Africa is proving to be an important battleground for global payments giants Visa and Mastercard.

The continent’s “infrastructure has advanced” to the point where “Africa has finally started to make sense,” according to Visa Executive Chairman & former CEO Alfred F. Kelly, Jr.

So the two behemoths are investing billions of dollars to make sure they win as fintech comes of age across the continent.

Call it the scramble for fintech in Africa — it’s one of the more interesting business stories happening on the continent today.

The emerging threat

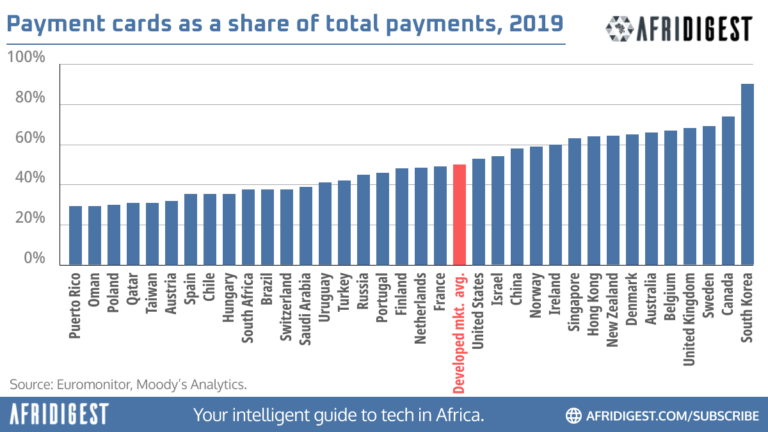

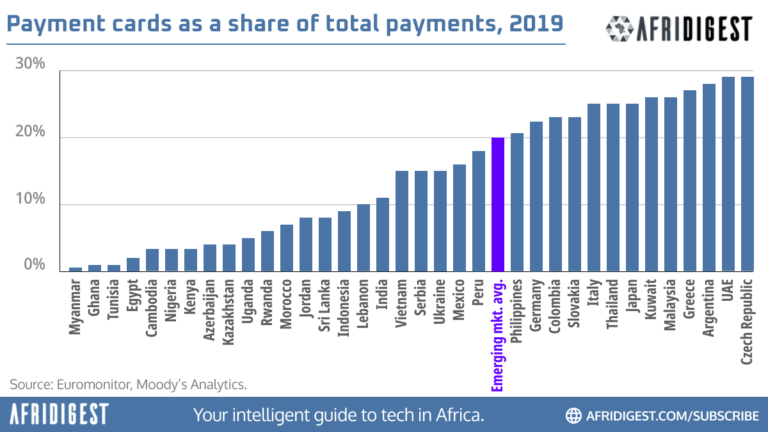

Roughly 50% of payments in developed markets are done with cards.

In emerging markets, the figure is 20%.

And across Africa, the figure is just a fraction of that.

As alternative, non-card payment methods like mobile money, digital wallets, and bank transfers continue to take hold across Africa, the threat of African consumers “leapfrogging” cards becomes ever more real.

The Mastercard-Visa duopoly handles ~90% of global card payments outside China, however, and has a lot of experience converting threats into opportunities.

Here’s what Visa and Mastercard are doing to avert and coopt the threat of cards never gaining widespread adoption in African markets.

Visa and Mastercard in Africa

In 2011, Visa bought South African B2B mobile financial services provider Fundamo for $110 million.

The objective of the deal, in line with Visa’s global strategy, was to help Visa grow its mobile payment services across Africa, Asia, & Latin America.

Here’s a video of Visa’s then-Global Head of Product, Bill Gajda, explaining Visa’s mobile payments strategy at the time of the acquisition.

In 2021, Mastercard invested $100 million in the mobile money business of mobile network operator Airtel Africa.

With the deal, Mastercard gained a partner that it would work with across Africa on “card issuance, payment gateway, payment processing, merchant acceptance, remittance solutions” & more.

In 2023, Mastercard agreed to take an undisclosed minority stake in the fintech business of South African mobile network operator MTN.

The deal deepens Mastercard’s exposure — alongside Africa’s largest telco — to digital payments across Africa (with a slight focus on remittances).

Not to be outdone, Visa pledged to invest $1 billion in Africa through 2027.

One of the most visible ways in which the company will spend that $1 billion is on its new Africa Fintech Accelerator.

Visa says it will work with ~40 African fintechs each year for the next five years and invest in a third of them. It announced the first cohort in November 2023.

Meet the 23 African startups selected for the inaugural @Visa Africa Fintech Accelerator program

Here's the breakdown:

• 6 from Nigeria

• 4 from Ghana

• 3 from Kenya

• 3 from Morocco

• 3 from South Africa

• 1 from Egypt

• 1 from Tunisia

• 1 from Uganda

• 1 from Zambia https://t.co/zslwCoT84G pic.twitter.com/EHSZChuW4w— Afridigest ???????????????????? (@AfridigestHQ) November 17, 2023

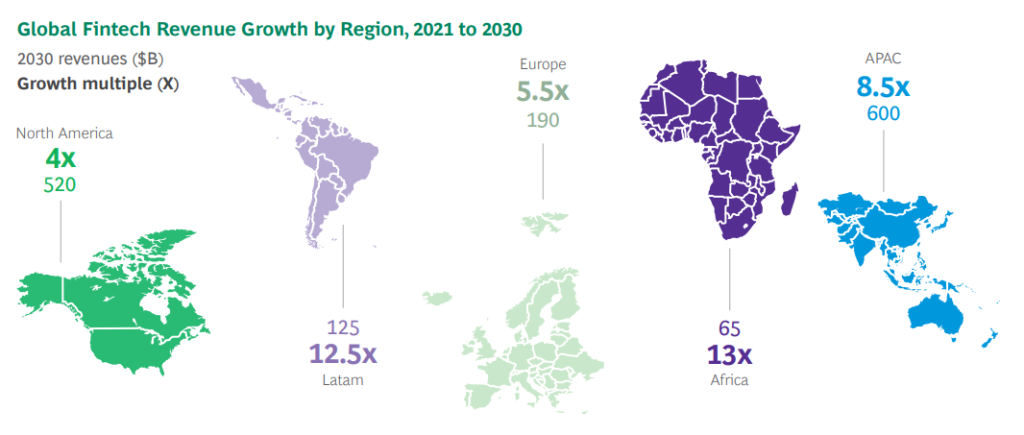

Ultimately, according to BCG, Africa is projected to be the fastest-growing fintech market worldwide over the next decade.

But fintech in Africa will be a lot less card-dependent than fintech in the West.

So Visa & Mastercard are spending billions to make sure they have a seat at the table as the market develops. Watch this space.

Share: