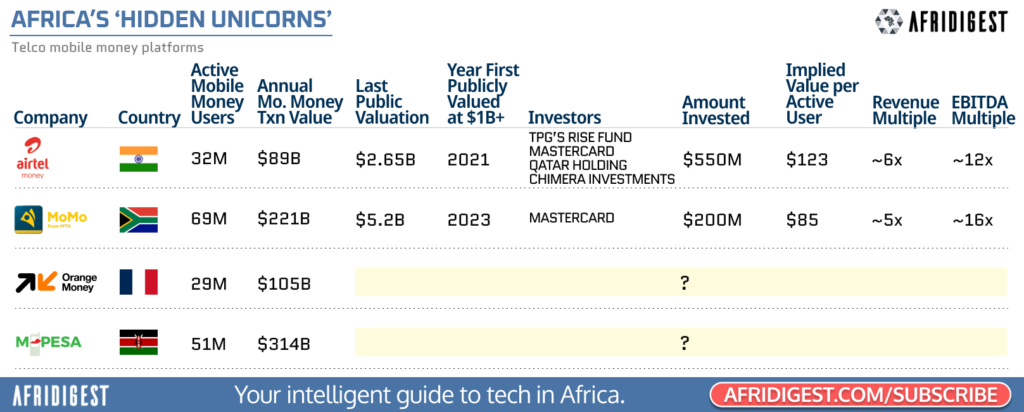

Africa has a number of well-known tech unicorns. But there are some “hidden unicorns” too: telco mobile money arms.

Telecom operators across the continent have largely conducted their mobile money businesses via wholly-owned subsidiaries, but they’re increasingly monetizing these assets — thanks in no small part to increased investor interest in Africa’s fast-growing digital payments landscape.

As a result, the value of these businesses is becoming clearer to all.

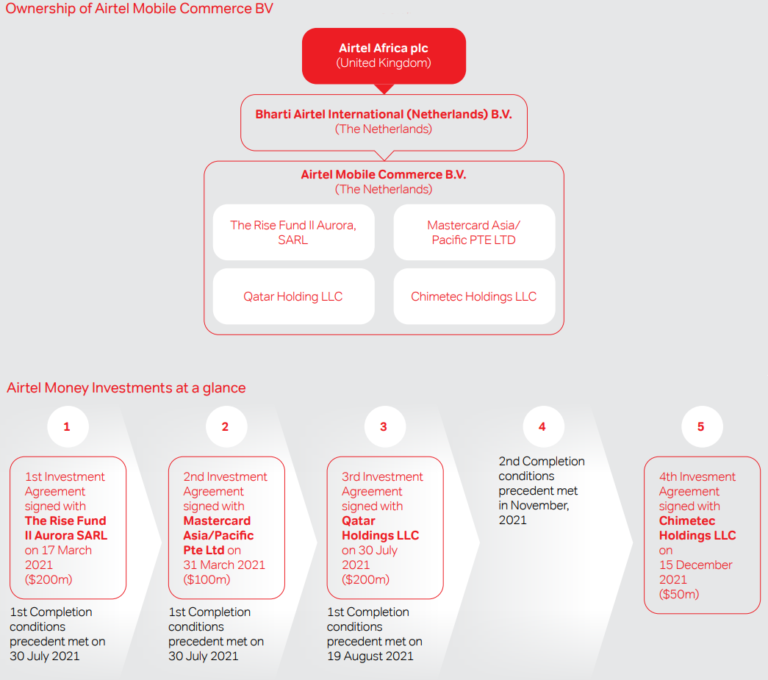

In 2021, for example, Airtel Africa unlocked $550 million in value from its mobile money subsidiary, Airtel Mobile Commerce. It sold a $200 million stake to TPG’s Rise Fund, a $100 million stake to Mastercard, another $200 million stake to Qatar Investment Authority (QIA), and a $50 million stake to Chimera Investments.

In total Airtel Africa sold ~21% of its Airtel Money business and disclosed that these buyers valued the unit at $2.5 billion.

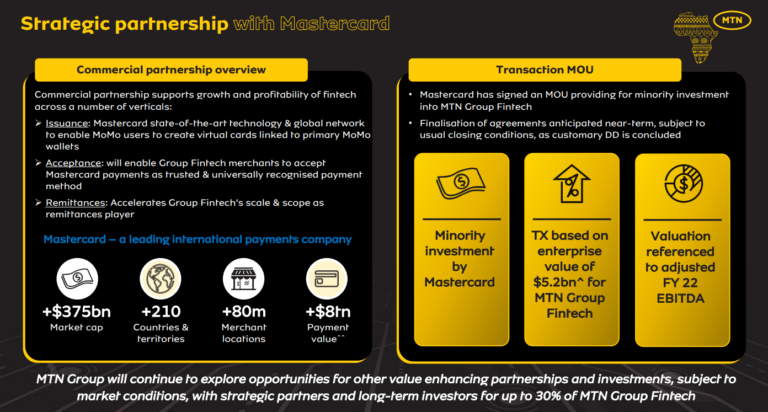

In April 2021, one month after the Airtel Money/TPG Rise deal was announced, MTN CEO Ralph Mupita told Bloomberg, “With similar [multiples] to that of Airtel, our [mobile money unit] valuation would sit at … about $5 billion. No decision has been made as yet [as to] the best approach to unlock value.”

Mupita and Africa’s largest telco have now decided how best to extract value from MTN’s mobile money unit.

MTN signed definitive agreements to sell a $200 million stake in MTN Group Fintech BV — the legal entity that houses MTN Mobile Money (MoMo) — to Mastercard at a $5.2 billion valuation. (MTN first announced the signing of a memorandum of understanding with Mastercard in August 2023, but the size of the transaction wasn’t disclosed at the time.)

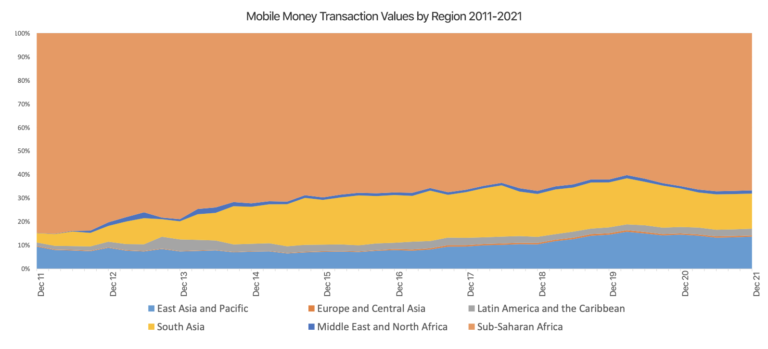

Africa is the epicenter of mobile money globally. Sub-Saharan Africa alone accounts for two of out every three dollars sent via mobile money worldwide. So it’s no surprise that hugely valuable companies are being built in the sector.

Source: GSMA. UNCDF.

And thanks to the monetization efforts of Airtel Africa and MTN, exactly how much Airtel Money and MTN MoMo are worth in the marketplace is now a part of the public record.

And so, too, are their valuation multiples (~6x revenue, ~12x EBITDA, ~$123 per active user for Airtel Money in 2021 and ~5x revenue, ~16x EBITDA, ~$85 per active user for MTN MoMo in 2023).

While one can extrapolate from the multiples above, what’s still unknown is how investors might value Orange Money and M-Pesa today.

Notably, when asked in May 2021 about the potential of spinning off M-Pesa, Vodacom Group CEO Shameel Joosub responded, “We are not in a position yet where we think the time is optimal to sell or even monetize a portion of the assets because we believe there is still a lot of growth left… It’s too early to have that conversation now. Maybe 2, 3 years down the line, it will be … a different conversation.”

Unless things have changed, it should be about time for Joosub, Vodacom, and Safaricom to start taking steps to capture some of the value that resides in M-Pesa.

In any case, when you think about unicorns in Africa, you’d be wise not to ignore the value telcos across the continent are creating with mobile money.

Share: