Maslow on motivation

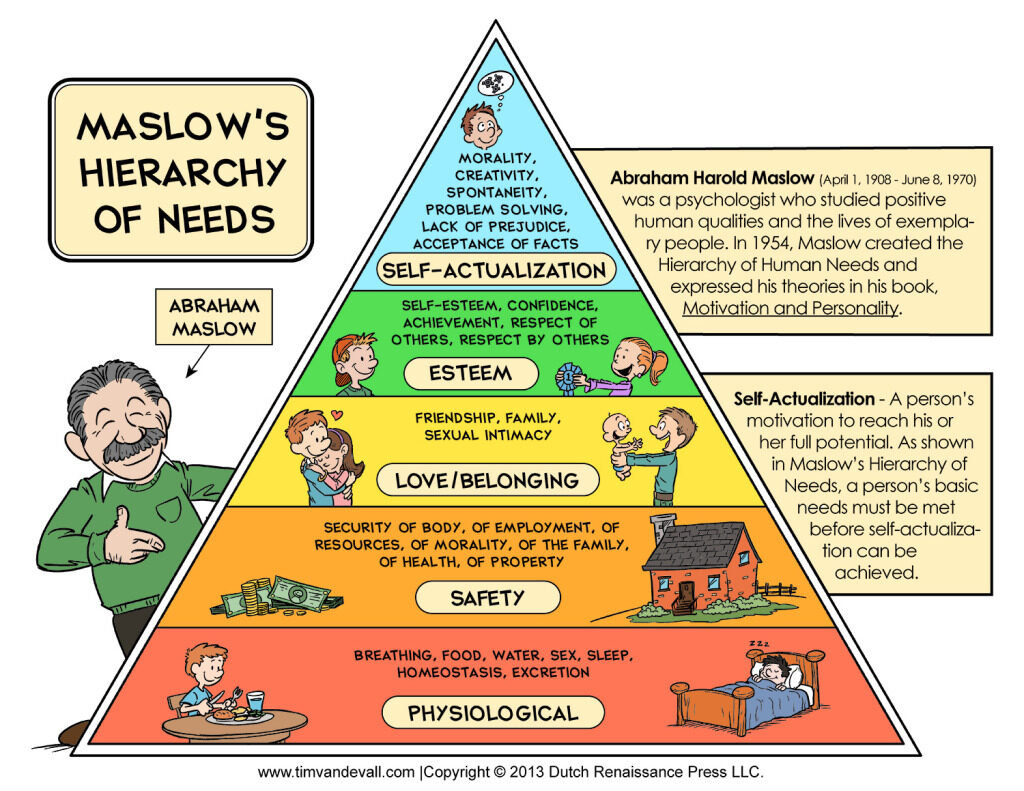

What motivates human behavior? According to Abraham Maslow, the answer is unmet needs. Said differently, unsatisfied needs are the underlying drivers of what people do, the choices they make, and how they behave.

Maslow formally introduced this concept in his 1943 paper, A Theory of Human Motivation. And he further developed it in his subsequent book, Motivation and Personality. His theory, presented as a hierarchy of needs, is now one of the most widely cited for explaining human behavior.

Maslow asserted that there exists a set of basic needs that must be met before one is able to focus on higher-order, more complex needs, commonly depicted today in a five-step pyramid model.

Like most models, it’s a simplification, but nonetheless a useful one.

At the base of the pyramid are the so-called physiological needs. Maslow explains: “These physiological needs are the most pre-potent of all needs … A person who is lacking food, safety, love, and esteem would most probably hunger for food more strongly than for anything else.”

Above these are the safety needs. In Maslow’s words, these are “need[s] for protection and reassurance,” “preference[s] for…undisrupted routine or rhythm,” and the desire for “an organized world rather than an unorganized or unstructured one.” Maslow also restates this as a general preference for “a safe, orderly, predictable, organized world, … in which unexpected, unmanageable or other dangerous things do not happen.”

Next up in the hierarchy are the love and belonging needs. Maslow describes this as a “hunger for affectionate relations with people in general, namely, for a place in [a] group” and a desire “to attain such a place more than anything else in the world.”

Following that are esteem needs. Maslow clarifies that these involve a desire “for achievement, … for independence and freedom, … for reputation or prestige” and for “importance [and] appreciation.”

Finally, at the very top of the hierarchy is the need for self-actualization. This involves the desire to fulfill one’s potential and “become everything that one is capable of becoming,” according to Maslow.

Applying Maslow’s model

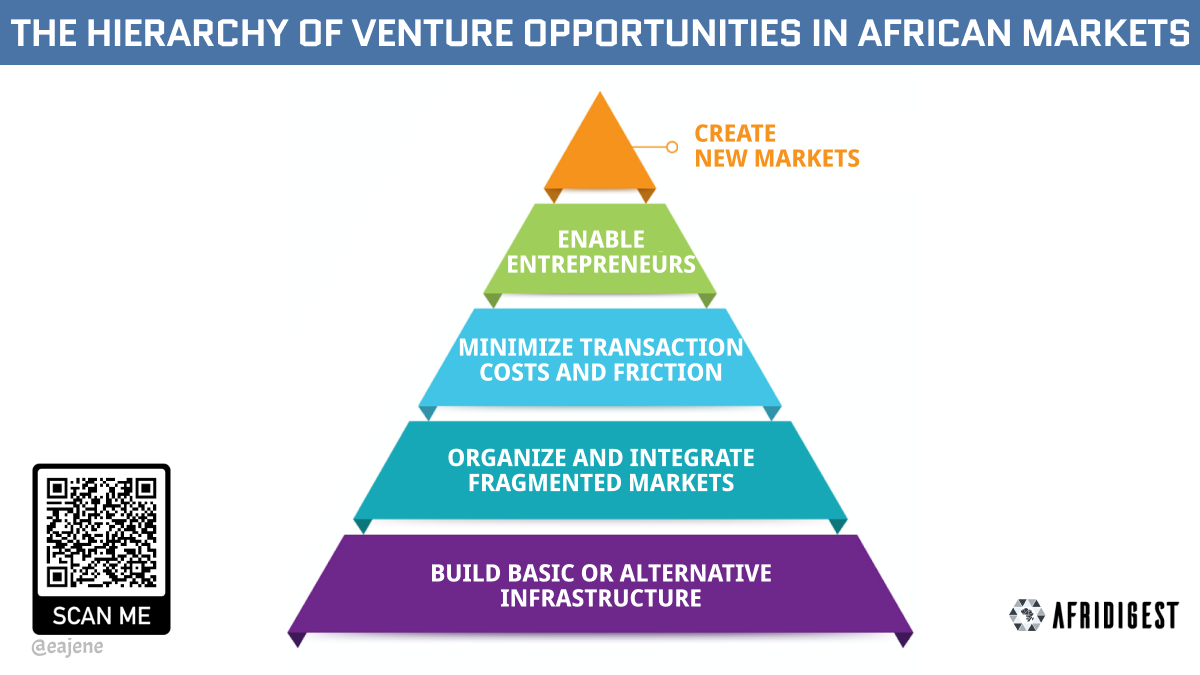

While Maslow explored the catalysts of individual behavior, his hierarchy of needs can be applied to ecosystems and markets as well. Specifically, investors and entrepreneurs can extend Maslow’s theory of human motivation to develop a theory of market motivation, so to speak — one that can be used as a framework to examine the opportunity set for new ventures.

Before investing or ‘entrepreneuring,’ savvy actors tend to develop a vision of the future, which they then put themselves in the best position to benefit from. The most successful of these actors identify fundamental truths and underappreciated trends that underpin markets, and seize the opportunities created by their information advantage.

Whereas Maslow’s hierarchy of needs is descriptive, providing a framework for understanding why people undertake certain behaviors, a hierarchy of market needs is best understood as prescriptive, providing a framework for entrepreneurs and investors to assess the relative attractiveness of various opportunities then take action.

Thus, in this context, the framework is called a hierarchy of opportunities. However, because market structures can and do vary widely, and different markets are in different stages of development, any hierarchy of market needs or opportunities will need to be adapted to align with market realities.

What follows here is a hierarchy of opportunities contextualized to sub-Saharan African markets and their specific stages of development.

However, this analysis may be loosely applicable to other emerging markets, particularly those in southeast Asia, some of which are at similar stages of development.

Please note that this is not a ranking; rather, in keeping with Maslow’s original hierarchy, the pyramid here symbolizes that higher-order opportunities become easier to realize as more lower-order opportunities are achieved.

The hierarchy of venture opportunities in Africa & other emerging markets

- Maslow’s view: Physiological needs

- Venture opportunity: Build basic or alternative infrastructure

- Analysis: For Maslow, ‘physiological needs are the most pre-potent of all needs.’

And in an ecosystem, the prepotent layer is infrastructure. Without adequate infrastructure, ventures in an ecosystem are stunted, and the entire ecosystem is unable to achieve its full potential.

Across emerging markets and sub-Saharan Africa in particular, there generally remain robust opportunities to create ventures that introduce basic or alternative infrastructure that can underpin the entire ecosystem. See, for example, Interswitch (financial switch infrastructure).

- Maslow’s view: Safety needs

- Venture opportunity: Organize and integrate fragmented markets

- Analysis: Under the Maslowian view, safety needs present themselves as a general preference for order & structure. And the analogue layer in an ecosystem are ventures that increase order, structure, and predictability.

Across emerging markets, there can be staggering amounts of market disorder and a widespread lack of cohesiveness. Sub-Saharan Africa, for example, can be said to be defined by a fragmented private sector. Thus, entrepreneurs & investors have an opportunity to deploy models that integrate and organize fragmented markets. See, for example, Flutterwave (unification of the pan-African digital payments ecosystem).

- Maslow’s view: Love and belonging needs

- Venture opportunity: Minimize transaction costs & friction

- Analysis: Maslow describes this need as a “hunger … for a place in [a] group” and a desire “to attain such a place more than anything else in the world.”

There are strong social and community aspects at play here, and ventures that facilitate communities and social interaction are implicated here.

Across emerging markets, there can be large obstacles for different actors to engage with each other and transact. Thus, the opportunity here is for entrepreneurs & investors to develop ventures that minimize transactional costs & friction. See, for example, Autochek (eliminating friction in the used car marketplace).

- Maslow’s view: Esteem needs

- Venture opportunity: Enable entrepreneurship & economic empowerment

- Analysis: According to Maslow, esteem needs are preferences “for achievement, … for independence and freedom, … for reputation or prestige” and for “importance [and] appreciation.”

This aligns with ventures that enable improved economic outcomes for others.

In sub-Saharan Africa in particular, the economy is driven by SMEs and the region has the world’s highest rates of entrepreneurship. Thus, the opportunity here for entrepreneurs and investors is to create & support ventures that enable SMEs to thrive, that economically empower partners, and that facilitate micro-entrepreneurship & financial freedom. See, for example, Paystack (helping entrepreneurs and SMEs accept payments).

- Maslow’s view: Self-Actualization

- Venture opportunity: Create new markets

- Analysis: For Maslow, self-actualization represents fulfilling one’s potential and “becom[ing] everything that one is capable of becoming.” In Maslow’s view, this was rare & poorly understood: “we do not know much about self-actualization, either experimentally or clinically.”

Similarly, ventures that create entirely new markets are rare and poorly understood. But therein lies the opportunity. Ventures that are able to do so minimize competition and maximize potential value capture.

Note again: It’s a misinterpretation to treat this hierarchy as a ranking of or comparison between opportunities. Rather, the appropriate interpretation is that as more lower-order opportunities become realized, more higher-order opportunities can be unlocked.

The final analysis

As shown here, entrepreneurs & investors in sub-Saharan African (and similar) markets are most likely to find success if they concentrate on ventures that: build basic or alternative infrastructure; organize and integrate fragmented markets; minimize transaction costs & friction; enable entrepreneurship & economic empowerment; and/or create entirely new markets.

A key benefit of this analysis is that it maximizes the likelihood of good timing. Experienced startup investors and founders understand that timing plays an often unappreciated role in venture outcomes; indeed, some think that the single most important factor in a startup’s success is timing.

The best way to increase the probability of successful timing is by thoughtfully considering the underlying structure of a market alongside nonobvious long-term trends, and using that to inform further inquiry.

In this analysis, these considerations have implicitly informed the application of Maslow’s hierarchy; thus the opportunities identified here are those that, given sub-Saharan Africa’s current stage of development, maximize the potential for startups to benefit from good timing.

Entrepreneurs & investors in sub-Saharan Africa and similar emerging markets should be wary of opportunities that don’t readily fit into one of the five prongs identified here, as the ultimate payoff and long-term potential may be limited at this time. Still, while this analysis is helpful to identify and characterize opportunities, it is best treated as a starting point.

It’s important to remember that although there may broadly be opportunities in any given market, the actionable question for entrepreneurs & investors is whether there’s a real & timely market in a specific opportunity.

If you’re interested in getting investment exposure to vetted startups across Africa’s tech ecosystem that fall under this hierarchy, please fill out this form.

Share: