According to World Bank data, sub-Saharan Africa’s population was just over 1 billion in 2016. Coupled with the region’s current smartphone adoption rate (28%) and the current internet penetration rate (19%), it’s clear that the potential represented by Africans coming online and participating in the digital economy is significant.

That said, across various cities and countries, segments of the population are already actively participating. Today, these participants access the internet via mobile by and large, and with Android’s close to 50% market share on the continent, ~ 1 in 2 do so from a device linked to the Google Play store.

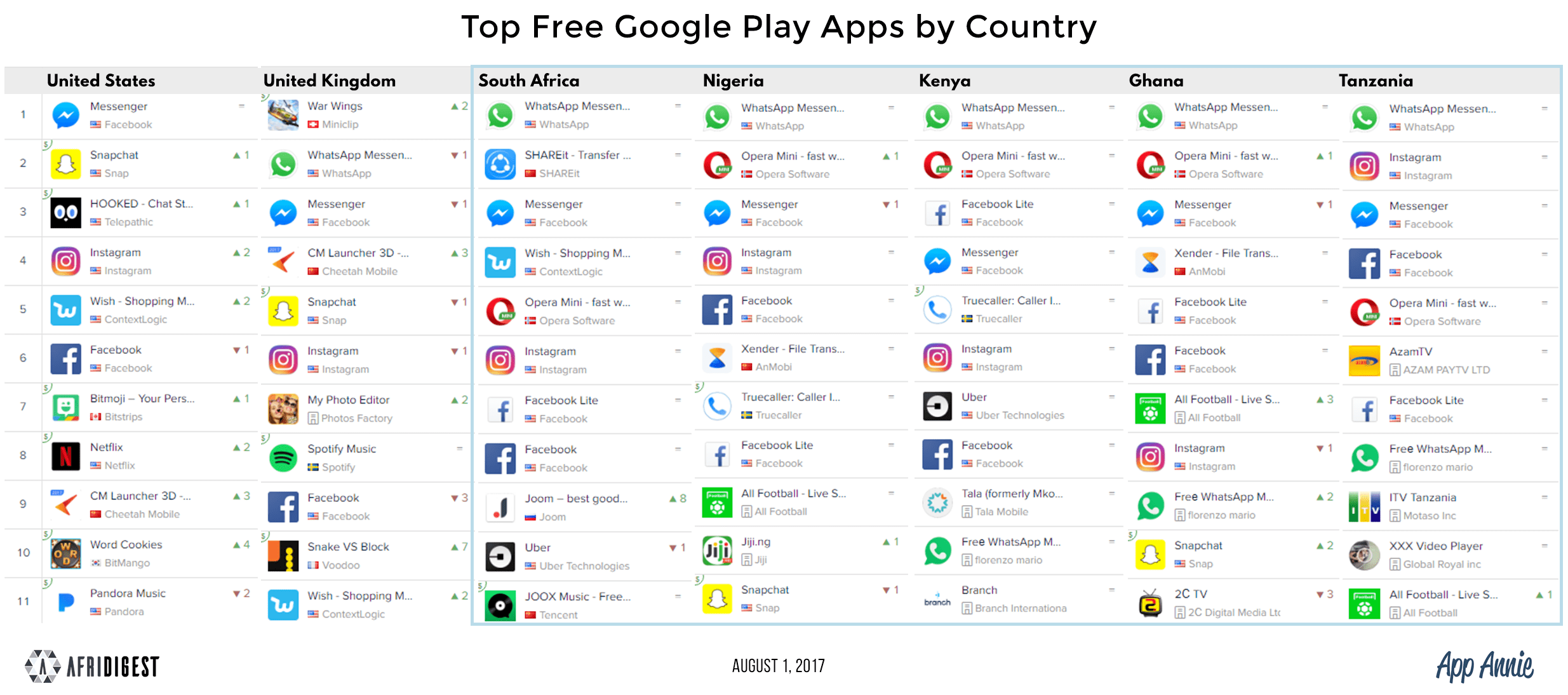

Against that backdrop, in an attempt to glean (cursory) insights about today’s internet user in Africa, Afridigest looked at a snapshot of the top Google Play apps in South Africa, Nigeria, Kenya, Ghana, and Tanzania, along with their US and UK counterparts:

Key Overall Themes:

- Across Africa, today’s internet user is generally concerned about data.

- WhatsApp is by far the dominant communications app in Africa.

- It’s not just WhatsApp; Facebook as a whole is dominant in Africa.

In all five African countries surveyed, Opera Mini, the browser whose core value proposition is saving users “tons of data,” is a Top 5 app. Moreover, in 3 of the 5 countries surveyed (South Africa, Nigeria, and Ghana), either Shareit or Xender appear, apps which allow users to transfer files (including other apps) without incurring data charges using WiFiDirect technology.

Unlike the US where users primarily rely on Facebook Messenger (and WhatsApp is 13th on the list), WhatsApp is the number one app across all African countries surveyed. It’s no wonder then that businesses across the continent utilize or are seeking to utilize WhatsApp as an additional channel.

While Facebook-owned apps hold three of the top ten spots in the US, and four in the UK, in all of the African countries surveyed, Facebook owns half of the top ten apps, largely due to the popularity of the fifth app in Facebook’s arsenal, Facebook Lite.

Country Specific Observations:

- Kenya appears to be a hotspot for mobile phone micro-lending, with fintech startups Tala and Branch both appearing on the list.

- Mobile commerce appears to be big business in South Africa, with the Wish and Joom apps both appearing.

- Video content appears to be highly popular in Tanzania where 3 of the top ten apps are video-related (AzamTV, ITV Tanzania, and XXX Video Player).

While the Google Play app data above is a snapshot in time in a rapidly changing environment, speaking very generally, today’s internet user in Africa primarily goes online to communicate with friends and family using Facebook’s suite of apps, but appears ready to embrace other mobile-internet enabled offerings such as relevant fintech solutions (e.g, mobile loans), relevant video content (e.g., football related-programs), and mobile commerce.

While high relative data costs appear to be a key concern, he/she navigates the environment by utilizing apps designed to thrive in such an environment like Xender, Opera Mini, and Facebook Lite.

As more and more of the world’s economy becomes ‘digitalized,’ and more and more Africans come online for the first time, ventures—both on the continent and abroad—that target online audiences in Africa would do well to study the changing behavior of today’s internet user so as to apply lessons learned to the user of tomorrow.

If you enjoyed this article, subscribe to be notified when more like it are published.

Share: