliable as cash…

Regarding the preference for cash over digital payments, I think the reasons are reliability, simplicity, and perceived lack of transaction costs.

Cash is very reliable. There are no worries over stuff like network issues, the possibility of failure, etc. And with cash, there’s zero learning curve.

Most digital payment solutions are too complicated and many solutions are designed for large-value transactions, so they effectively penalize micro-transactions — and merchants and buyers don’t want to lose value in any way.”

Paying informal economy vendors

According to the Central Bank of Nigeria (CBN) in 2011, the Nigerian economy “uses too much cash for transactions for goods and services, especially for buying and selling.”

So over the next decade plus, the Nigerian government rolled out a number of policy initiatives to promote digital payments.

In December 2022 in particular, now-former CBN governor Godwin Emefiele began the ‘naira redesign’ policy, officially in furtherance of cashless aims, but unofficially whispered to be designed to thwart politicians who had stockpiled cash ahead of the country’s February/March 2023 elections.

Whatever the reasons, by early 2023, there was widespread cash scarcity across Nigeria.

“Millions of citizens have slipped into penury and destitution as a result of the disruptions and tribulations perpetrated by the currency redesign policy,” said Muda Yusuf, CEO of the Lagos-based Centre for the Promotion of Private Enterprise.

But chaos is a ladder.

And as Bloomberg wrote in February 2023, “Nigeria’s move to outlaw high-value notes is the best thing that’s happened to mobile-money operators in Africa’s biggest economy.”

One of the big winners was mobile payments unicorn OPay — due ostensibly to the platform’s simplicity, reliability, and speed.

In Nigeria, the informal sector contributes ~65% of GDP and ~80% of jobs according to the IMF, and OPay won the trust of informal economy workers at a time when traditional banks struggled.

2023 was a record year for digital payments in Nigeria, and according to then OPay co-CEO Olu Akanmu in March 2023, OPay saw “some of the strongest growth in [its] history” during Nigeria’s cash crisis.

Paying for fuel

Many petrol stations, particularly in Nigeria’s urban areas, are equipped to accept digital payments, but paying for fuel without cash often remains a challenge.

One platform addressing this challenge is FuelCredit, an e-wallet that allows consumers and corporates to pay for fuel digitally and even on credit.

I spoke with the company’s Founder & CEO Olusola Olanipekun, and a lightly edited transcript of our exchange is below.

Why build a digital payment solution for Nigeria’s fuel vertical?

“Genuine issues still remain in how fuel is purchased in Nigeria. POS and cards sometimes still fail and sometimes there may be a lack of cash in the country. The FuelCredit platform provides customers with a reliable alternative. And digitization brings simplicity, data capture, and convenience to say the least.”

How and why is FuelCredit better than paying with cash?

“FuelCredit gives institutions and consumers access to a free dashboard that shows them their consumption history and allows them to plan better. The platform also allows users to store ‘fuel money’ away from other funds in a dedicated digital pouch. And primary account holders can add family, friends, or employees to their FuelCredit account and they can even set limits for their beneficiaries. In the near future, we’ll also build a loyalty program to reward users.”

What are some of the obstacles you face from partners and end customers? And what are some early indications of traction?

“The key concerns tend to revolve around trust, cost of our service, and an initial pushback to embrace a new way of doing things. In terms of traction, all of our products (retail and corporate) are live now, and one of the major fuel marketers in the country, Mobil, has embraced us.”

While Nigeria has instituted several cashless policies over the years, a variety of everyday obstacles exist that reinforce consumers’ reliance on cash in the country.

As seen above, some of the key challenges revolve around trust, reliability, complexity, and cost.

Policymakers and innovators would do well to thoroughly understand and address these and other everyday obstacles in their drive for a cashless Nigeria.

Share: