Super apps are having a moment in Africa.

Not long ago, Kenya’s Safaricom, the country’s leading telco, launched the M-Pesa super app. Not to be outdone, South Africa’s leading telco, Vodacom, followed suit with its own super app, VodaPay — developed in partnership with China’s Alipay. And last November, Algerian super app Yassir announced a $150 million Series B and a planned expansion across French-speaking Africa & beyond.

Clearly, African super apps are trending. So what’s going on?

In ‘Tech in Africa,’ authors Gabriele et al. provide some ecosystem-level context. They describe this pan-African pursuit of the super app model as the second of three major waves that characterize the African tech ecosystem to date:

According to Gabriele et al., this super app second wave is sandwiched firmly between the first wave, Africa’s e-commerce gold rush; and the third wave, its fintech gold rush.

If Jumia and Konga are emblematic of the first wave (e-commerce) and African unicorns Flutterwave & Chipper Cash are among those leading the third wave (fintech), it begs the question: which companies spearhead the second wave?

Africa’s super apps: archetypes & players

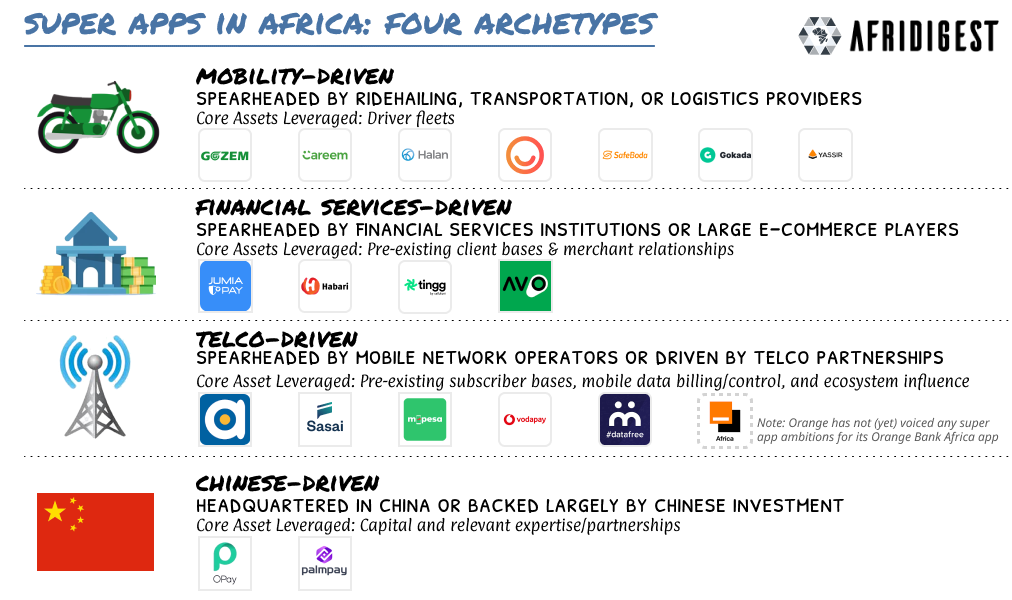

It turns out there are four main archetypes of super apps in Africa (at least so far):

- Mobility-driven

- Financial Services-driven

- Telco-driven

- Chinese-driven

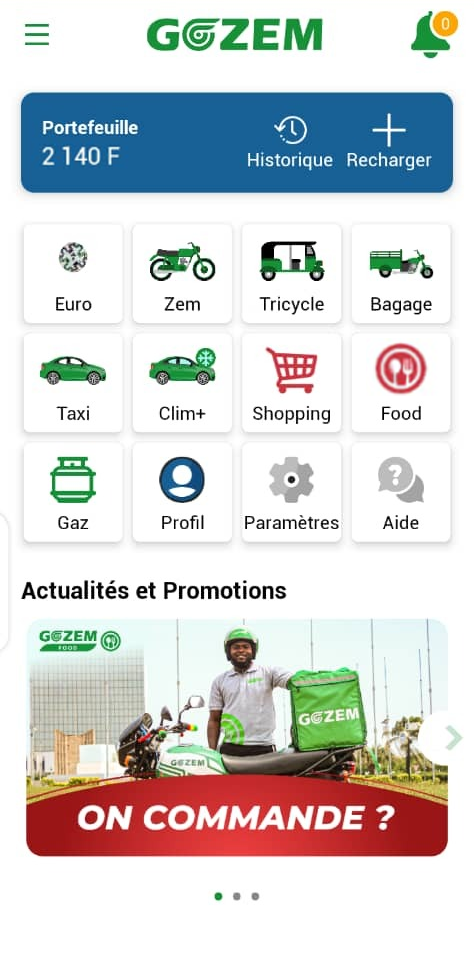

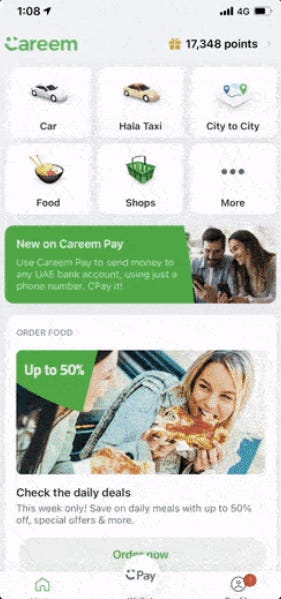

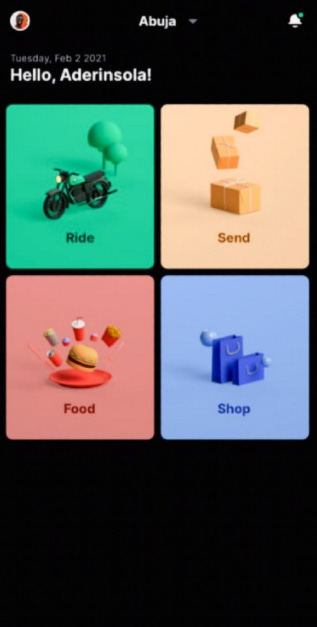

Mobility-driven super apps generally provide ride-hailing, transportation, or logistics offerings and employ the Grab & Gojek playbook with a fleet of drivers as their core super app asset. In other words, they generally start with a transportation/logistics service then offer adjacent services to increase driver engagement & utilization. Examples include Gozem, Careem, Halan, Gokada, Temtem, SafeBoda, and Yassir.

- Gozem, operational in Francophone West and Central Africa, launched its super app experience in August 2020.

- Dubai-headquartered Careem, an Uber subsidiary since the $3.1 billion acquisition in January 2020, launched its super app experience in June 2020 — it’s operational in Egypt, Morocco, and the MENA region.

- Egypt-based Halan (now MNT-Halan) launched its super app experience in October 2020.

- Nigeria’s Gokada launched its super app experience in June 2021.

- Algeria’s Temtem launched its super app experience, temtem ONE, in October 2020

- Uganda’s SafeBoda expanded beyond ride-hailing in December 2019.

- And then there’s also Algeria’s Yassir, which appears to the most well capitalized of the group so far, after a Series B fundraise of $150 million in November 2022.

Financial Services-driven super apps, on the other hand, are typically spearheaded by financial services institutions or large e-commerce players that have a captive audience for payments. The core assets they leverage across the super app tend to be large pre-existing client bases and pre-existing merchant/SME relationships. Examples include JumiaPay, Habari, Tingg, and Avo.

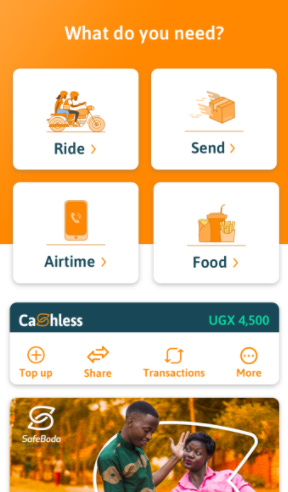

- NYSE-listed Jumia launched JumiaPay as a mobile money wallet in August 2016 and launched all-in-one app Jumia One in March 2018. At some point in 2020, Jumia combined the two apps creating a new JumiaPay lifestyle and financial services super app.

- Guaranty Trust Bank, a tier-one Nigerian bank, launched its Habari super app in December 2018.

- Kenya’s Cellulant launched Tingg in October 2019.

- And South Africa’s Nedbank launched Avo in May 2020.

Telco-driven super apps are spearheaded by mobile network operators (or rely on close partnerships with them) and they leverage MNO strengths—large subscriber bases, troves of data, and a notable degree of influence over local telco ecosystems (e.g., OEM relationships, zero-rating, etc.)—as their core super app assets. Examples include Ayoba, the M-Pesa super app, VodaPay, & Datafree’s Moya App. (And potentially Orange Bank Africa.)

- MTN launched Ayoba in May 2019.

- Econet launched Sasai in July 2019 via Cassava Fintech International (CFI), its fintech subsidiary.

- Kenya’s Safaricom launched the Huawei Mobile Money-powered M-Pesa super app last month in June 2021.

- South Africa’s Vodacom launched the VodaPay super app in October 2021.

- South Africa’s MoyaApp evolved into a super app in mid-2021.

- And French telco Orange launched mobile banking app Orange Bank Africa in July 2020, which could eventually morph into a super app of sorts.

Chinese-driven super apps are headquartered in China or backed by significant Chinese investment; their core super app assets tend to be capital and/or relevant partnerships & expertise. OPay and PalmPay are the two players here; however both are arguably diversified financial services apps today, rather than true multi-vertical super apps.

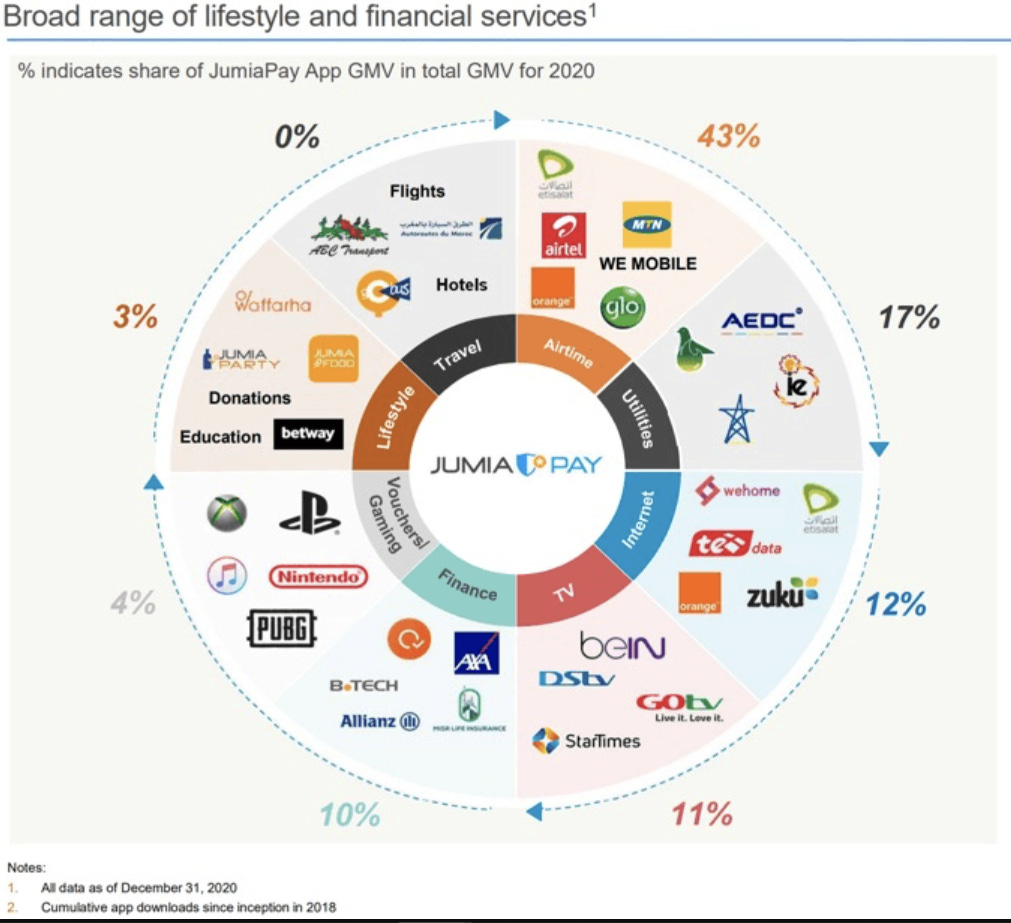

- PalmPay, operational in Nigeria and Ghana, launched in November 2019 and is backed by Transsion, the largest seller of smartphones in Africa; it enjoys pre-installation on over 20 million Tecno, Infinix, and Itel phones, as well as offline distribution via Transsion’s sizeable retail network.

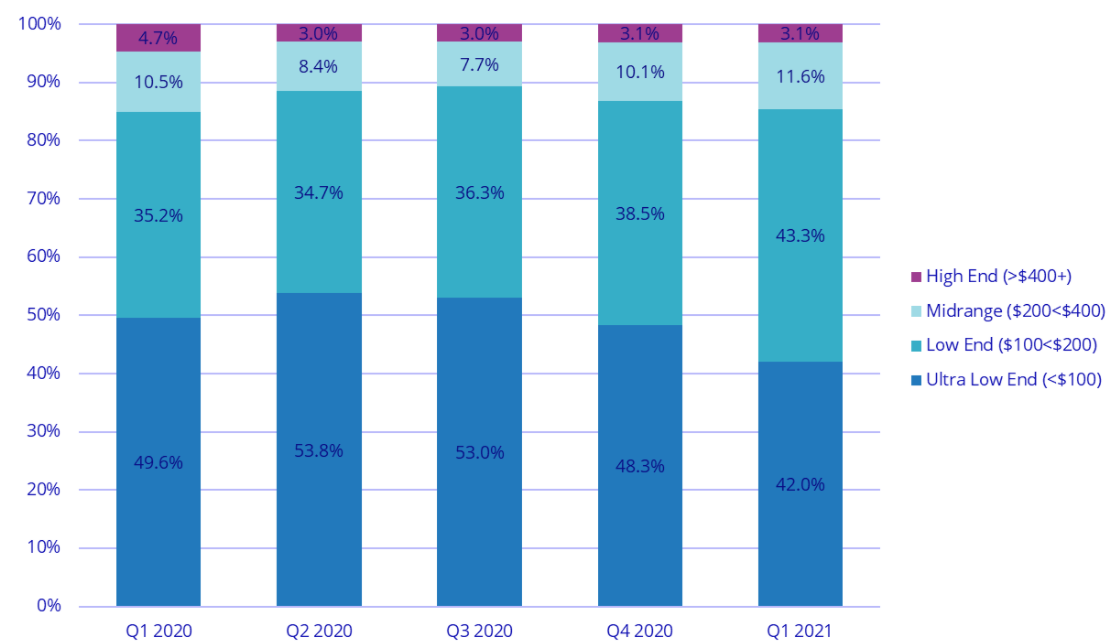

Africa Smartphone Market Share. Source: IDC.

- OPay, operational in Nigeria and Egypt, launched in summer 2018 after acquiring Paycom’s mobile money license; it’s controlled by Chinese billionaire, Yahui Zhou and enjoys significant access to capital. OPay raised one of the first mega-rounds targeting the continent—$120M in November 2019.

In addition to the four archetypes above, it’s worth noting that there’s a growing trend on the continent that sees startups aspire to own all the opportunities in a target vertical and position themselves as ‘super apps for X.’ Nigeria’s Eden Life, for example, has positioned itself as a “super app for domestic services,” Cameroon’s Healthlane as a “super app for anyone across the continent to access healthcare,” and Ivory Coast’s Djamo as a “financial super app.”

What’s driving the continent’s super app trend?

Super apps are increasingly popular across the continent as they’re well suited to the continent’s digital economy. On the one hand, there’s a certain market pull towards super apps from the continent’s bottom-of-the-pyramid users, and at the same time, companies serving these users are increasingly pushed to explore super app-like diversification in search of growth and business sustainability.

Market ‘pulls’ — why super apps are attractive to African consumers

- The proliferation of cheaper, lower-end phones with limited storage.

According to IDC data, low-end and ultra-low-end smartphones comprised 85% of smartphones shipments on the continent in Q1. These smartphones tend to have limited storage capacity, thus capping the number of apps, files, photos, etc. that users can carry at once. This creates a pull towards multi-service super apps as they enable users to avoid the painful decision of what content to delete in order to download a new app.

- High relative data costs.

According to the Alliance for Affordable Internet, across Africa, the average cost for 1GB of internet data is 7.1% of the average monthly salary, compared to 1.9% in the Americas and 2.7% in Asia. This again creates a pull towards multi-service super apps as they enable users to avoid not just the emotional costs involved in downloading multiple apps on lower-end smartphones, but the financial costs as well. - Nascent internet economy.

Although there are regional differences internally, the African continent as a whole is home to the world’s lowest internet penetration rate. Many users are coming online for the first time and there can often be steep learning curves for users as they engage with various service providers. Super apps, on the other hand, simplify the new internet world, enabling users to access a wide variety of services within a single interface and offering improved user experiences thanks to unified identity, payments, & more within the super app ecosystem.

Super apps respond uniquely to the needs and pain points of African consumers today and thus the market pulls towards them. Not only do they lubricate or minimize the frictions everyday consumers on the continent face, they also offer uniquely high ‘bang for your buck’ experiences to a highly value-conscious clientele.

Market ‘pushes’ — why super apps are attractive to companies operating in Africa.

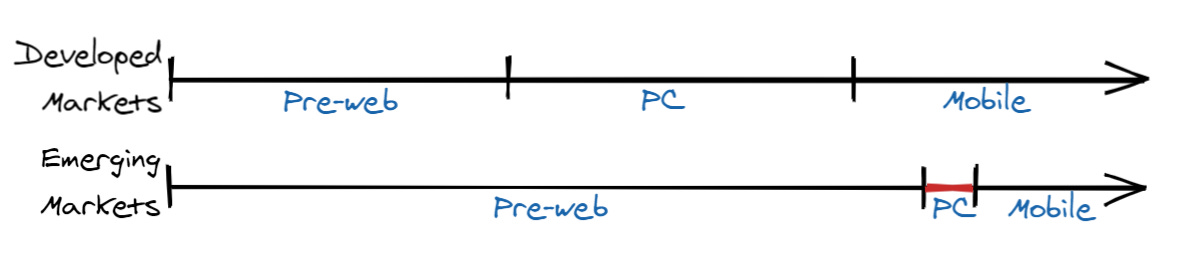

- Ecosystem dynamics: nascency of the digital economy in a mobile-first / mobile-only market.

Unlike in other more developed parts of the world, African markets offer companies a unique opportunity to influence and shape the emerging internet consumer. And since, for many across the continent, the internet is mobile-only, the market effectively pushes firms to experiment and seek to establish dominant positions via innovative mobile-first models; super apps are a prime candidate.

- Market fragmentation.

I think what companies underestimate is the risk-adjusted cost of expanding from one end of the continent to the other. … The idea of having to go across the continent and do it successfully is nontrivial. … This is one of the biggest issues that companies face trying to expand beyond a certain size. Victor Basta, Managing Partner - Magister AdvisorsOne of the defining aspects of African markets today is fragmentation. Indeed, the varying regulatory, cultural, and business environments from one country to the next create real risks and obstacles for companies seeking to scale. And where the attractiveness or viability of regional expansion is diminished, growth-seeking firms are propelled to explore other avenues like product/service diversification. (See also: ‘How African startups should think about growth‘)

- Clean playing field.

In developed markets, there seem to be at least a handful of significant competitors in every segment. Across Africa however, partly due to the level of fragmentation on the continent, there’s a lot of room for new entrants across verticals; this encourages companies to explore new non-core opportunities without fear of provoking an entrenched player.

- Economics & Efficiencies.

ARPUs, average revenues per user, on the continent are much smaller than in other regions. For example, Facebook earned almost 20x more per user in the US & Canada than in Africa/ROW in Q4. Such an environment incentivizes firms to maximize their existing customer bases & internal advantages and spread costs. The typical super app playbook of starting with high-frequency low-margin services then using a key asset (e.g., a transport fleet) to cross-sell lower-frequency, higher-margin offers is well suited to this.

Given market dynamics, super apps are a sensible response on the part of digital businesses operating in the African context. They hold the potential for businesses to unlock and maintain sustainable growth via various monetization & efficiency benefits, and the playing field is wide open for experimentation with the model.

Interested in going deeper? Our strategic intelligence & advisory firm Afridigest Intelligence can help you understand, identify, and take advantage of related opportunities: intelligence@afridigest.com.

Share: