Intro

Lipaworld is a marketplace for digital vouchers that allows folks in the diaspora to send value to their loved ones back home in Africa.

Context

- The majority of Africans — on the continent and in the diaspora — live and work in the informal sector.

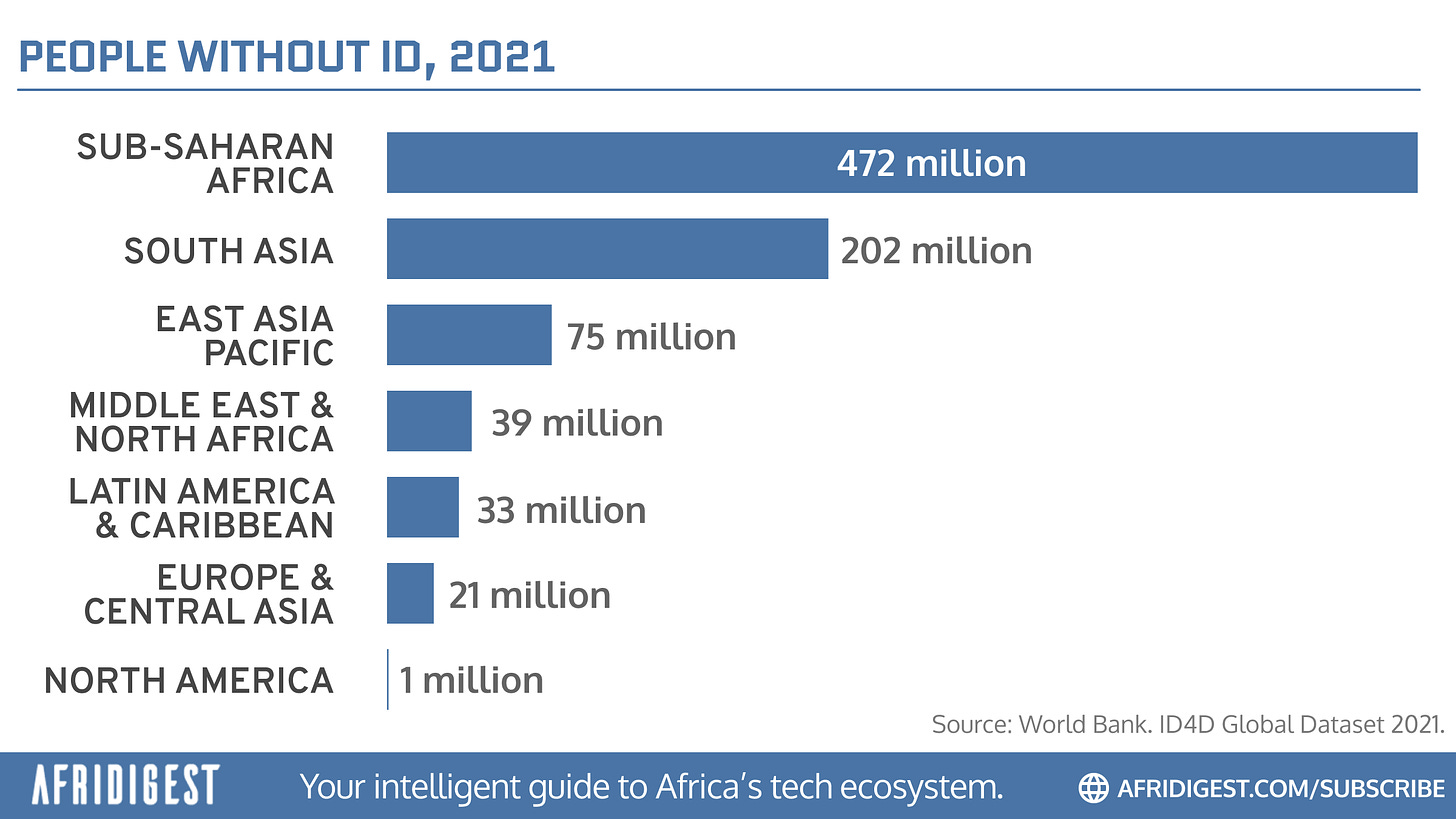

- An estimated 850 million people worldwide don’t have official identification, and nearly 60% of them are in sub-Saharan Africa.

- For undocumented individuals, KYC requirements of traditional remittance platforms can pose an undue burden. Alternative remittance channels can be risky and inefficient.

- Lipaworld employs a model powered by digital vouchers that reduces the overall KYC burden and offers the unbanked & undocumented access to safe, fast, and efficient remittances. Receivers can receive value with no ID required, for example.

Solution

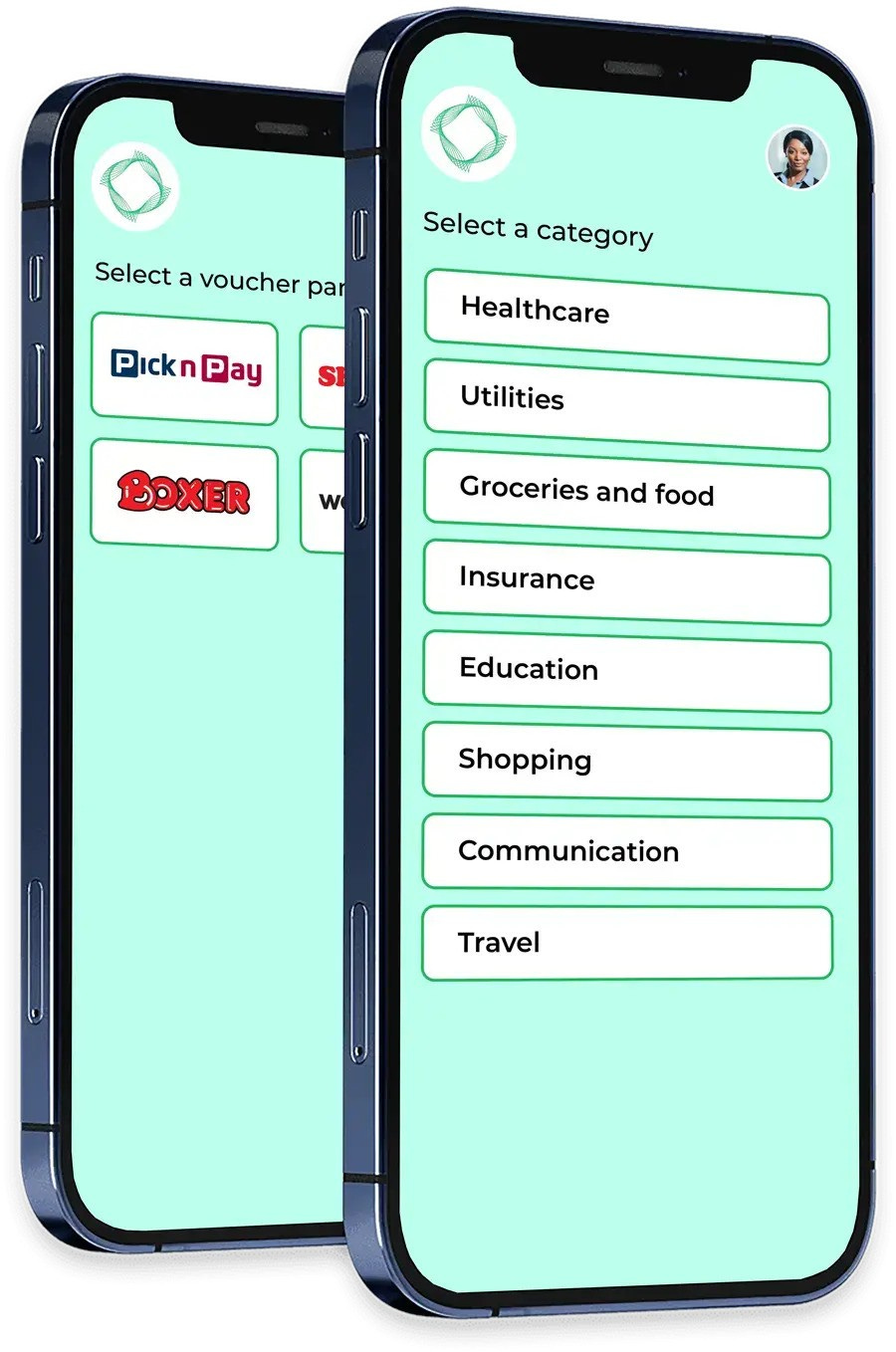

- Lipaworld’s core solution is a marketplace for digital vouchers across various categories.

- Recipients select desired vouchers and share with senders who initiate payment.

- Vouchers codes are then sent digitally (e.g., via SMS or WhatsApp) and can be redeemed online or in person.

- The company has a strategic initial focus on fully building out the Utilities segment, after which it will broaden & deepen its offering in other categories.

Revenue/Monetization

- The company charges senders a 5% fee per transaction and it also earns commissions from partners from whom its buys vouchers.

- Lipaworld is revenue-generating. While its fee is less than the typical cost of sending remittances to sub-Saharan Africa, the company aims to offer more competitive send fees over time as volumes from commissions grow.

Management Overview

- Founders: Jonathan Katende (CEO), Victor B. (CTO)

- The co-founders have previously worked together and each have a decade of experience building tech products.

- The CEO was the former head of growth at Talk360, the South African/Dutch international calling platform that distributes call credit vouchers.

Company Overview

- Team size: 7 (3 full-time, 4 part-time)

- Founded: 2023

- Headquarters: NYC

- Home market: South Africa

- Initial target markets: South Africa, Nigeria, Ghana, Kenya, Zimbabwe

- Early traction: Lipaworld is operational in 33 states in the USA so far. It has struck major partnerships with 1Voucher, Flash, DT One, and others.

Fundraising

- The company has raised $50,000 to date.

- It’s actively raising $800,000 to reach 10,000 users and internal MRR targets.

Upside opportunities

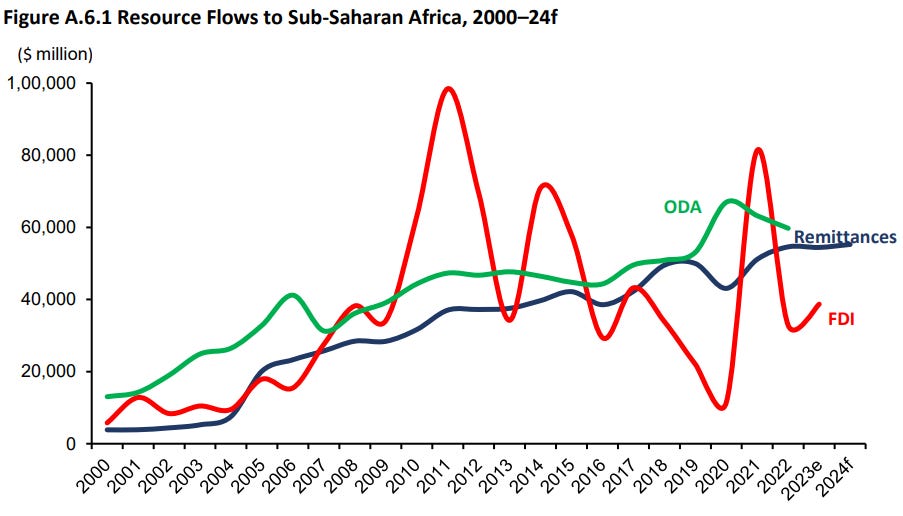

- The company is addressing a large, established market with significant growth potential. Remittance inflows to sub-Saharan Africa were $55 billion in 2023, according to the World Bank, and they’ve grown steadily over the last twenty years.

- The company is taking a fresh, somewhat contrarian approach. While there are many players in the remittance space, Lipaworld differentiates itself via a focus on the informal sector as its core target market and its emphasis on voucher-based, purpose-bound remittances. While voucher-driven remittances might be a relatively new concept in sub-Saharan Africa, the concept has been or is being proven in other regions (e.g., OKY in Latin America).

- The opportunity extends beyond remittances. While the company is focused on remittances from the US to Africa, the platform can also be used for same-country domestic vouchers and gifting. Moreover, to the degree the company succeeds in attracting a mass of early users, it can potentially leverage that position to build a wallet and other financial services to become a neo-bank of sorts for its informal sector clientele. Alternatively, the company could potentially execute a platform play to act as a provider of voucher infrastructure for other businesses.

Downside risks

- Regulatory changes could happen. The company currently takes advantage of ‘agent of payee’ exemptions which allow it to service US customers in a compliant manner. Regulation may or may not change, however. The relevant regulatory environment needs to be better understood.

- There’s no shortage of well-capitalized players in the remittance space. Africa-focused cross-border fintechs, legacy banks & MTOs, digital-first incumbents, and more are active in the marketplace. If Lipaworld proves that there’s an attractive opportunity in voucher-based cross-border payments, other market participants might be quick to move into the space.

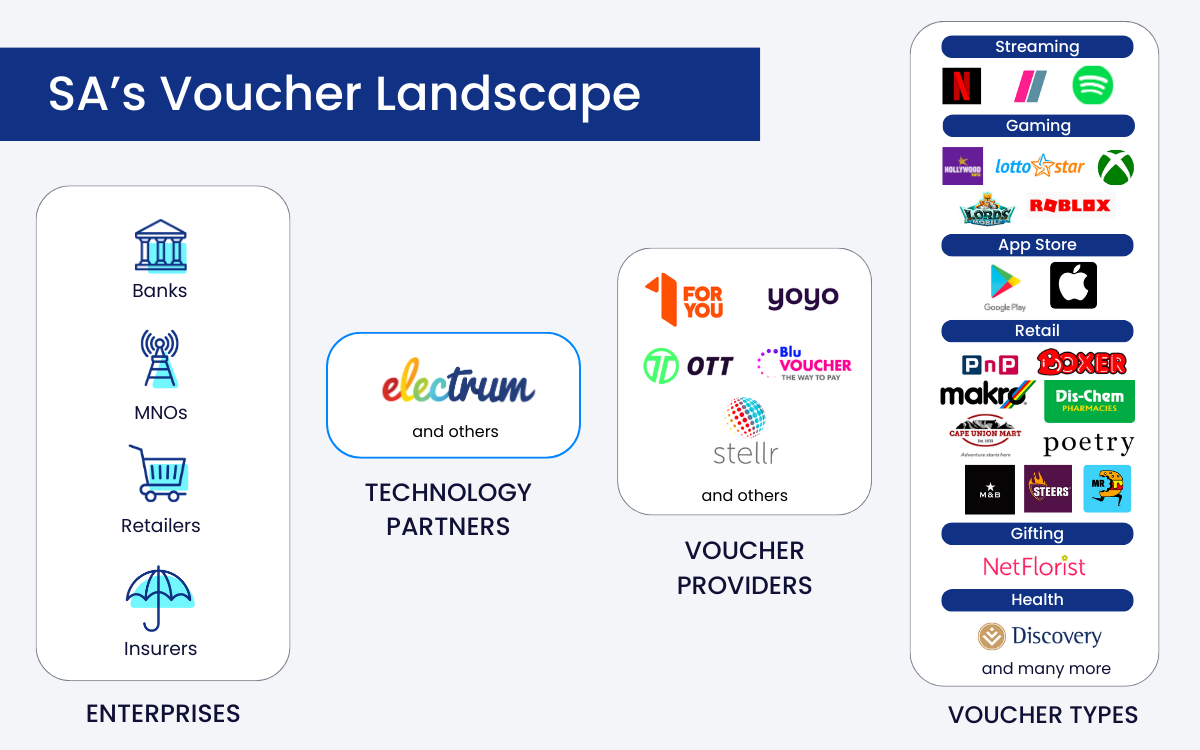

- Voucher-based payment ecosystems may be limited outside of South Africa. While South Africa has a thriving voucher payments landscape, voucher uptake across the rest of the continent needs to be investigated further. The company may ultimately need to invest significantly in customer education in other markets. That said, there are promising signals. Zambia, for example, has experimented with an e-voucher system for farmers, Orange Morocco recently introduced digital vouchers for games, and various players are operating voucher solutions in Uganda and Kenya.

Competitors/Comparable Companies

- Voucher marketplaces: OKY (focused on USA to Latin America), SureGifts

- Legacy MTOs: Western Union, Moneygram, etc.

- Digital-first incumbents: Remitly, Transferwise, etc.

- Cross-border fintechs: Flutterwave, Chipper Cash, Lemfi, Eversend, Kaoshi, Maraboo, etc.

Last word

Lipaworld offers an innovative alternative for cross-border value transfer: voucher payments or productized remittances, if you will.

Based on insights earned through personal & professional experiences in one of the continent’s most dynamic voucher markets, the company’s founding team has high conviction that this solution offers a value proposition that customers will love.

With its current approach, the company is betting on the rise of voucher-based payments across the continent, increased importance of directed remittances & purpose-bound money, and strong market pull & robust growth trajectories for financially inclusive solutions that serve the underserved.

What do you think?

Is Lipaworld a potential winner?

Disclaimer: Nothing in this post constitutes investment or legal advice. Conduct your own research, perform due diligence, and/or consult with investment advisers before making investment decisions.

Apply to be featured in the next Afridigest Startup Spotlight.

Share: