Analyzing Africa’s export patterns offers one major lesson for founders and executives:

Controlling resources or having a compelling competitive advantage isn’t enough; what matters is whether you can capture the value those resources create.

Africa stands at a pivotal moment.

While the continent commands an impressive share of global resources — including a third of mineral reserves, ~12% of oil reserves, and ~8% of natural gas reserves — translating this natural wealth into prosperity for the masses remains a critical challenge.

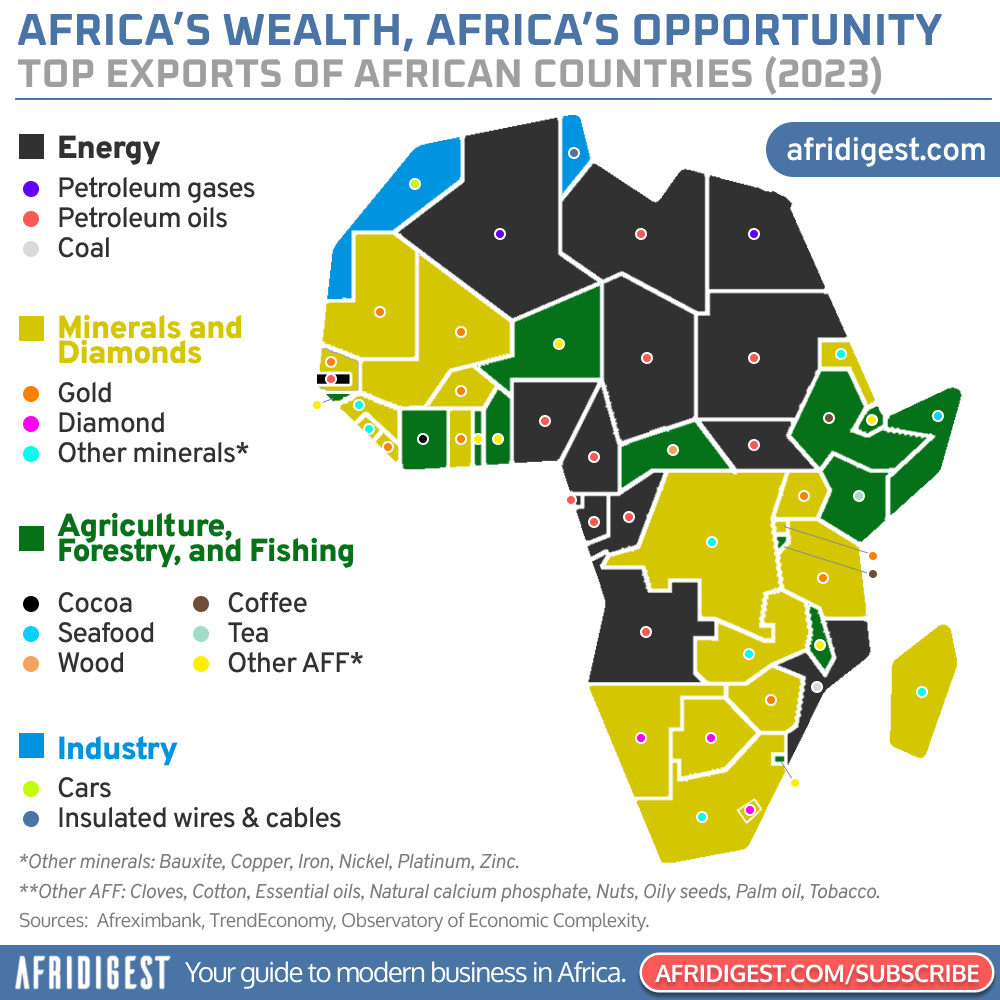

Three dominant patterns of Africa’s export landscape

Oil titans

Countries like Nigeria, Angola, and Algeria have built their economies on petroleum exports, highlighting both the strength and vulnerability of resource-dependent economies.

While these energy exports generate significant revenues, they often stifle economic diversification and create limited local employment opportunities. (See The FT Film, ‘Nigeria’s struggle to break the oil curse,’ for example.)

Mineral giants

The continent’s mineral wealth reaches far and wide to include:

- West Africa’s prominent gold belt

- Southern Africa’s diamond wealth

- Vast deposits of strategic minerals including bauxite, copper, iron, nickel, platinum, and zinc distributed across various regions

Agricultural leaders

Africa’s agricultural sector showcases both its ecological diversity and the persistence of historically extractive models:

- About 70% of the world’s cocoa beans come from four West African countries: Côte d’Ivoire, Ghana, Nigeria and Cameroon, yet Africa captures less than 5% of the $100B+ chocolate industry.

- Ethiopia and Kenya lead in coffee exports but primarily as raw bean suppliers rather than finished product producers.

- Even the continent’s growing fishing industry primarily exports unprocessed catch to foreign processing facilities.

The transformation challenge

Despite the continent’s abundance and variety of natural resources, three key challenges persist:

1. The raw materials trap

While Africa’s resource wealth is an important source of revenue, the dominance of unprocessed exports means that job creation largely happens abroad, not at home.

2. Underdeveloped intra-Africa trade

70-90% of exports from African markets leave the continent, limiting opportunities for regional trade relationships.

3. The value addition gap

While success stories exist — like Morocco’s automotive sector and Tunisia’s electrical equipment industry — they remain exceptions rather than the norm. This highlights both the possibility and current limitations of industrial development across the continent.

The way forward

Africa possesses three critical advantages for economic transformation: vast natural resources, fertile agricultural land, and a young, entrepreneurial population.

However transforming the continent’s export profile and converting these advantages into prosperity requires infrastructure development, policy reform and implementation, and greater regional integration.

Success stories like Morocco’s automotive sector provide evidence that targeted infrastructure investment in power generation and distribution, transportation networks, industrial parks and zones, and digital connectivity enable and accelerate industrial development.

The key to unlocking Africa’s full export potential, then, lies in strategic investments in infrastructure, technology, and value-addition capabilities, combined with careful attention to regional integration and sustainable development.

The continent’s future lies not in being the world’s resource basket, but in becoming a global leader in value creation and sustainable development. This will require coordinated action from all stakeholders — political leaders, private sector players, and civil society.

Share: