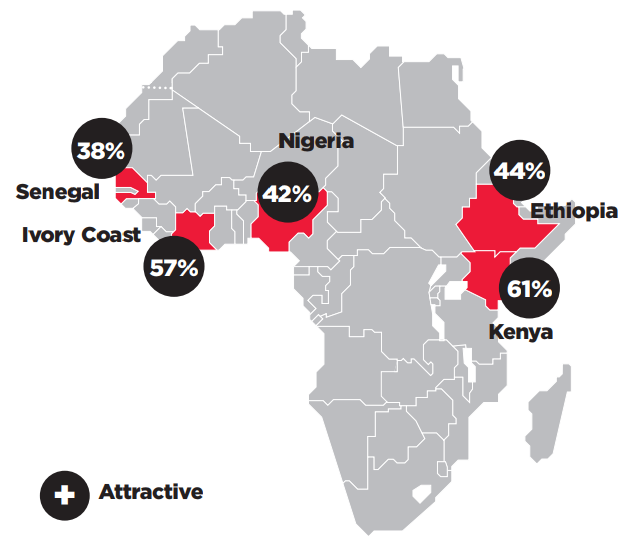

Kenya, Ivory Coast, and Ethiopia are the most attractive African countries to international investors in 2017, according to a recently released study from Havas Horizons, a division of the global communications group, Havas, and Institut Choisel, a French think tank.

Havas Horizons and Institut Choisel conducted a survey of representatives of the most active financial institutions in Africa, finding that 61% of respondents have a positive perception of investment opportunities in Kenya (in 2017), 57% in Ivory Coast, 44% in Ethiopia, 42% in Nigeria, and 38% in Senegal.

At the other end of the spectrum, the survey’s respondents perceived significant investment risks in the Democratic Republic of the Congo, Nigeria, Somalia, Sudan, and Mali. (These countries share a proneness to governance issues, instability, economic difficulties, and lack of infrastructure.)

Notably, Nigeria, the continent’s largest economy, is perceived as both a highly attractive and highly risky investment destination in 2017 among investors, as the country’s strong potential is counterbalanced by the collapse of the Nigerian naira, the decline in national income due to lower oil prices, and several other factors.

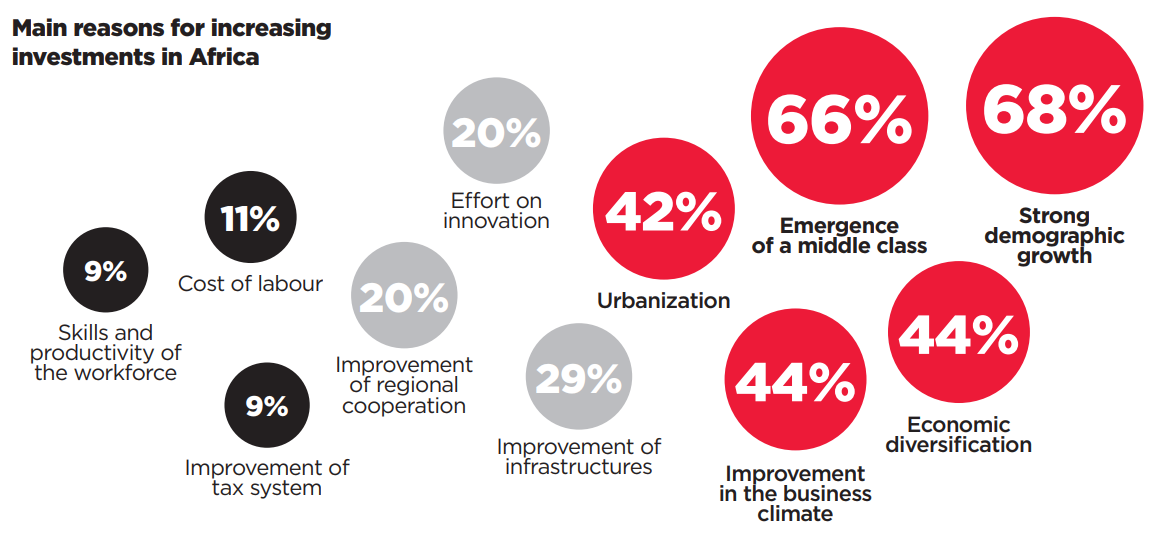

Survey respondents were also asked about reasons for increasing or decreaisng investment in Africa. As shown in the chart below, strong demographic growth was cited by 68% of respondents as the main reason for optimism (with the emergence of a middle class a close second at 66%).

Conversely, political instability and corruption were cited as the top obstacles to investing in the region.

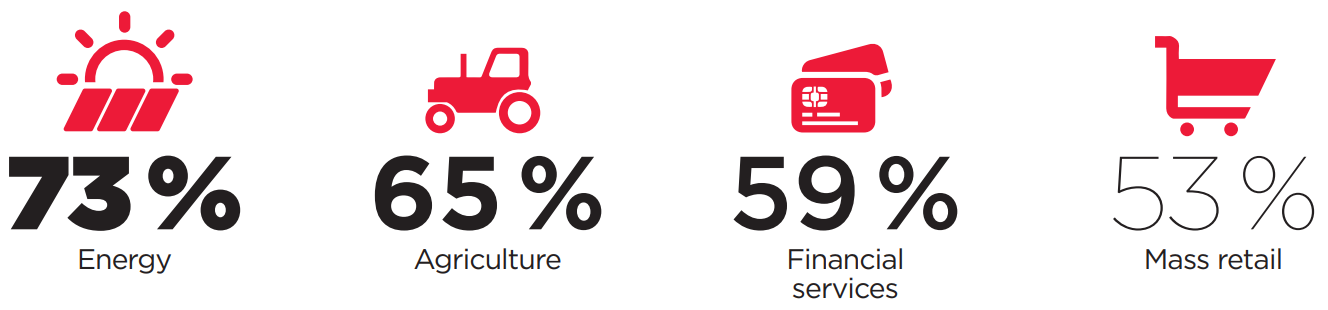

In addition to rationale, international investors were also surveyed on the industries they considered the most attractive for investment across the continent:

Sectors that address basic needs led the pack: energy was the most attractive sector, followed by agriculture. With Africa “starved for electricity,” the opportunity for electrification across the continent remains large. Similarly, with Africa’s population poised to rise rapidly, the opportunity to feed families across the continent is large as well. (It’s worth noting here recent news that Polar Star Management, one of the best performing Africa-focused hedge funds, plans to raise $115 million to exploit rising demand for food in Africa.) After sectors that involve addressing basic needs, investors were also attracted to those linked to the continent’s emerging consumer middle class: financial services and mass retail.

Jean-Philippe Dorent, Vice President, Havas Horizons, and Pascal Lorot, President, Institut Choiseul share perspectives on why the survey matters to ventures on the continent:

International investors have a critical role to play in the future of Africa. Their perception of the risks involved in investing in Africa will determine the resources available to the continent for transforming its economies. After all, it is international investors who provide the financial capabilities for funding the infrastructure projects that Africa so dearly needs. And it is they who support the financing of major pan-African firms, as well as local small and medium-sized businesses (SMEs), and entrepreneurs and start-ups across the continent.

List of investors surveyed:

Abakus Advisors, ACP, Advent International, AfrAsia Bank Limited, African Development Bank, African Export Import Bank, African Risk Capacity, Ardian, Business Partners International, CDG Capital Private Equity, Crédit du Maroc, Danone, DEX Capital, Ecobank, Euromena, Euromena Funds, FCCA, Fusion Capital, Gabonese Sovereign Wealth Fund, Golden Palm Investments, Goldman Sachs, GreenWish Partners, Group Castel – BGI, Helios Investment Partners, ICBC Paris, Investisseurs & Partenaires (I&P), Islamic Trade Finance, Kusuntu Partners, Livelihoods Venture, Meridiam, Messier Maris & Associés, Natixis Global Asset Management, Okan, One2five Advisory, Proparco, Qalaa Holdings, Qatar National Bank, Saham Group, Saint-Gobain, SmartPhorce Holding, Société Générale, The Beige Group, Verod Capital, Wendel, Wendel Africa, and Yearling Advisors.

If you enjoyed this article, subscribe to be notified when more like it are published.

View the full report (PDF) here.

Share: