Loomo is a conservative stock trading app focused on novices.

Context

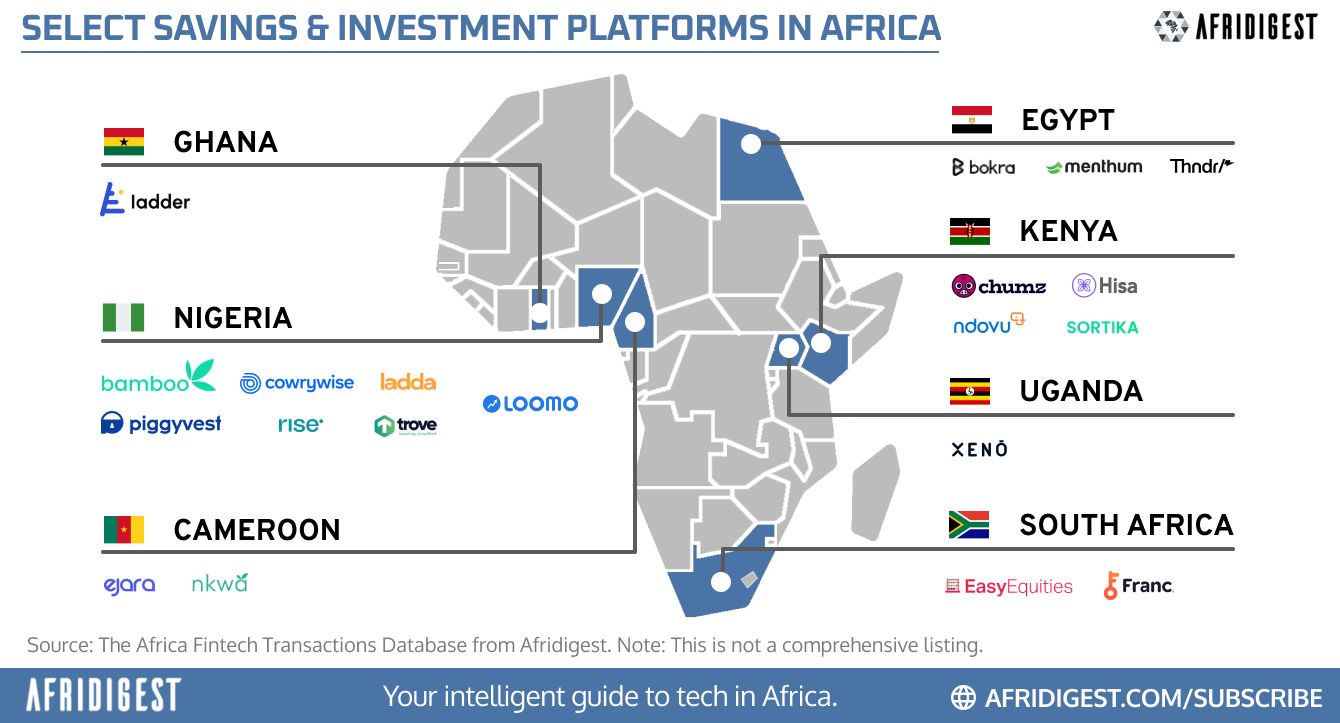

- Online savings and investment apps have proliferated worldwide — and across Africa, too.

- On the one hand though, users of savings platforms in Africa are increasingly driven to search for higher returns as their purchasing power is eaten away by currency depreciation/devaluation, rising inflation, and rising interest rates.

- On the other hand, the vast majority of DIY retail investors lose money — 70-90% of investors depending on the study — due to a mix of avoidable mistakes, poor investment psychology, and bad decision-making.

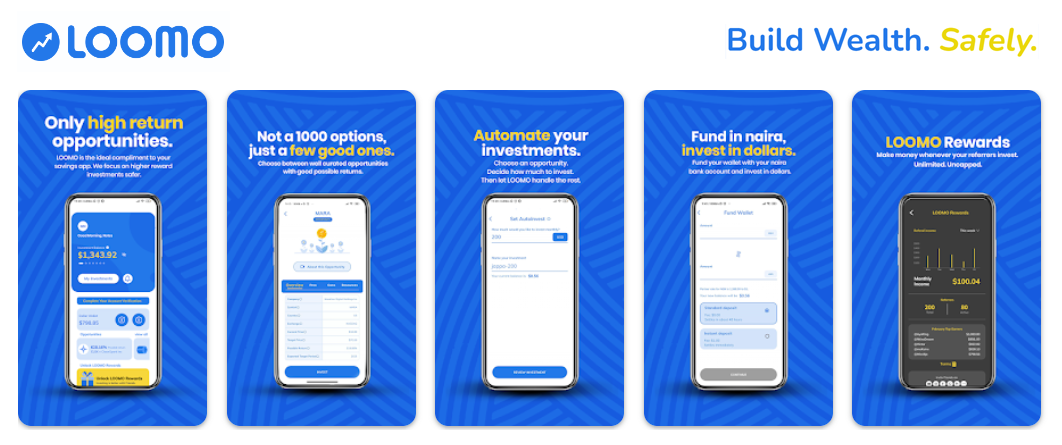

- Loomo offers users access to pre-selected, potentially high-return investments with product features that reward good investment behavior and act as guardrails against bad behavior.

Solution

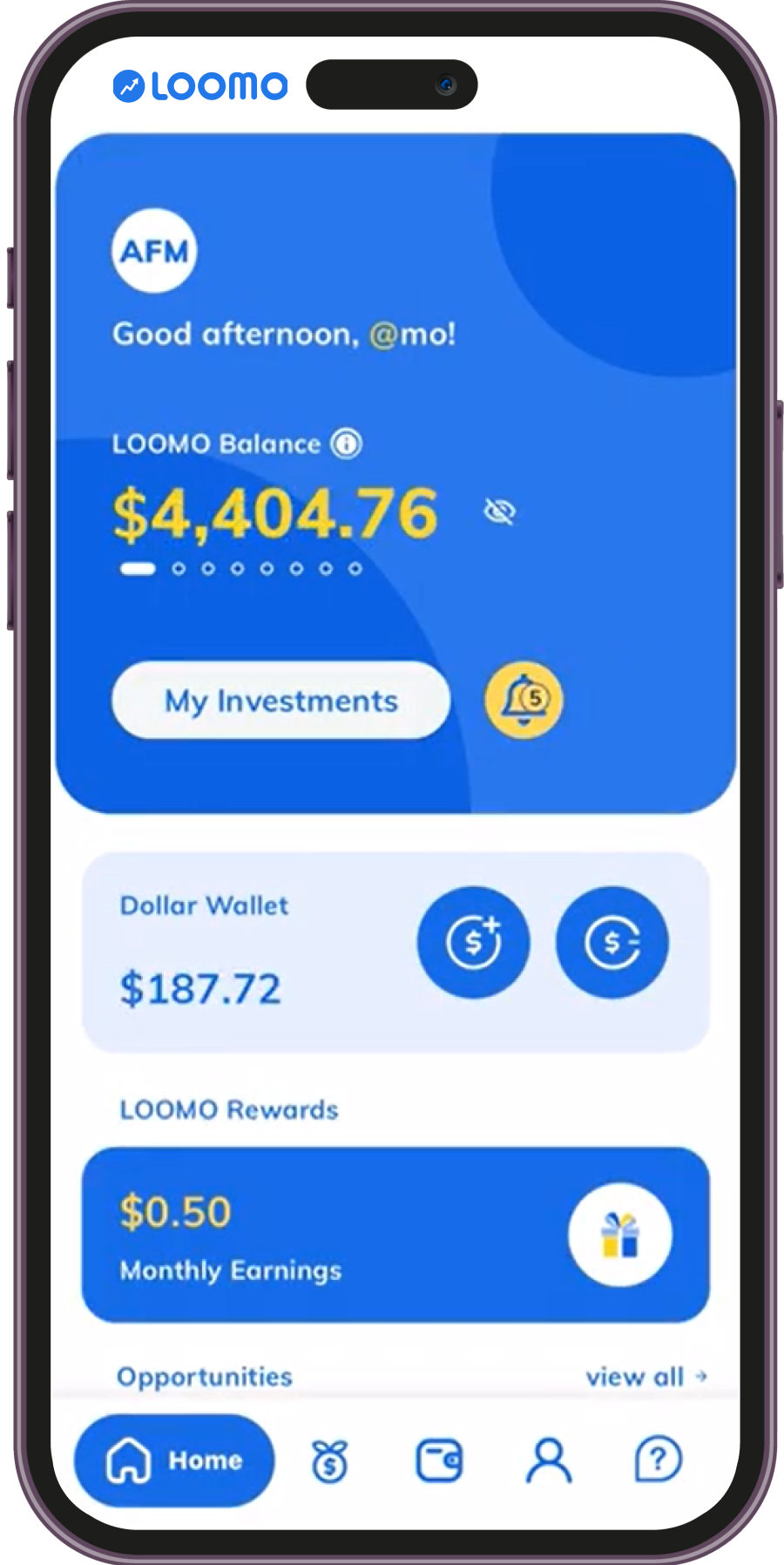

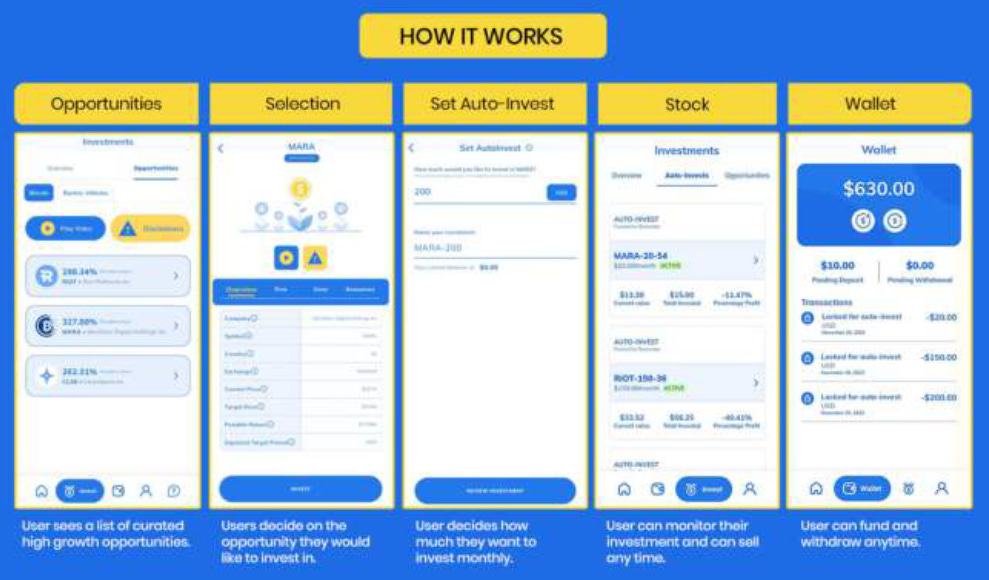

- Loomo’s core solution is an app that offers:

- A limited number of curated stocks (under specific themes like electric vehicles and Bitcoin mining)

- Mandatory dollar cost averaging

- Informational videos about stocks offered

- USD investments with local currency funding

- How it works. Users sign up to Loomo, then once verified, they’re able to fund their in-app USD wallet with local currency (e.g., Nigerian naira). They’re then able to choose a particular stock from the list of curated stocks available and set their desired investment amount. Loomo will then dollar-cost average this amount and invest it periodically over the next 3-4 weeks.

- In the future the company will offer additional investment themes and stocks, introduce additional trading & platform features (like trailing stop loss and auto-debit), and sell a form of investment insurance that could drive significant revenue.

Revenue/Monetization

- The company makes money in three ways today: 1) trading commissions (from every purchase and sale), 2) processing fees (every time users fund their accounts), and 3) FX margin when local currency is converted to USD.

- Due to its mandatory dollar cost averaging methodology, Loomo’s users likely average more transactions per month than similar platforms.

Management Overview

- Founders:

- The founders initially set out to build a crypto-investing venture but pivoted after identifying a gap in the market for solutions that cater to non-expert/beginner retail investors.

Company Overview

- Team Size: 6 (4 full-time, 2 part-time)

- Founded: 2022 (before pivot to current opportunity)

- Launched: Feb 28, 2023

- Headquarters and initial target market: Nigeria

- Sector: Fintech (Wealthtech)

- Early Traction: 100% user retention so far, small sample size notwithstanding. Major partnership struck with Trove to cover licensing requirements.

Fundraising

- Loomo has raised over $100,000 to date from Ventures Platform, Velocity Digital, and several angel investors.

- The company is actively raising $150,000 to reach its first 10,000 users and hit internal MRR targets.

Upside/opportunities

- The company has built something that early users find valuable. The Loomo platform in its current form is just over four months old and in that time it has experienced zero churn. It’s also starting to see early signs of strong user trust (as evidenced by amounts transferred to Loomo) and organic growth via unsolicited word-of-mouth marketing.

- The company’s solution seems very well-timed. Africans across many countries are currently facing the most difficult economic times seen “in a generation or more.” Against that backdrop, many will likely become first-time investors as they search for solutions. If Loomo can develop a reputation as the best platform for this segment — with its blend of high potential returns and in-built safety features — then its user adoption curve might be surprisingly steep.

- The right partnership could significantly accelerate the company’s growth trajectory. If the company is able to strike mutually beneficial partnerships with large, established savings platforms like PiggyVest or Cowrywise and/or personal-finance-focused communities like Money Africa, that could do wonders for user acquisition.

Downside/risks

- It’s early. While Loomo has experienced 100% user retention to date, a question that’s yet to be answered is how the company will acquire users efficiently and scalably. The company is making progress with its referral program, its influencer marketing program, and various partnership discussions, but its customer acquisition engine is not yet well defined. Plus, an alternative viewpoint is that its target customers may simply not have the money to drive significant AUM for the business.

- The company currently faces significant partner risk. The company relies on its partner Trove to meet licensing requirements and if that partnership were to disappear, Loomo would have to stop operating (and it might take significant time to find a replacement). That said, the founders of Trove and Loomo have known each other for a long time, and Loomo views this partnership as a savvy way to figure out its business before pursuing possible options like acquiring its own licenses.

- How defensible is the business? While Loomo is targeting a segment that may be overlooked by other players, competitors — particularly those with the necessary licenses already — could potentially replicate the business model before Loomo establishes a strong market presence.

Competitors/Comparable Companies

- Trading and investment apps:

- Local – Trove Finance, Bamboo, Chaka, Rise, Ladda

- Global – Robinhood, Betterment, Wealthfront

(Loomo differentiates by focusing on safety and guided investing)

- Saving platforms: Cowrywise, PiggyVest (Loomo offers potentially higher returns)

- Crypto trading apps: Quidax, Binance (Loomo provides a more conservative approach to high-return investments)

Last word

American online stock trading app Robinhood realized that it’s easier to convince people who don’t invest to start investing than it is to steal customers from rival platforms. Over 40% of Robinhood’s users identify themselves as first-time investors and the business is valued at $20 billion today.

Loomo is in the earliest days of pursuing a similar strategy. Rather than competing with the various ‘Robinhoods for Africa’, the company is explicitly building for ‘non-consumers’ in the market at a time when making and investing money is increasingly top of mind, given the economic environment.

If successful, Loomo could potentially transform the landscape of personal investing in Nigeria and beyond.

The company is led by a team with high conviction and an outsider perspective, bringing fresh thinking to a longstanding problem. Finally, it always speaks volumes when your past employer invests in your business.

What do you think?

Is Loomo a potential winner? Cast your vote now.

Share: